Credit Cards

Apply for the OpenSky® Secured Visa® Credit Card: Learn how!

Applying for the OpenSky® Secured Visa® Credit Card is a smart move for credit building. Enjoy low fees and easy approval. Start your journey to better credit with a simple online application.

Advertisement

OpenSky® Secured Visa® Credit Card: With a quick online application and no credit checks, you’re on your way towards better credit!

A secured credit card can help you achieve better financial health so you can qualify for better cards in the future. Today, we’ll show you how to apply for the OpenSky® Secured Visa®.

In the realm of secured card, this is one of the best options. While you won’t earn any traditional rewards, it’ll get you where you need to go. Curious? Then let’s begin.

No credit check is required, the approval takes just a few minutes and you can also benefit from the fact the card reports monthly to all 3 major credit bureaus.

Apply for it today and see how easy it is to get back on track with your finances! This card is simple and easy to understand.

It’s a very nice option for people that are looking for simple features and people who are new to credit, or who are working on rebuilding their credit.

Besides, when you apply, you get instant feedback letting you know if your application was approved or not.

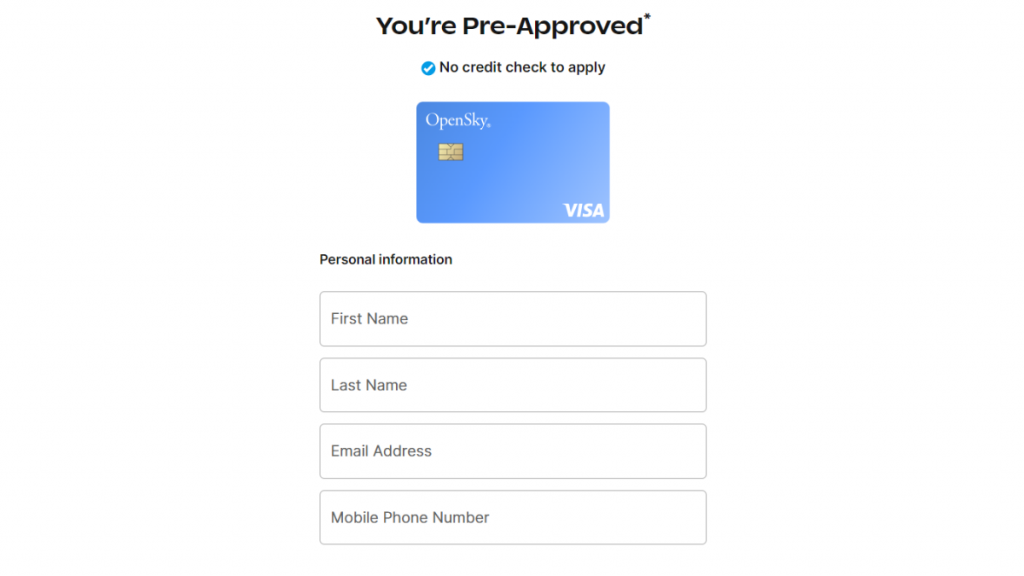

Apply for the OpenSky® Secured Visa® Credit Card online

In order to apply for OpenSky® Secured Visa® Credit Card:

- You must be 18 years or older

- Provide your Social Security Number

- Submit a refundable security deposit

After you get approved, you need to activate your card. Visit the company’s website and click the blue MyAccount button to get to the online account management login page.

You can find the Activate Card button on the top right if using a desktop.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Using the app to apply isn’t an option available at this moment. However, you can use the app for everything else.

Meaning you can manage payments and transactions with a few taps on a screen, from your phone or tablet. Additionally, you can also make payments using the app.

OpenSky® Secured Visa® Credit Card vs. Assent Platinum Secured Credit Card

But if you are still unsure if this card is the best option for your financial life, we can help you out!

Check out our comparison table below to learn more about another great credit card, the Assent Platinum Secured Credit Card.

| OpenSky® Secured Visa® Credit Card | Assent Platinum Secured Credit Card | |

| Credit Score | All credits are welcome to apply. | All credits can request the card. |

| Annual Fee | $35. | $0. |

| Regular APR | 25.64% (variable). | 29.24% (variable). |

| Welcome bonus | It does not offer a welcome bonus. | None. |

| Rewards | It does not offer rewards. | No rewards program available. |

Apply for the Assent Platinum Secured Card

Looking for a card with a hassle-free process? Read on a learn how to apply for the Assent Platinum Secured Credit Card! $0 annual fee!

Trending Topics

LoanPioneer review: is it worth it?

Need money to solve one-off issues? Check out this LoanPioneer review and find out if it can solve your problems.

Keep Reading

HCOL area: what is the meaning for your finances?

What is an HCOL area meaning? This article answers this question and explains where HCOL, MCOL and LCOL areas connect to your finances.

Keep Reading

Companies are resorting to robots as a response to labor shortages

Labor shortages caused the orders for workplace robots to rise over 40% during the first quarter in the United States. Read on for more!

Keep ReadingYou may also like

Applying for the Mission Money debit card: learn how!

With the Mission Money card you get access to an amazing app to help you manage your budget and pay no annual fees. Learn how to get yours!

Keep Reading

Make up to $20 per hour working at AutoZone: see job vacancies

AutoZone is hiring with competitive pay and benefits- Check out job vacancies on our website and find your perfect fit!

Keep Reading

CreditFresh Line of Credit: how to apply now!

Looking for a reliable and convenient line of credit? Then apply for the CreditFresh Line of Credit today! Borrow up to $5,000 fast!

Keep Reading