Debit Cards

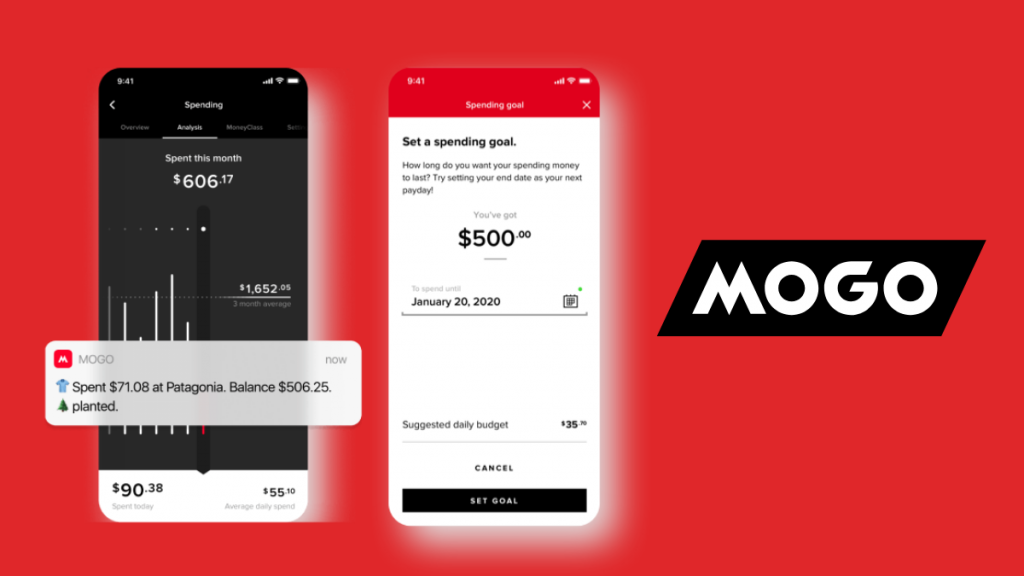

Mogo debit card review

Millions of Canadians are already enjoying the Mogo debit card benefits. Read this review to understand why and see if you'd like to get one too.

Advertisement

Note: The Mogo debit card has been discontinued by the issuer, and currently, it is not possible to apply for it.

Mogo debit card: the best way to spend your money is to get rewards for it

Mogo debit card is a new way to spend your money. We can’t keep using banking services the same way for so long. It’s time to let technology simplify and optimize our everyday tasks.

With your old checking account and debit card from your traditional bank, you could use it only to spend money and had to face a lot of steps to solve simple things. Mogo debit card is not that way. You’ll earn rewards and can solve everything through your mobile app.

To learn everything about the best debit card to use in Canada (according to over 1.6 million Canadians) keep reading this review.

How to get a Mogo debit card?

Are you ready to improve the way you manage your money with a debit card? Mogo card will give you rewards while helping you to save money with better budgeting.

- Credit Score: It is a reloadable debit card, so don’t worry about your credit score.

- Annual Fee: Mogo will charge you $0 for you to use this card.

- Regular APR: No APR

- Welcome bonus: There is no welcome bonus to opening your account.

- Rewards: Every time you swipe or tap your card, Mogo will plant a tree for you and give you 50 Green Satoshi.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Mogo debit card work?

It is very simple to get your Mogo card, as there is no unnecessary bureaucracy. Just open your account, transfer money to it and use your card to spend it.

Mogo’s customers claim that the mobile app functions help them save money by showing hints of budgeting. The rewards will also help save the planet too, with trees that offset your carbon footprints and Green Satoshis, which is a sustainable cryptocurrency.

Mogo debit card pros and cons

There are a lot of pros to this debit card, which you can compare to the cons and decide if you’d like to apply for a Mogo card. We’ve highlighted a few pros and cons here for you:

Pros

- Super intuitive app that helps you manage your finances and will help you save more money.

- You transfer the amount you wish to spend, and there is no way to overspend or create debt.

- No fees to open your account or to use your debit card.

- Visa protects your card, with zero fraud liability.

- Track your credit score for free, even though this is not a credit card.

- Earn cryptocurrencies as rewards for using your card, which can help you enter the crypto market.

Cons

- If you need to build credit, you’ll have to pick another card, because Mogo does not build credit.

- It does not offer an extended warranty or any kind of insurance on your purchase.

- The card has a spending limit per purchase and per day, as well as a deposit limit.

- Your money is not CDIC insurance, so it’s not a good idea to keep a lot of money in your account anyway.

Does my credit score need to be good?

No, you don’t need any credit score at all. Mogo debit card has no credit involved, just the prepaid debit card. So, don’t worry about hard inquiries on your credit score.

Want to apply for a Mogo card?

You can get your Mogo card almost instantly – at least the virtual one. Learn everything about the process to open your account and request your debit card in the following post here on Stealthy Capitalist.

How to apply for a Mogo debit card?

Are you ready to improve the way you manage your money with a debit card? Mogo card will give you rewards while helping you to save money with better budgeting.

Trending Topics

Pay $0 annual fee: Assent Platinum Secured Credit Card review

You just found the card that works for you! Read our Assent Platinum Secured Credit Card review and learn how! Build credit quickly!

Keep Reading

Make up to $17/h working at Five Guys: see job vacancies

Unleash your inner burger maestro: Discover Five Guys job opportunities with medical coverage and many other benefits. Read on!

Keep Reading

Earnest Private student loan review: is it worth it?

Do you need to finish your studies and have no money? Find out how the Earnest Private student loan can help you out!

Keep ReadingYou may also like

Applying for the Luxury Black credit card: learn how!

Want to know what it takes to get your hands on a Luxury Black card? We'll show you how easy it is to apply so you can start earning rewards!

Keep Reading

No fees and no hassle: Sesame Cash Debit Card review

You just found a game changer debit card! Read our Sesame Cash Debit Card review and learn how to build credit and pay no fees! Let's go!

Keep Reading

Wedding loans in Canada: financing your big day

Wedding loans in Canada can make your dream come true. Understand how this loan works and get married the way you deserve!

Keep Reading