Credit Cards

Applying for the Capital One SavorOne Cash Rewards card: learn how!

Better than going out for dinner with friends is to earn 3% cash back on it. This and much more you will get with your Capital One SavorOne Cash Rewards. This article will show how you can get one.

Advertisement

Capital One SavorOne Cash Rewards Card: up to 8% cash back to enjoy the best entertainment events

Capital One SavorOne Cash Rewards card is a champion when it comes to the best rewards credit cards. It’s hard to find a single flaw in it, and almost every review gives it 5 stars.

If you doubt it, look at this card’s features. If you don’t like paying for your credit cards, you will love the $0 annual fee.

And if you enjoy having dinner with your family and friends, or going out to attend the best cultural events, you will love the 3% bonus cash back.

Also, if you like doing these things traveling around the world, enjoy the 0% foreign transaction fee.

As you can see, this card is worth it. Keep reading to see how does the application process works and the eligibility requirements.

Apply online

The internet has its pros and cons. One of the good things about the internet is how much it has streamlined bureaucratic processes such as applying for a new credit card.

If you have a good or excellent credit score, you can give it a try.

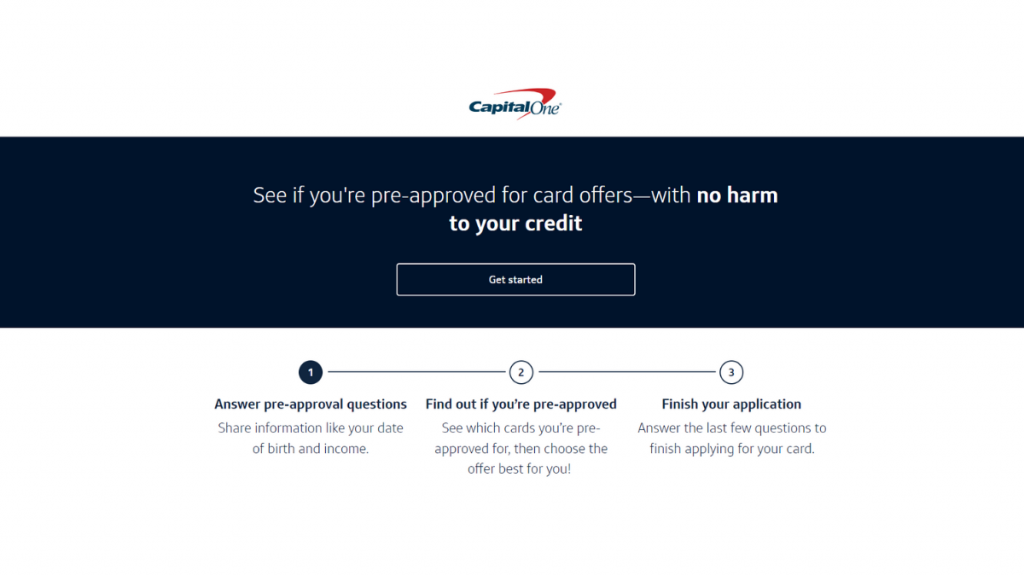

Access the Capital One website, look for the SavorOne Cash Rewards, and hit the “apply now” button. You can check the card details and read important disclosures about it.

There will be a small form to fill out. Inform your full name, date of birth, and SSN. Once you submit it, you will receive an offer, that you can accept or decline.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Capital One mobile app will help you manage your account and control your expenses and rewards. As soon as you got approved, you can download it to use all its features.

But the application has to be done on the Capital One website.

Capital One SavorOne Cash Rewards credit card vs. Capital One Venture Rewards card

If you’re looking for an excellent card, Capital One has many. The Capital One SavorOne is good for everyday expenses. If you prefer a travel card, take a look at the Venture Rewards.

Capital One SavorOne Cash Rewards

- Credit Score: Excellent.

- Annual Fee: Does not charge an annual fee.

- Regular APR: 0% for the first 15 months, then a variable 19.99% – 29.99%.

- Welcome bonus: Spend $500 within the first 3 months to earn $200.

- Rewards: 1% cash back on everything, and 3% cash back on selected categories, like dining and entertainment.

Capital One Venture Rewards

- Credit Score: Excellent.

- Annual Fee: $95

- Regular APR: 19.99% – 29.99% variable, based on your creditworthiness.

- Welcome bonus: 19.99% – 29.99% variable, based on your creditworthiness.

- Rewards: 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel.

Learn how to apply for the Capital One Venture Rewards and enjoy its travel benefits.

How to apply for the Capital One Venture Rewards?

This card has an excellent reputation in the market for giving great rewards to its cardholders. Consider applying for the Capital One Venture Rewards credit card.

About the author / Julia Bermudez

Trending Topics

Lexington Law review: repair your credit with confidence

Need to rebuild credit? This review will show you how Lexington Law can be an excellent option and help you.

Keep Reading

What is a mortgage statement?

A mortgage statement is an important document that provides essential information about your mortgage loan. But, what is this? Learn now!

Keep Reading

Applying for the Aspiration Spend & Save™ card: learn how!

Learn how to apply for the Aspiration Spend & Save™ card. A product that cares for your wallet and the environment just as much.

Keep ReadingYou may also like

Merrick Bank Double Your Line Platinum Visa credit card full review

The Merrick Bank Double Your Line Platinum Visa credit card will help you improve your credit score and double your limit within a few months.

Keep Reading

Social Welfare Programs: all you need to know

Learn about the history of social welfare programs and how they continue to shape our modern society. Discover what's currently available.

Keep Reading

Make up to $20 per hour working at AutoZone: see job vacancies

AutoZone is hiring with competitive pay and benefits- Check out job vacancies on our website and find your perfect fit!

Keep Reading