Comparison

Applying for the Blue Cash Everyday® Credit Card: learn how!

A Blue Cash Everyday® Credit Card awaits your application. Earn up to 3% cash back on purchases and pay no annual fee!

Advertisement

Blue Cash Everyday® Credit Card: 0% intro APR for 15 months

Blue Cash Everyday® Credit Card could be useful if you make frequent purchases at supermarkets, gas stations, and online. And we’re here to teach you how to apply for it!

This card offers several exclusive benefits for cardholders. So keep reading and learn how the application process works!

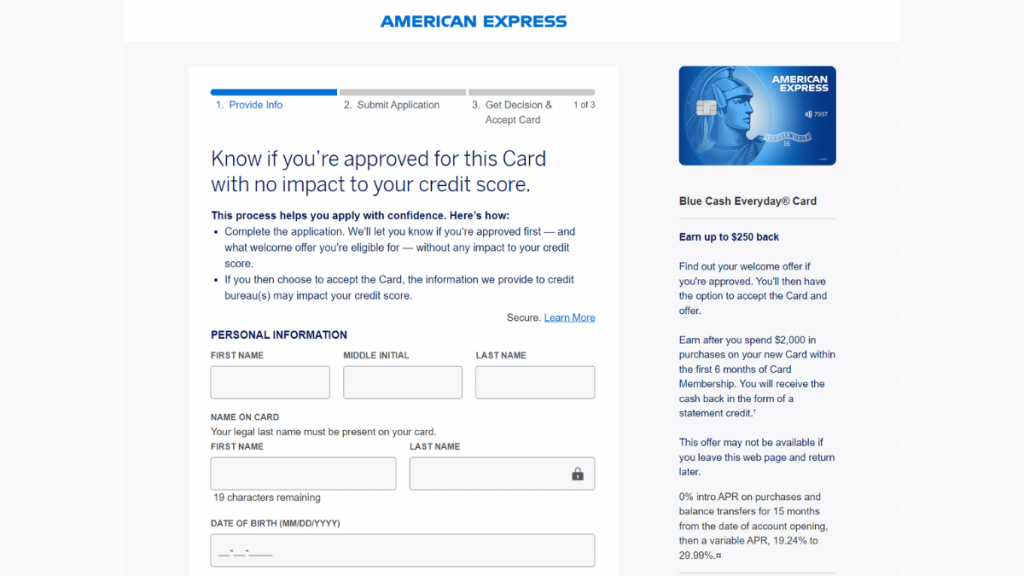

Apply online

First, you’ll need to access the website we’ve provided above! There, select the “Apply Now” option to get started.

Further, you must fill out a form with your personal information, including full name, email address, date of birth, phone number, and home address.

After checking all the information you’ve provided, follow the steps to complete your application.

At this point, you’ll only need to wait for the result to see whether you’re approved! Simple, isn’t it?

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

American Express provides an excellent mobile app to its customers. However, you cannot apply for this card through it!

For that, you’ll need to access their official website. Still, you can easily manage your account from anywhere.

Track spending and rewards, find offers, check your balance, and pay your bill with the Amex app.

So touch ID and Face ID are fast, safe, and secure on compatible devices. Fast, secure, and convenient: Amex® Mobile App.

If you have doubts whether the Blue Cash Everyday® Credit Card is the best option for you, how about checking the comparison table below?

Both require same-level credit scores. In addition, both annual fees cost a total of $0. So continue looking to analyze the bonuses and rewards.

Blue Cash Everyday® Credit Card

- Credit Score: Good to excellent;

- Annual Fee: $0 (rates & fees);

- Regular APR: 0% intro APR for 15 months from account opening; 19.24% to 29.99% on purchases and balance transfers after (rates & fees);

- Welcome bonus: Earn up to $250 back after spending $2,000 on purchases in the 1st 6 months of card Membership (terms apply);

- Rewards: 3% cash back on groceries, U.S. Online retail purchases, and gas stations; 1% cash back on other purchases (terms apply).

PenFed Platinum Rewards Visa Signature® Card

- Credit Score: Good/excellent;

- Annual Fee: $0;

- Regular APR: 17.99% variable on purchases; 0% intro APR for 12 months on balance transfers made in the 1st 90 days from account opening, 17.99% after;

- Welcome bonus: 15,000 points after $1,500 on purchases during the first three months;

- Rewards: 5x points on the gas you pay at the pump and EV charging; 3x points at the supermarket, restaurants, and TV, radio, cable, and streaming services; and 1x points on any other purchase;

- Terms apply.

Has the PenFed Platinum Rewards Visa Signature® Card gotten your attention? Great! Read our following article and learn how to apply for it.

Applying for the PenFed Platinum Rewards Visa

If you need a card with great perks for drivers and discounts on gas and EV stations, read on to learn how to apply for the PenFed Platinum Rewards Visa Signature® Card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The information provided was accurate at publication, though certain offers may no longer be applicable.

Trending Topics

Wedding loans in Canada: financing your big day

Wedding loans in Canada can make your dream come true. Understand how this loan works and get married the way you deserve!

Keep Reading

Home Depot Project Loan review: is it worth it?

Read our Home Depot Project Loan review and learn how this product can help you! Borrow up to $55K to renovate your home! Read on!

Keep Reading

Apply for The Credit People: credit recovery made simple

The Credit People is a great option to restore your name in the financial market. Learn how to apply for The Credit People and succeed.

Keep ReadingYou may also like

Net First Platinum credit card full review

The Net First Platinum credit card is the perfect card for individuals who shop at the Horizon Outlet website. Check it out!

Keep Reading

Elevate your finances: Apply for the Sesame Cash Debit Card today

Upgrade your online banking experience! Apply today for the Sesame Cash Debit Card and earn cash back on select brands! Read on!

Keep Reading

Milestone® Mastercard® – Unsecured For Less Than Perfect Credit full review

If you have less-than-perfect credit, you should apply for the Milestone® Mastercard® - Unsecured For Less-Than-Perfect Credit! Learn more!

Keep Reading