Reviews

Applying for the Upgrade Triple Cash Rewards Visa® Card: Learn how!

Applying for an Upgrade Triple Cash Rewards Visa® Card is easy and fast, and you can do it even with an average credit score. This article will show you how it works.

Advertisement

Upgrade Triple Cash Rewards Visa® Card: Only got fair credit? No problem. You still get 3% cash back!

The Upgrade Triple Cash Rewards Visa® Card is almost too good to be true. After all, it gives you great rewards. And that’s not all.

The credit limits are super high, and you can get up to $25,000. Some people with excellent credit scores can get up to $50,000.

And don’t worry about your credit card balance. You can pay it within 60 months installments and the rates are fixed to help you plan your payments.

And the rewards get even better. Earning 1% cash back in every purchase is already good for a credit card with a $0 annual fee.

Every penny back seems like profit. But Upgrade will give you more than this, with a 3% bonus cash back buying this for home, health, and auto.

If you like what you’re reading, stay on this post to learn how you can get this card for yourself and enjoy all these benefits. See how to apply for a Upgrade Triple Cash Rewards Visa® below.

Apply online

Are you unsure if your credit score will get you a reasonable offer and don’t want to hurt it with a hard inquiry? Don’t worry!

Upgrade will make just a soft pull to pre-qualify you. If you agree with their offer, then you can proceed with the application process.

You can do it online, on the Upgrade website. Select the Upgrade Triple Cash Rewards Visa® Card and get started.

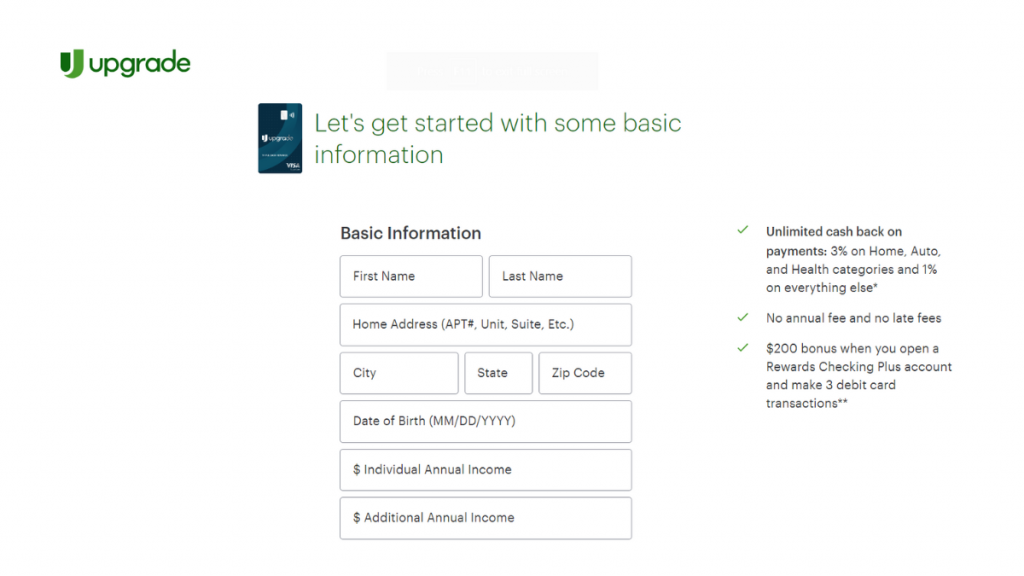

There will be a short form asking for some basic information. Inform your full name, home address, date of birth, and annual income.

Also, create an Account with an email and password. It is very important to read the terms of the card. If you agree with them, check the box and submit your application.

You will soon receive the offer with your credit limit and APR. If you like what you got, proceed as requested and you will soon receive your new credit card.

Moreover, you should know that this card is unavailable in DC, IA, WV, WI, NC, NH, and HI.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Upgrade Triple Cash Rewards Visa® Card vs. Capital One Venture Rewards Card

Picking a new credit card is not always easy. If you need one more option to compare, it’s ok.

If you’re willing to pay a fee to have a more robust credit card, you can take a look at the Capital One Venture Rewards features.

While the Upgrade Triple Cash Rewards Visa® gives you cash back and fixed-rate installments to pay your balance, the Capital One Venture Rewards gives you points and travel benefits.

Upgrade Triple Cash Rewards Visa® Card

- Credit Score: Doesn’t have to be excellent, and you could get approved with an average one.

- Annual Fee: None.

- Regular APR: It will depend on your creditworthiness, and range from 14.99% to 29.99%.

- Welcome bonus: None.

- Rewards: Earn cash back every time you pay your card bill, 1% on every purchase, and 3% for selected ones.

Capital One Venture Rewards

- Credit Score: This card demands an excellent credit score.

- Annual Fee: $95 annual fee.

- Regular APR: 19.99% – 29.99% variable, based on your creditworthiness.

- Welcome bonus: If you spend $4,000 within 3 months, you will receive 75,000 miles.

- Rewards: 5 miles per dollar for travel expenses and 2 miles per dollar on everything else. Terms apply.

If you have what it takes to be a Capital One Venture Rewards cardholder, go for it.

If you need any help with the application process, please read the following content with some information on this subject.

How to apply for the Capital One Venture card?

This card has an excellent reputation in the market for giving great rewards to its cardholders. Consider applying for the Capital One Venture Rewards credit card.

Trending Topics

Applying for the Home Depot Consumer Credit Card: learn how!

Are you planning to apply for a Home Depot consumer credit card? Here, learn everything you need! $0 annual fee and more!

Keep Reading

Applying for the SavorOne Rewards for Good Credit card: learn how!

Learn how to apply for a SavorOne Rewards for Good Credit card and get 3% cash back on all of your favorite everyday categories!

Keep Reading

9 retirement planning mistakes to avoid

Retirement is a time to reap the rewards of work. Check out the main retirement mistakes and learn how to avoid them.

Keep ReadingYou may also like

Netflix announces layoffs of 150 employees

As the streaming giant continues to face increased competition, Netflix is cutting an estimated 150 staffers in its latest round of layoffs.

Keep Reading

Apply for the American Express® Gold Card: Learn how!

Check out how to apply for the American Express® Gold Card and enjoy reward points, discounts, and many other benefits!

Keep Reading

Choose the perfect loan for your finances: compare the options!

Need a new car, home repairs, money for a wedding, or just some extra cash? Compare options and choose a loan for you.

Keep Reading