Loans

PenFed HELOC review: Unlocking Your Home Equity

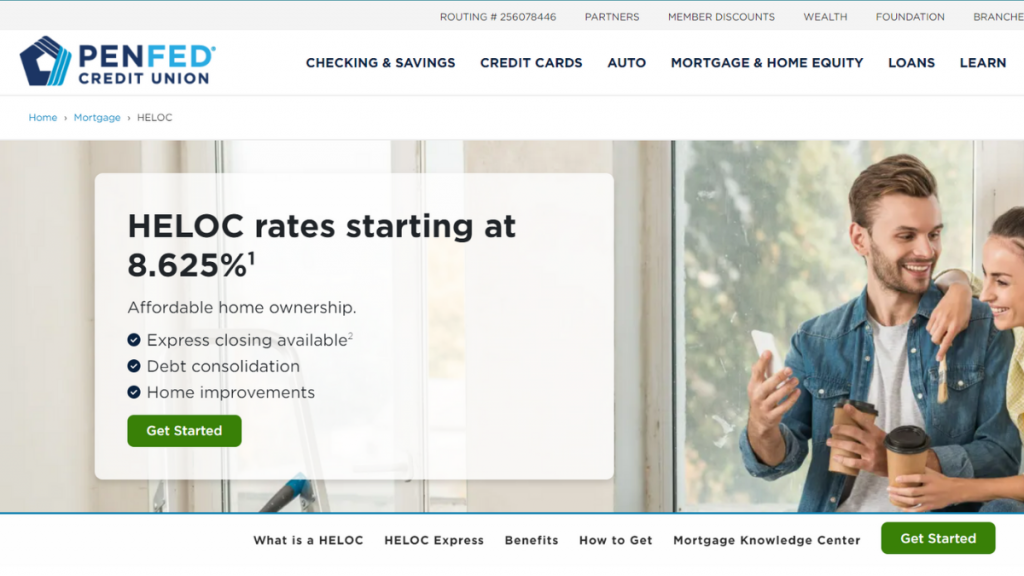

With competitive interest rates and a wide range of loan amounts, PenFed HELOC may be the perfect solution for your financial needs.

Advertisement

Up to $500K for your home equity

If you’re a homeowner looking to tap into your home equity, a home equity line of credit (HELOC) can be a great option. So don’t miss our PenFed HELOC review!

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now – get the money you need quickly and use it for several purposes! Keep reading and learn more!

Here’s a closer look at what PenFed HELOC has to offer. So, keep reading to learn more!

| APR | Rates starting at 8.625%; |

| Loan Purpose | Debt consolidation, home improvement, large purchases, and more; |

| Loan Amounts | $25,000 to $500,000; |

| Credit Needed | 660 Minimum; |

| Terms | Draw: 10 years, Repayment: 20 years; |

| Origination Fee | Not Disclosed; |

| Late Fee | 5%; |

| Early Payoff Penalty | Not Disclosed. |

PenFed HELOC overview

PenFed’s HELOC offers an amazing financial product to help you achieve your financial goals! It brings affordable conditions to those who need some extra money!

Also, it allows you to quickly access the funds and use them for multiple purposes, including home improvements, debt consolidation, pay off student loans, etc.

You can borrow up to $500K and repay the HELOC in up to 20 years! So don’t hesitate to get the money you need!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is it worth it to apply for PenFed HELOC?

Whether or not PenFed HELOC is worth it for you depends on your specific financial situation and needs. Some potential benefits and disadvantages of PenFed HELOC include:

Benefits

- Competitive rates: With a low introductory rate and competitive variable rates, PenFed HELOC can be a cost-effective way to borrow against your home equity;

- Flexible repayment options: With a 10-year draw period and a 20-year repayment period, PenFed HELOC gives you plenty of time to pay back what you owe. And you can make interest-only payments during the draw period;

- Large borrowing amount: With up to $1 million, PenFed HELOC can provide you with the funds you need for big-ticket expenses.

Disadvantages

- Limited availability: PenFed is a credit union, so you must be a member to apply for a HELOC. Membership is limited to certain groups, such as military personnel and their families;

- Fees: While PenFed does not disclose origination fees, they do charge a late fee of 5% and may charge other fees, such as appraisal fees or early termination fees;

- Variable rates: While variable rates can benefit in a low-interest-rate environment, they can also be a disadvantage if rates rise over time, causing your monthly payment to increase.

What credit score is required for the application?

To be considered for PenFed HELOC, you need a minimum credit score of 660. However, remember that credit score is just one of several factors that PenFed will consider when reviewing your application.

Indeed, other factors may include your debt-to-income ratio, employment history, and the amount of equity you have in your home.

How does the application process work?

To apply for the PenFed HELOC, you’ll need to gather necessary documents such as income statements, tax returns, and proof of homeownership.

Then, you can apply online through PenFed’s website or over the phone.

Once your application is approved, you must complete a home appraisal and sign the final documents.

So if you’re interested in learning more about how to apply for the PenFed HELOC, check out our article on “How to Apply for a PenFed HELOC.”

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now – get the money you need quickly and use it for several purposes! Keep reading and learn more!

Trending Topics

Applying for the One Finance Account: learn how!

Apply for a One Finance Account today and learn how to manage your expenses, monitor your bank account, and save your money all in one app!

Keep Reading

Truist Future Credit Card full review: 0% APR for the first 15 months

Read our comprehensive Truist Future Credit Card review. Pay $0 annual or foreign transaction fees! Keep reading and learn more!

Keep Reading

TOP 10 best personal loans 2022: even for bad credit!

Do you have a low credit score and need an affordable loan? Read this article to discover the best personal loans for bad credit.

Keep ReadingYou may also like

Lending Tree Personal Loan review: is it worth it?

Read our Lending Tree Personal Loan review and find out if this service is right for you! Connect with multiple lenders.

Keep Reading

What is a mortgage statement?

A mortgage statement is an important document that provides essential information about your mortgage loan. But, what is this? Learn now!

Keep Reading

NetCredit Personal Loans: how to apply now!

Do you need financial assistance? Learn how to apply now and get up to $10,000 with NetCredit Personal Loans. Start your application today!

Keep Reading