Loans

Tap into Your Home’s Equity: Bank of America HELOC review

The smart choice for homeowners who need to finance large expenses or pay off high-interest debt - ensure Bank of America HELOC today!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Your home equity with competitive rates

Are you looking to renovate your home or pay off high-interest debt? Bank of America HELOC may be the solution you’re looking for, and today we’ll review it!

Moreover, with competitive rates and flexible terms, a HELOC allows you to tap into your home’s equity to finance your goals. So, check out the features and benefits.

| APR | Starting at 7.49%; |

| Loan Purpose | Home renovation, debt consolidation, and more; |

| Loan Amounts | $25,000-$1 million; |

| Credit Needed | 660 minimum; |

| Terms | 10-year draw period and 20-year repayment term; |

| Origination Fee | Not Disclosed; |

| Late Fee | Not Disclosed; |

| Early Payoff Penalty | Not Disclosed. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Bank of America HELOC overview

Bank of America’s Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity they’ve built in their homes.

So, a HELOC is a revolving line of credit you can draw on as needed, and your home secures it.

Nevertheless, with Bank of America’s HELOC, you can access funds for various purposes, including home renovations, debt consolidation, or college tuition.

Therefore, one of the benefits of Bank of America’s HELOC is its competitive interest rates. We are making it an attractive option for those looking to borrow money.

Additionally, Bank of America doesn’t charge an application fee, making it more affordable for borrowers to access the funds they need.

Is it worth it to apply for Bank of America HELOC?

Whether or not it’s worth applying for Bank of America’s HELOC depends on your financial situation and goals.

Moreover, a HELOC can be a valuable tool for homeowners who need to access their home’s equity to finance large expenses or pay off high-interest debt.

However, it’s important to carefully consider the pros and cons before applying.

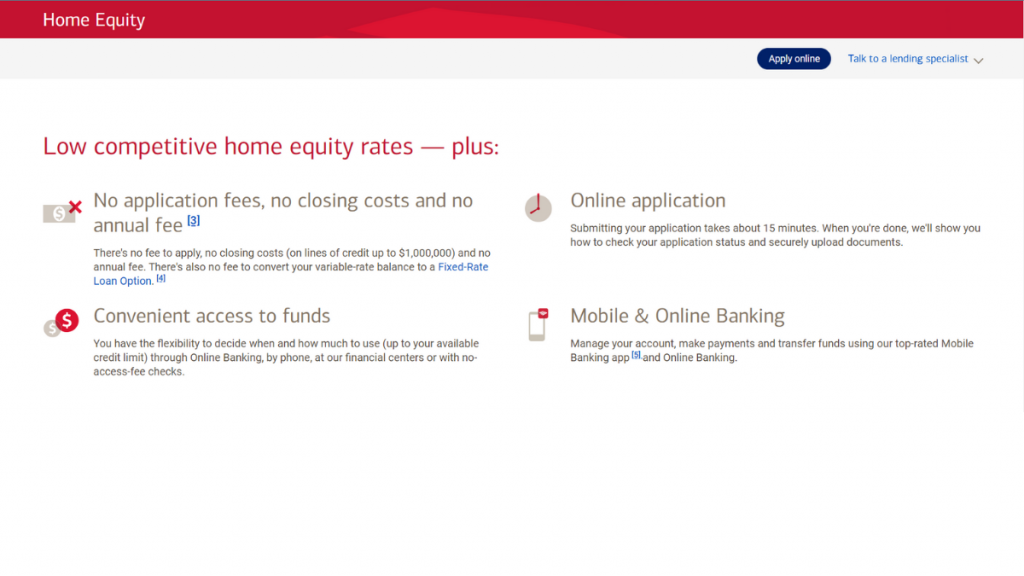

Benefits

- Competitive interest rates: Starting at 7.49%, Bank of America’s HELOC offers competitive rates that may be lower than other forms of credit;

- Flexibility: With a HELOC, you can use the funds for various purposes, from home renovations to debt consolidation;

- No application fees: Bank of America doesn’t charge an application fee for its HELOC;

- Convenient access to funds: You can access your HELOC funds through online banking, checks, or a Bank of America debit card.

Disadvantages

- Variable interest rates: The interest rate on your HELOC may change over time, making it harder to budget for your payments;

- Risk of foreclosure: A HELOC is secured by your home, which means that you could risk losing your home if you can’t make your payments;

- Minimum draw requirements: Bank of America requires a minimum draw of $25,000 when opening your HELOC. This could be a disadvantage if you don’t need that much money.

What credit score is required for the application?

You’ll need a credit score of at least 660 qualify for Bank of America’s HELOC.

Remember that your credit score isn’t the only factor Bank of America will consider when reviewing your application.

They’ll also examine your debt-to-income ratio, employment history, and other financial factors.

How does the application process work?

If you’re a homeowner looking for a flexible and affordable way to access the equity in your home, then you should apply for Bank of America HELOC today!

Moreover, this guide walks you through the steps to apply for this option. So, check out!

Apply online

One of the easiest and most convenient ways to apply for a Bank of America HELOC is to do so online. After all, here’s how:

- Visit the Bank of America website and navigate to the HELOC page;

- Click on the “Apply Now” button to start your application;

- Provide your personal information, including your name, address, and Social Security number;

- Enter your employment and income details, including your current employer, job title, and monthly income;

- Enter information about your home, including the property address, the estimated value of your home, and your outstanding mortgage balance;

- Submit your application and wait for a response from Bank of America.

Requirements

However, you must meet certain eligibility requirements to apply for a Bank of America HELOC. So these include:

- A minimum credit score of 660;

- Sufficient equity in your home;

- A stable income and employment history;

- A debt-to-income ratio of 43% or lower.

In addition, you may be required to provide additional documentation, such as proof of income and a home appraisal, to support your application.

Apply on the app

If you prefer to apply for your Bank of America HELOC on the go, you can do so through the Bank of America mobile app. So, check out:

- Firstly, download the Bank of America app from the App Store or Google Play Store;

- Log in to your account or create a new one;

- Navigate to the HELOC section of the app;

- Follow the same steps as the online application process, providing your personal, employment, and home information;

- Submit your application and wait for a response from Bank of America.

Bank of America HELOC vs. Alliant Credit Union HELOC: which is best for you?

While Bank of America offers competitive rates and flexible repayment terms, it’s not the only option for homeowners looking for a HELOC.

Alliant Credit Union also offers HELOCs with competitive rates and flexible repayment terms, making it a strong alternative for borrowers.

When deciding which lender to choose, it’s important to compare rates, fees, and eligibility requirements to determine which is best for your financial situation.

So, check the comparison below:

| Bank of America HELOC | Alliant Credit Union HELOC | |

| APR | Starting at 7.49%; | Starting at 8.75%; |

| Loan Purpose | Home renovation, debt consolidation, and more; | Home renovation, debt consolidation, and more; |

| Loan Amounts | $25,000-$1 million; | Up to $250,000; |

| Credit Needed | 660 minimum; | Not Disclosed; |

| Terms | 10-year draw period and 20-year repayment term; | 10-year draw period and 20-year repayment; |

| Origination Fee | Not Disclosed; | Not Disclosed; |

| Late Fee | Not Disclosed; | Not Disclosed; |

| Early Payoff Penalty | Not Disclosed. | Not disclosed. |

In summary, the Alliant Credit Union HELOC offers competitive interest rates and a variety of loan options. However, qualifications may be more strict than other lenders.

Finally, if you want to apply for an Alliant Credit Union HELOC, check out our “How to Apply” article for more information.

Apply now for Alliant Credit Union HELOC

Learn how to apply for Alliant Credit Union HELOC and take advantage of the benefits offered by this financial institution – low rates!

Trending Topics

SoFi Personal Loan review: is it worth it?

Learn more about the pros and cons of a Sofi personal loan and whether it's worth getting one. No hidden fees and fast funding. Read on.

Keep Reading

Sable Review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep Reading

Bilt Mastercard® review: $0 annual fee

Are you looking for a new credit card? Check out our Bilt Mastercard® review. Earn points and pay no annual fee!

Keep ReadingYou may also like

What is market capitulation and why should you keep investing?

Despite recent market downturns, there are still plenty of reasons to invest even if a market capitulation happens. Learn more next!

Keep Reading

Chase Freedom Unlimited® Review: 0% intro APR

A great cash back card with plenty of flexibility! Check out our Chase Freedom Unlimited® review to see if it's the right card for you.

Keep Reading

X1 Credit Card Review: earn up to 10x points

Check out our review of the X1 Credit Card to see how it can help you. Earn points on purchases and pay no annual fee!

Keep Reading