Reviews

Apply for the Reflex® Platinum Mastercard® Card: Learn how!

Need some help with your credit score? The Reflex® Platinum Mastercard® Card can be the solution you're looking for. See how to apply!

Advertisement

Reflex® Platinum Mastercard®: Easily apply and build credit!

The Reflex® Platinum Mastercard® Card is an excellent option to rebuild credit. It also has a good starting limit and is open to requests by people with any credit score.

If you know how to apply, you can increase your chances and have a higher starting limit. Check out how to apply online below!

Apply online

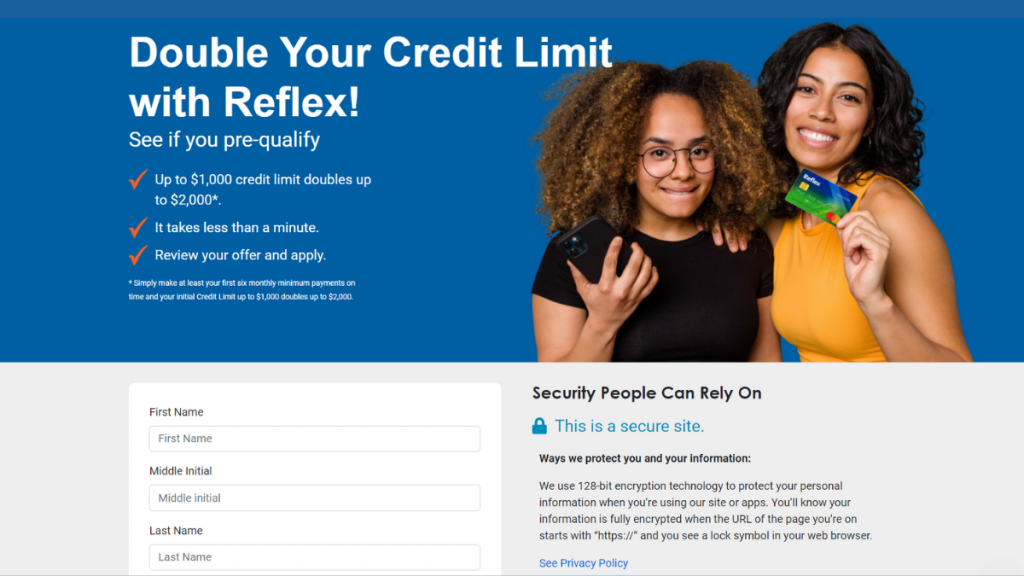

Before considering applying for your Reflex® Platinum Mastercard® Card, it is important to consider whether you are eligible.

If you have the requirements, go ahead. Log in to the Reflex® Platinum Mastercard® official website using a computer or notebook with internet access.

Then, fill in the form with your personal and financial data and wait for your evaluation.

It is worth mentioning that the analysis can bring immediate results if there is no outstanding problem.

However, you can also be approved after a few days if there are any serious defaults.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can apply for the card through the official website by following the steps above. However, you can’t apply through the app.

Reflex® Platinum Mastercard® vs. FIT™ Platinum Mastercard®

As we have seen, the Reflex® Platinum Mastercard® Card is a great option for those with a bad credit score.

In addition, it carries reasonable APR rates and reports good usage to major credit bureaus. However, it is not the only option. You can also opt for the FIT™ Platinum Mastercard®.

After all, this credit card is ideal for rebuilding credit and does not require a good credit score. However, it does not have an initial bonus. Check out the comparison below.

Reflex® Platinum Mastercard®

- Credit Score: Fair/Poor/Bad/Limited;

- Annual Fee: $125 for the first year. After that, $96 per year;

- Regular APR: 29.99% variable;

- Welcome bonus: N/A;

- Rewards: There’s no rewards programs available at this time.

FIT™ Platinum Mastercard®

- Credit Score: Poor/Fair;

- Annual Fee: $99;

- Regular APR: 29.99% variable;

- Welcome bonus: N/A;

- Rewards: None.

And now, if you think the FIT™ Platinum Mastercard® will be a better option for you, check out our post below to learn about the application process!

How do you get the FIT™ Platinum Mastercard®?

If you're looking for a card to rebuild your credit history, you can count on the FIT™ Platinum Mastercard® to help you. It's easy to apply and to get approved.

Trending Topics

Merrick Bank Personal Loan review: is it worth it?

In this Merrick Bank Personal Loan review you will learn if borrowing from this bank is a good deal, and whether it is for you.

Keep Reading

Make up to $20 per hour working at Raising Cane’s: see job vacancies

Explore exciting career opportunities at Raising Cane's. Discover the diverse roles available here- stay tuned!

Keep Reading

First Access Visa® Card full review

If you have a low score and need a credit card, read our First Access Visa® Card review and find out how this credit card option can help!

Keep ReadingYou may also like

Applying for the Upgrade Rewards Checking Account: learn how

Learn everything you need to know about applying for the Upgrade Rewards Checking Account, including what information you'll need to start.

Keep Reading

PenFed HELOC review: Unlocking Your Home Equity

Read our full review if you want to know if PenFed HELOC is the right loan for you! Borrow up to $500K quickly at affordable terms.

Keep Reading

Ethereum successfully completes its first test merge

Ethereum, the world's second largest cryptocurrency by market cap, completed a major development milestone this past week with a test merge.

Keep Reading