Reviews

Freedom Gold credit card: complete review

If you are running into trouble trying to get approved for a new credit card, Read our Freedom Gold card review and see why this one might just quickly solve that problem for you

Advertisement

Freedom Gold credit card: a simple and easy way to get a credit card with no credit, employment or income checks.

The Freedom Gold credit card can be an interesting option if you have been having difficulties getting approved for a new credit card. This card will accept applicants with bad or no credit at all, without running employment or credit checks.

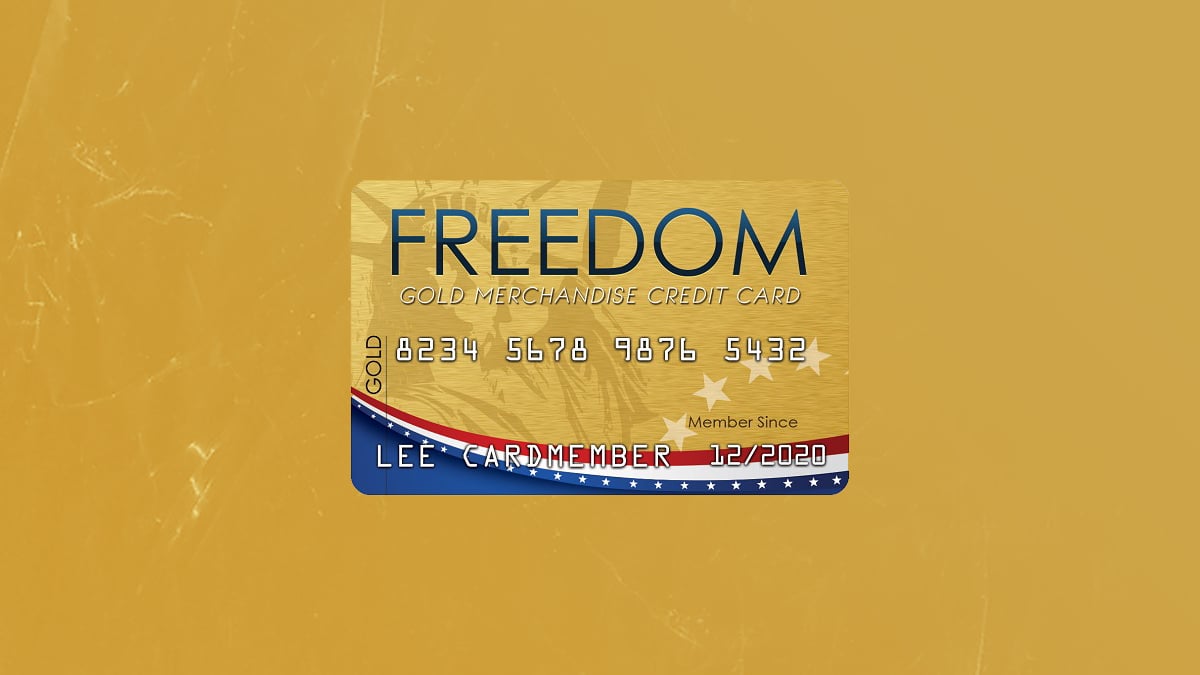

All you need to do is to complete their online application, and you are good to go. The card offers an initial $750 in unsecured credit which can be used in Horizon Outlet online purchases. Spending this credit responsibly will help you build a solid credit history and become eligible for better credit card offers.

This card charges no interest on purchases, with a nice 0% APR. However, you should keep in mind they do charge a monthly fee of $25 or 10% of its total balance. Additionally, your Freedom Gold activation will cost you a one-time $5 fee.

Have a look at a few valuable numbers about this card.

How to apply for the Freedom Gold Credit Card

Learn the application process to get your Freedom Gold credit card today!

| Sign-up bonus | N/A |

| Annual fee | $177.24 |

| Rewards | N/A |

| Other perks | Travel assistance insurance |

| APR | 0% |

How does the Freedom Gold credit card work?

In order to use your Freedom Gold card’s $750 limit you are going to have to login at Horizon Outlet’s website. To do that, you can use your card’s 16-digit number and your Zip Code. That is going to give you access to a variety of products ranging from clothing to everyday home essentials.

There is also a clearance section where you will find products at discount prices, as well as view your account balance. In addition, you get access to Credit Hawk, which offers free credit monitoring and identity theft protection of up to $1 million.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Freedom Gold credit card pros and cons

Pros

- Accepts applicants of all credit scores

- Travel assistance insurance

- Instant approval

Cons

- No signup bonus

- Does not report to credit bureaus

- Charges an annual fee

Does my credit score need to be good?

The Freedom Gold credit card is ideal for individuals facing difficulties getting a new credit card due to poor or non-existent credit history. The card issuer does not run credit checks on applicants, and almost all applications get accepted.

Want to apply for the Freedom Gold card?

The application process for this card is quite simple. Everything is done online, with zero red-tape and the approval is instant.

If you would like a more complete guide for how to apply for this card, just click on the link below and you are going to give you a hand.

How to apply for the Freedom Gold Credit Card

Learn the application process to get your Freedom Gold credit card today!

Trending Topics

5 Best Apps to Turn Your Photos Into Cartoons

Turn your photos into funny cartoons using these 5 apps. Here is a full list of options to explore. Stay tuned!

Keep Reading

Rocket Loans or LightStream Loans: pros and cons

Choosing the best loan for you can be quite a challenge. However, Rocket Loans or LightStream Loans can be good options. Check out!

Keep Reading

Aspire® Credit Card full review

Want to recover your credit score using a card? So learn more about the Aspire® Credit Card in this review and see if it works for you.

Keep ReadingYou may also like

Sallie Mae student loan application: how to apply now!

Sallie Mae has a student loan that will meet all your needs. Read on to learn more about the Sallie Mae student loan application.

Keep Reading

Crypto with the most potential in 2022: great investment opportunities

Do you know which is the crypto with the most potential in 2022? Bitcoin has given way to other currencies like Ethereum. Read on!

Keep Reading

Apply for the FIT™ Platinum Mastercard®: Learn how!

You can easily apply for the FIT™ Platinum Mastercard®, get a quick response, and start building your credit score today! We'll show you how.

Keep Reading