Credit Cards

Neo Financial credit card full review

Are you looking for a better credit card to use in Canada? Look no further. You found the Neo Financial credit card. Read this review to see which benefits it has to offer.

Advertisement

Neo Financial credit card: the best card to get cash back – rates go up to 15%

The Neo Financial credit card has everything Canadians wish for when they apply for a credit card. It is considered by many the best cash back credit card to get.

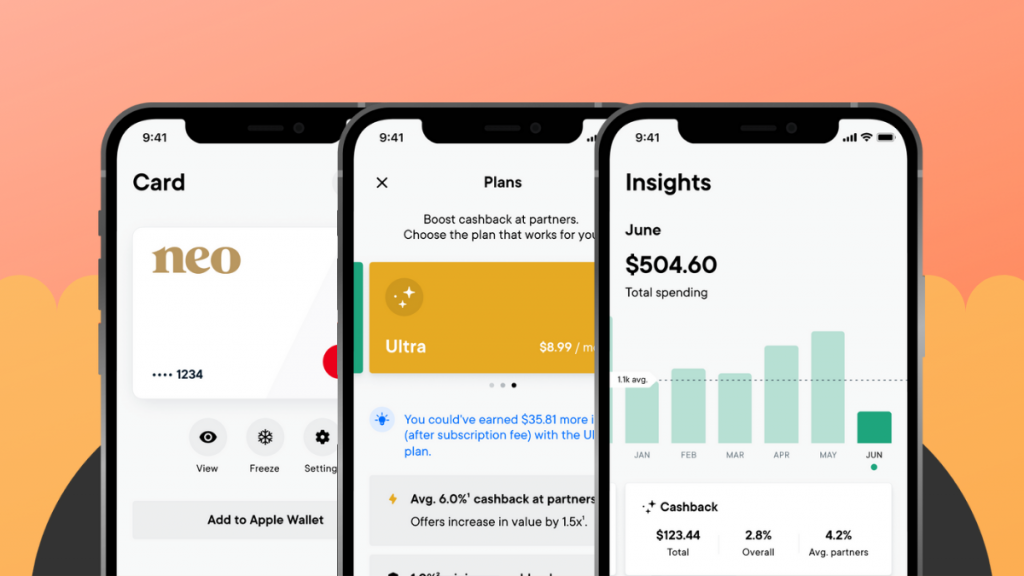

With fair prices, you can get a lot of rewards. Neo Financial is not a bank but provides high-quality financial services. The credit card gives you rewards and helps you save money. The mobile app has features to manage your expenses, with insights about how you’re using your money and how you could manage it better and save more.

To learn more about its features, keep reading this review. We bet you’ll like what this card has to offer.

How to get the Neo Financial credit card?

If you need a new credit card, get this opportunity to step up to a better one. Neo Financial credit card will give you many benefits and it's easy to get approved.

- Credit Score: You don’t need a credit score to get the secured version, and you can get the unsecured one with at least 600.

- Annual Fee: You can opt for the free version or upgrade to the premium version with a monthly fee.

- Regular APR: 19.99% to 24.99% for purchases

- Welcome bonus: Up to 15% cash back on your first purchases at selected stores

- Rewards: Up to 5% cash back. Terms apply

How does Neo Financial credit card work?

Neo Financial will cut off the bureaucracy and put you in charge of your own finances. The modern app has features that will help you control every penny, and understand your expenses. Also, you can track your rewards, and redeem them whenever you want to.

The credit card has more than one version. There is a free version in which you pay a $0 annual fee. With as little as $2.99 per month, you can upgrade and get up to 5% cash back.

And if you still need to build some credit history, opt for the secured credit card. You can get one with a security deposit of as little as $50.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Neo Financial Credit card pros and cons

Neo Financial customers have wonderful things to say about it. Especially about the high rate of rewards. You can get a lot of cash back and save some money. Read some pros and cons of Neo Financial credit cards.

Pros

- No annual fee and you can opt to pay a monthly fee to improve your rewards rate.

- Apply via an app and pre-qualify before checking your score.

- The mobile app is very handy, and you can solve everything related to your account over there.

- Up to 15% cash back welcome bonus for select purchases

- Virtual card to use on your phone everywhere.

Cons

- Not available for some provinces.

- Has a monthly cap for earning cash back.

- Has no insurance coverage for phone, car, or extended warranty.

Does my credit score need to be good?

To apply for the unsecured version you can try to get one with a 600 credit score. However, if you’re still not there, apply for the secured one with a deposit starting at $50.

Want to apply for Neo Financial card?

Applying for a Neo Financial card is as easy as using it. You can apply online and get a response in minutes. Learn everything about it by reading the next content.

How to get the Neo Financial credit card?

If you need a new credit card, get this opportunity to step up to a better one. Neo Financial credit card will give you many benefits and it's easy to get approved.

Trending Topics

Lending Tree Personal Loan: how to apply now!

If you want to apply for the Lending Tree Personal Loan, you're in the right place. Enjoy fast funding. Qualify with lower credit. Read on!

Keep Reading

Applying for the PenFed Platinum Rewards Visa Signature® Card: learn how!

Wondering how to apply for the PenFed Platinum Rewards Visa Signature® Card? Wonder no more! We'll show you how easy it is.

Keep Reading

Fortiva® Mastercard® Credit Card Review

Explore our Fortiva® Mastercard® Credit Card review for insights on earning cash back on everyday purchases and building credit easily.

Keep ReadingYou may also like

Supplemental Nutrition Assistance Program (SNAP)

The Supplemental Nutrition Assistance Program (SNAP) was designed to lift families from food insecurity. Learn all about this!

Keep Reading

Applying for the PenFed Gold Visa® Card: learn how!

Learn how the PenFed Gold Visa® Card application works. Enjoy 0% intro APR for 15 months and more! Keep reading and learn everything you need!

Keep Reading

How to Find a Career You Love: 6 Practical Tips

Learn how to get a fulfilling future with these 6 practical tips to find a career you love. Keep reading to learn more!

Keep Reading