Reviews

Apply for Lexington Law: how to get your approval fast

Lexington Law is the ideal service for credit rebuilding. Check out how to apply and succeed with the request.

Advertisement

Lexington Law: Get the best plan to improve your finances!

Lexington Law is an excellent option for credit recovery, being one of the most sought-after in the market. However, knowing how to apply for Lexington Law is critical for approval.

The application process doesn’t require much of a headache; just filling out the information in a form. This application can be carried out online or through an application. Check out how to apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply online

Find out now if you want to know how to apply for Lexington Law. There are two main ways to use it: online or through the service’s official app for mobile devices.

However, before starting your application, it is important to remember that you must fulfill certain requirements. First and foremost, you must be a US citizen over 18 to apply.

In addition, you must have an address registered in your name to fill out the form. The online application can be made through a computer or notebook, where you fill in your information in a preform.

This form does not affect your credit score, as in the case of a prequalification. On the contrary, you apply your information so that the company knows your interest.

You will then receive an email to continue the process.

Apply using the app

There is not much information about Lexington Law offering a mobile app to its customers. However, follow the tips above to apply for this credit repair company and build credit!

Another recommendation: The Credit Pros

Now that you know how to apply to Lexington Law, you need to know that this is not your only option. After all, if you need to rebuild credit, several options are available with the variation of this service.

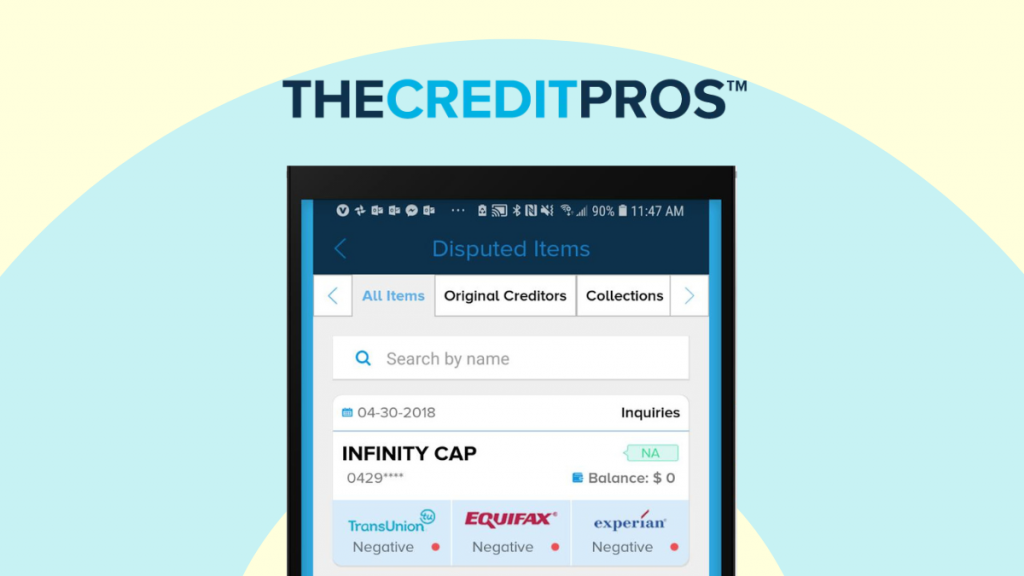

Another option we recommend is The Credit Pros, a similar credit rebuilding service. As with the previous option, The Credit Pros offers credit reconstruction and refund if there is no result within 90 days.

In addition, this option allows the construction of credit associated with this recovery. That is, you can have a credit line of up to $5,000. So, you can recover your credit score and have a significant and fast increase.

This alternative offers great customer support and has excellent reviews. In addition, it brings credit monitoring and fraud protection completely free, which makes you safer.

However, to enjoy these benefits, know that the monthly fee is one of the most expensive on the market. Additionally, line of credit tools may be limited on lower-value plans.

If you are interested in this alternative, it is important to know how to apply for a faster return. In this sense, check out the post we prepared to help you apply and succeed with the request.

How to apply for The Credit Pros

This post will give you the step-by-step to join The Credit Pros and fix your credit history once and for all.

Trending Topics

PenFed Platinum Rewards Visa Signature® Card full review

Looking for a rewards credit card? Read our PenFed Platinum Rewards Visa Signature® Card review to see if it's the right card for you.

Keep Reading

Join the Carrabba’s Italian Grill Fam: Apply for a job!

Apply for a job at Carrabba's Italian Grill and start your career in the restaurant industry. Learn more here!

Keep Reading

Ensure up to $100K quickly: Wells Fargo Personal Loan Review

Renovate your home, conquer debt, or make a major purchase- Discover how easy in our Wells Fargo Personal Loan review! Enjoy flexible rates!

Keep ReadingYou may also like

247LoanPros review: is it worth it?

Want to settle your debts? Follow this 247LoanPros review and see what benefits it can bring to your financial life.

Keep Reading

Spotify is testing the display of artists’ NFT galleries

Some users on Android are seeing a new feature from Spotify that allows artists to showcase their non-fungible token collections.

Keep Reading

Build credit with confidence: Pelican Pledge Visa Review

Looking for an affordable secured card to build your credit? See our Pelican Pledge Visa review and learn how it stacks up. Read on!

Keep Reading