News

What is market capitulation and why should you keep investing?

Capitulation is a term used to describe when investors decide it's time to get out of their losing investments and do something else with their money, but there are still some solid reasons for investing despite the big dip. Read on to learn more!

Advertisement

Investing now could pay off big time in the long run.

There’s a financial term that never leaves the mouths of analysts whenever the stock market is in trouble: capitulation. If you’re an investor, you have probably heard the term once or twice since January due to the market’s current situation. But what exactly does it mean? Capitulation is basically a point where most investors give up the hope of recovering lost gains and sell off their assets. It usually happens when the market’s shaken by volatility, uncertainty and investor’s sentiment is down.

Jason Steeno, president at CoreCap Advisors says that capitulation happens when investors no longer see a future for the asset. It’s when they understand that they’ve soaked up all the losses they possibly can. Therefore, it’s time to sell and get out.

According to Shweta Lawande, a financial planner at Francis Financial, this type of selling is usually based on fear. She believes that investors grow worried that they won’t be able to regain the money they invested previously by keeping the stock. The downside is that all of the selling among investors has a negative impact on stocks and causes their prices to drop even further.

What to expect after capitulation?

Identifying capitulation while it’s happening can be difficult, and many financial experts say it’s more easily spotted while looking in retrospect. However, it’s something most analysts watch for. That is because it can signal better days ahead by pointing to the bottom of a down market cycle.

Meaning that capitulation and a short-term drop usually signifies an improvement in stock prices later. Lawande adds that this ascending movement benefits from losses of investors who sold their stocks on the decline.

For many investors who are putting their money for the long term, capitulation can be a frightening period. But, according to financial advisors, one that requires very little action on the investor’s side. Steeno says he’s a big believer in staying invested, even during these trying times. He adds that history has shown that investors who pull their assets out when the market’s experiencing turbulence, usually miss out on the best rebound days. That ends up hurting their portfolio in the long run.

Market downturns also present good opportunities for expanding a portfolio. Lawande says that stocks that are being drawn down based on a fear reaction could become profitable in the near future. Moreover, purchasing those stocks mean taking advantage of much lower prices.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Stick with your original plan

Even though it’s easier said than done, in a situation when the market’s experiencing a high volatility with a risk of capitulation, the best course is to return to the original plan. That means what made investors begin to buy stocks and continue to invest when the markets were performing better.

To avoid sleepless nights, Lawande says it’s important for anxious investors to rebalance their portfolio. If a person’s nervous about losing too much money, it may be a sign that they’re risking too much. There’s no problem in reviewing the portfolio and changing it to a setting that will protect them from steep losses.

It’s hard to predict what might happen in today’s market environment because pretty much every area on a portfolio is being hit at once. However, Lawande says it’s crucial to focus only on what investors can control and stick to the original investing strategy.

Does the current market conditions seem strange to you? We can help you. Follow the link below to understand what a bear market is, its signs and how you can protect your capital.

Bear market: what is it in investing terms?

What is a bear market and what can you do to protect your investments when they occur?

Trending Topics

Credit Saint review: repair your credit with confidence

Credit Saint review helps you rebuild your credit score. Learn what the pros and cons of this option are and how it works.

Keep Reading

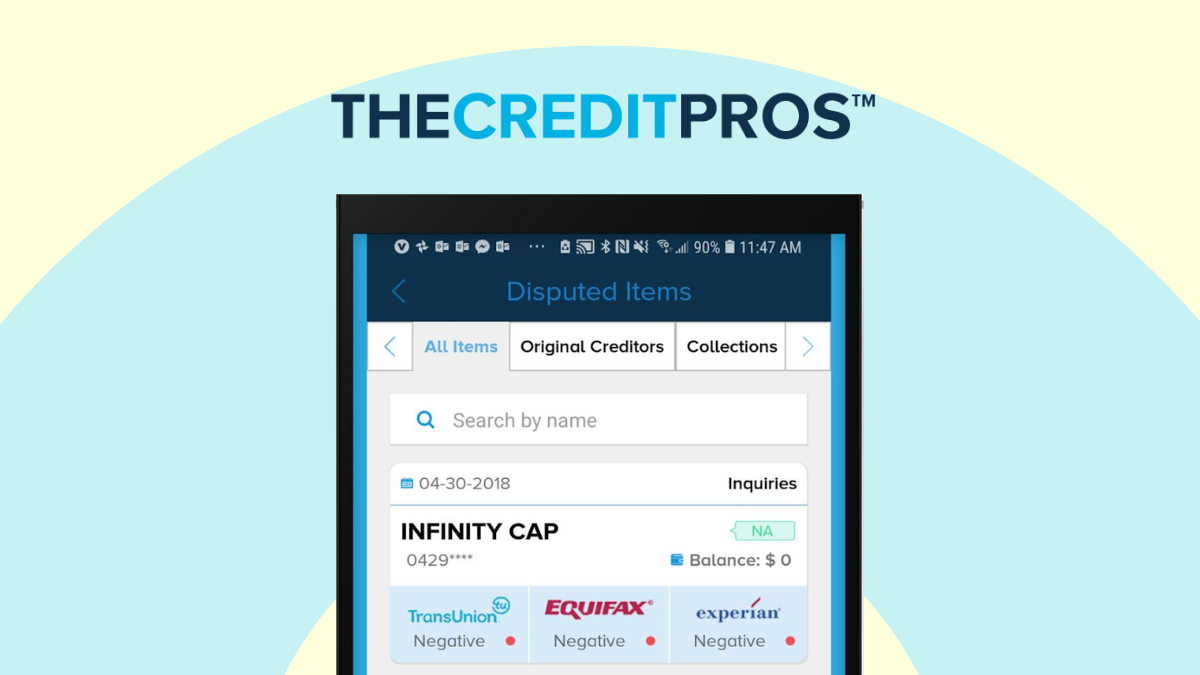

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep Reading

Merrick Bank Personal Loan review: is it worth it?

In this Merrick Bank Personal Loan review you will learn if borrowing from this bank is a good deal, and whether it is for you.

Keep ReadingYou may also like

Get a Job at Five Guys: Basic Steps to Apply Online

Discover the process to apply for a job at Five Guys. Competitive wages and ongoing development opportunities await. Keep reading!

Keep Reading

Applying for the Regions Life Visa® Credit Card: learn how!

Wondering how to apply for the Regions Life Visa® Credit Card? We'll show you how! Enjoy 0% intro APR for 15 months and more!

Keep Reading

Chase Freedom Unlimited® Review

A great cash back card with plenty of flexibility! Check out our Chase Freedom Unlimited® review to see if it's the right card for you.

Keep Reading