Reviews

Applying for the Indigo® Mastercard® Credit Card: learn how!

The Indigo® Mastercard® Credit Card is perfect for helping you rebuild credit. See what are the steps to make the application!

Advertisement

Indigo® Mastercard® Credit Card: easy application with a low score

The Indigo® Mastercard® Credit Card is a great option for those who need a card but don’t have enough score. It allows us to pay bills while helping to rebuild credit.

However, it is not enough to meet the requirements to qualify and be approved, it is essential to know how to apply.

The application can be made online and by application and requires the correct filling. Know more!

Apply online

Applying for the Indigo® Mastercard® Credit Card is essential to fulfilling the requirements. In this sense, it is important to be over 18 years of age and to be a US citizen residing in the US.

The online application can be made through a notebook or computer with internet access.

However, it is important to fill in the registration with as much data as possible and wait for the evaluation.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

Unfortunately, there is not much information about a mobile app for Indigo. So, if you think this card is the bets option for you to build credit, you can follow the steps above to complete your application!

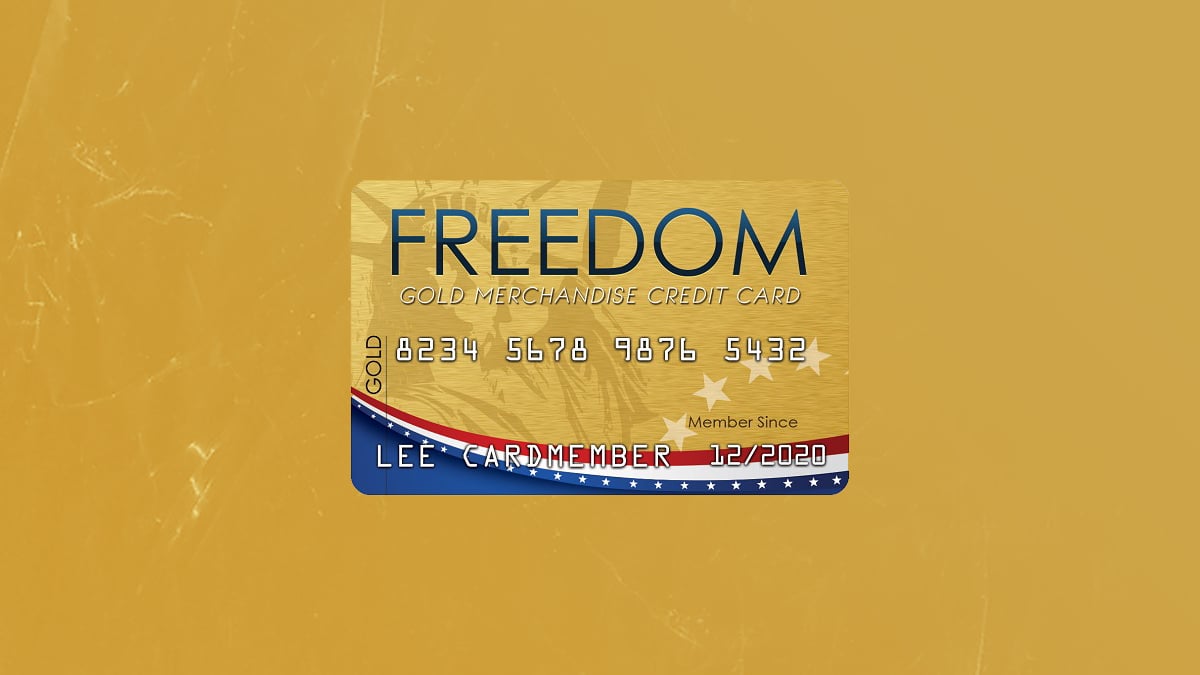

Indigo® Mastercard® Credit Card vs. Freedom Gold Card

While the Indigo® Card is a great option for anyone needing credit, it’s not the only one. An alternative to this card is the Freedom Gold Card.

In addition, the Freedom Gold Card allows for a higher credit limit, which can be as high as $750. Annual fees may be higher than Indigo® Mastercard® Credit Card due to the low APR.

However, the options must be evaluated individually, according to each person’s objective. Check out the comparison between these options and see which makes the most sense in your routine.

Indigo® Mastercard® Credit Card

- Credit Score: Bad / Poor;

- Annual Fee: $175 the first year; then $49 annually;

- Regular APR: 35.9%;

- Welcome bonus: N/A;

- Rewards: N/A.

Freedom Gold Card

- Credit Score: Bad / Poor;

- Annual Fee: $177.24 ($14.77/month);

- Regular APR: 0%;

- Welcome bonus: N/A;

- Rewards: N/A.

And if you’re interested in learning more about the Freedom Gold Card and how to apply for it, check out our post below to find out!

Freedom Gold Credit Card Review

The Freedom Gold card is an excellent no-red-tape option for individuals with poor credit who need to get their hands on a credit card fast. Let us help you do that.

Trending Topics

Applying for the Chase Freedom® Student card: learn how!

Want a card with many benefits for students? Then learn how to apply for a Chase Freedom® Student card and enjoy your benefits.

Keep Reading

Discover student loan review: is it worth it?

Looking for a great loan option to cover the cost of your studies? Then you need to know the advantages of the Discover Student Loan!

Keep Reading

Applying for the Chase Ink Business Cash® Credit Card: learn how!

Wondering how to apply for the Chase Ink Business Cash card? Wonder no more! Enjoy cash back, 0% intro APR, and more. Read on!

Keep ReadingYou may also like

U.S. Bank Cash+™ Visa Signature® or Discover it® Miles card: find the best choice!

Unsure if the U.S. Bank Cash+™ Visa Signature® or Discover it® Miles is the right card for you? See our review and learn how to earn rewards!

Keep Reading

Elastic Line of Credit: how to apply now!

Get quick and easy access to a flexible line of credit with Elastic. Apply and enjoy loan amounts up to $4,500 with terms up to 10 months.

Keep Reading

5kFunds personal loan: how to apply now!

In need of a personal loan to meet your needs and use as you wish? Check out how to apply for a 5kFunds personal loan today!

Keep Reading