Credit Cards

Upgrade Triple Cash Rewards Visa® Credit Card Review

Are you looking for a credit card with low costs and high rewards? Stop looking and check the Upgrade Triple Cash Rewards Visa® Credit Card benefits on this review. It might suit your needs.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Upgrade Triple Cash Rewards Visa®: a 3% cash back to fill your pockets with rewards

The Upgrade Triple Cash Rewards Visa® Credit Card is one of the best cards offered by Upgrade, a financial start-up issued by Sutton Bank.

This review will show you what’s the deal about this interesting card. After all, is it a credit card, a line of credit, or a personal loan?

If you need a new credit card to earn cash back, this card might be a good option for you.

With up to 3% cash back on selected categories to enjoy it, many people will surely like this card. Let’s see what else the Upgrade Triple Cash Rewards has to offer.

- Credit Score: Good to excellent.

- Annual Fee: No annual or monthly fee.

- Regular APR: Get 14.99% up to 29.99% APR, depending on your creditworthiness.

- Welcome bonus: None.

- Rewards: Cash back, with bonus on selected purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Upgrade Triple Cash Rewards Visa® work?

Some credit card specialists are suspicious about how this card works. It works like a credit card but has a lot of personal loan features.

The credit limit can be as high as $25,000 – some even get a $50,000. This is not something you can easily find on a credit card with a $0 annual fee.

But if you make a purchase this big on this credit card, you don’t need to worry about carrying a balance.

It will be split into installments at a fixed rate that gives you excellent predictability to budget and plan payments.

On top of that, the card will give you cash back, a Visa signature, and a physical card with contactless technology.

Upgrade Triple Cash Rewards Visa® Credit Card pros and cons

Pros

- If you agree with setting your bill into your checking account auto pay you can get the lowest APR.

- Your balance will be split into installments and you’ll have 12 to 60 months to pay it at a fixed rate and with no pre-payment fee.

- Earn 1% unlimited cash back when you pay your credit card bill, and up to 3% on selected purchases.

- The Visa signature will give you exclusive benefits, and your card will be accepted in virtually every corner of the world.

Cons

- Upgrade doesn’t allow balance transfers.

- If your credit score is not that great the APR can be high.

- It’s not available in DC, IA, WV, WI, NC, NH, or HI.

Does my credit score need to be good?

It is important to have this in mind: a good or excellent credit score will always grant you better offers.

With that in mind, know that you can apply with an average credit score for an Upgrade Triple Cash Rewards.

However, your APR and credit limit will not be as good as for someone with a better credit score.

Want to apply for the Upgrade Triple Cash Rewards Visa® Credit Card?

The Upgrade Triple Cash Rewards Visa® Card is almost too good to be true. After all, it gives you great rewards. And that’s not all.

The credit limits are super high, and you can get up to $25,000. Some people with excellent credit scores can get up to $50,000.

And don’t worry about your credit card balance. You can pay it within 60 months installments and the rates are fixed to help you plan your payments.

And the rewards get even better. Earning 1% cash back in every purchase is already good for a credit card with a $0 annual fee.

Every penny back seems like profit. But Upgrade will give you more than this, with a 3% bonus cash back buying this for home, health, and auto.

If you like what you’re reading, stay on this post to learn how you can get this card for yourself and enjoy all these benefits. See how to apply for a Upgrade Triple Cash Rewards Visa® below.

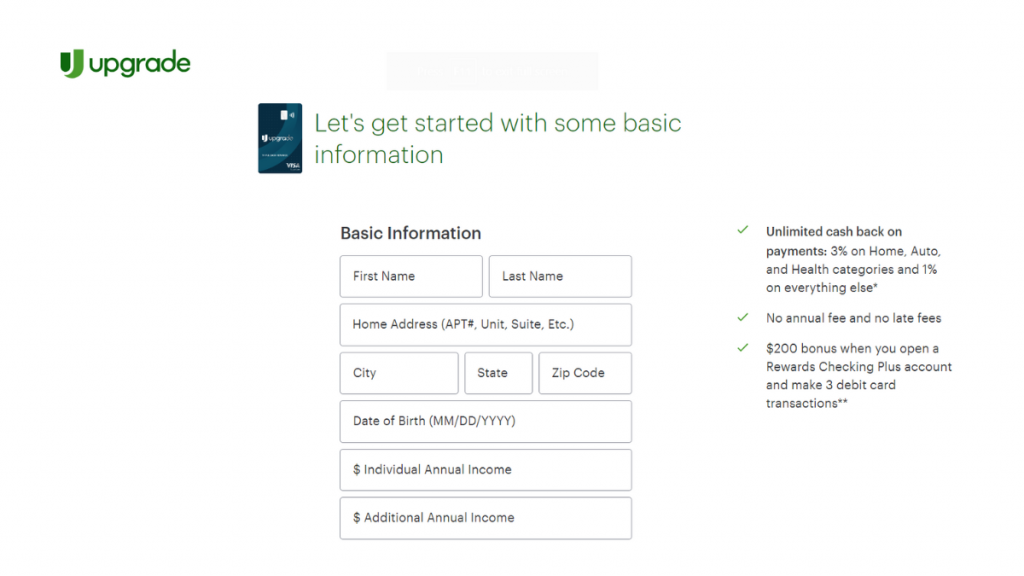

Apply online

Are you unsure if your credit score will get you a reasonable offer and don’t want to hurt it with a hard inquiry? Don’t worry!

Upgrade will make just a soft pull to pre-qualify you. If you agree with their offer, then you can proceed with the application process.

You can do it online, on the Upgrade website. Select the Upgrade Triple Cash Rewards Visa® Card and get started.

There will be a short form asking for some basic information. Inform your full name, home address, date of birth, and annual income.

Also, create an Account with an email and password. It is very important to read the terms of the card. If you agree with them, check the box and submit your application.

You will soon receive the offer with your credit limit and APR. If you like what you got, proceed as requested and you will soon receive your new credit card.

Moreover, you should know that this card is unavailable in DC, IA, WV, WI, NC, NH, and HI.

Upgrade Triple Cash Rewards Visa® Card vs. Capital One Venture Rewards Card

Picking a new credit card is not always easy. If you need one more option to compare, it’s ok.

If you’re willing to pay a fee to have a more robust credit card, you can take a look at the Capital One Venture Rewards features.

While the Upgrade Triple Cash Rewards Visa® gives you cash back and fixed-rate installments to pay your balance, the Capital One Venture Rewards gives you points and travel benefits.

Upgrade Triple Cash Rewards Visa® Card

- Credit Score: Doesn’t have to be excellent, and you could get approved with an average one.

- Annual Fee: None.

- Regular APR: It will depend on your creditworthiness, and range from 14.99% to 29.99%.

- Welcome bonus: None.

- Rewards: Earn cash back every time you pay your card bill, 1% on every purchase, and 3% for selected ones.

Capital One Venture Rewards

- Credit Score: This card demands an excellent credit score.

- Annual Fee: $95 annual fee.

- Regular APR: 19.99% – 29.99% variable, based on your creditworthiness.

- Welcome bonus: If you spend $4,000 within 3 months, you will receive 75,000 miles.

- Rewards: 5 miles per dollar for travel expenses and 2 miles per dollar on everything else. Terms apply.

If you have what it takes to be a Capital One Venture Rewards cardholder, go for it.

If you need any help with the application process, please read the following content with some information on this subject.

Capital One Venture Rewards Credit Card Review

This card has an excellent reputation in the market for giving great rewards to its cardholders. Consider applying for the Capital One Venture Rewards credit card.

Trending Topics

What are the retirement accounts alternative to a 401(k) plan?

If you're looking for retirement accounts that will give you the most financial freedom, skip the 401(k). Here are two better options.

Keep Reading

Being rich or wealthy: what’s the difference between them?

What is the difference between being wealthy and being rich? Which should you be aiming for? We’ll help you answer that question.

Keep Reading

Luxury Gold Card Review: Earn Rewards

If you're looking for a high-end credit card that offers travel redemptions, we’ve got you covered. Read our Luxury Gold card review to find out more!

Keep ReadingYou may also like

Credit limit of up to $35K: Pelican Prime Visa Review

Are you ready to simplify your credit card experience? Then read our Pelican Prime Visa review. Access your FICO Score for free!

Keep Reading

Citi Strata Premier℠ Card Review: Earn Much More!

Explore our Citi Strata Premier℠ Card review to learn how you can get a substantial welcome bonus, enticing rewards, and exclusive perks.

Keep Reading

700 credit score: is it good enough?

Wondering if a 700 credit score is good enough to get you the best interest rates and terms on loans? Find out now.

Keep Reading