Loans

Auto Loan Zoom: how to apply now!

Explore the steps to getting your auto loan quickly and easily with Auto Loan Zoom. Borrow up to $35,000! Stick around and learn more!

Advertisement

Apply for Auto Loan Zoom: 3-minute application with a same-day release

Finding the perfect car that fits your budget can be tricky, but it doesn’t have to be this way. Apply for Auto Loan Zoom and enjoy a simple process!

With Auto Loan Zoom, you’ll know exactly how much you qualify to borrow in no time without leaving home or going through stacks of paperwork! Stick with us and learn!

Apply online

Applying for an Auto Loan with Auto Loan Zoom is simple and secure. You can ensure the money you need in no time!

Firstly, to get started, you must visit their website and begin the application form by entering your zip code and email address.

Second, from there, provide your full name, contact information, and SSN. Additionally, you must also indicate if you’ve filed for bankruptcy in the past five years.

Furthermore, you must provide information about your current address and rent payment amount.

Lastly, enter details to confirm your annual income and employment status before submitting the form to apply for the loan.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Requirements

Applying with Auto Loan Zoom is a great first step to obtaining your desired car.

Moreover, being a US resident over 18 and having a regular source of income are eligibility criteria.

It is important to recognize that depending on the lender in their network, additional criteria may be expected before approval is given.

Besides, be sure to carefully review the terms of the loan offer before formally accepting it.

Furthermore, researching ahead of time will surely make getting behind the wheel much easier!

Apply on the app

You must apply for the Auto Loan Zoom through the website. Therefore, you must follow the previous recommendations and choose the best lender.

Auto Loan Zoom vs. MaxCarLoan: which one is the best for you?

Applying for an auto loan can be daunting, but online companies such as Auto Loan Zoom and MaxCarLoan make the process easier.

Both services offer competitive rates, with each company possessing unique features that meet different needs.

Auto Loan Zoom, for example, is known for its transparent process and easy application, so borrowers know what to expect from start to finish.

They also calculate estimated payments upfront so you can decide if this fits within your budget.

However, MaxCarLoan can be another option if you also want high values to buy your car. So, check our comparison and choose your next car loan.

| Auto Loan Zoom | MaxCarLoan | |

| APR | Variable according to the creditors that are associated with AutoLoan Zoom; | See terms on the website; |

| Loan Purpose | Financing or purchasing vehicles; | Auto; |

| Loan Amounts | Up to $35,000; | Up to $35,000; |

| Credit Needed | All types of credit are accepted, depending on the creditor; | All types of credit are accepted; |

| Origination Fee | Variable according to the creditors that are associated with AutoLoan Zoom; | None; |

| Late Fee | Variable according to the creditors that are associated with AutoLoan Zoom; | None; |

| Early Payoff Penalty | Variable according to the creditors that are associated with AutoLoan Zoom. | None. |

MaxCarLoan gives you up to $35,000 towards your next car and accepts all types of credit. Then check out the post below for a complete guide to applying this alternative.

MaxCarLoan: how to apply now!

Learn how to apply for MaxCarLoan! Get the perfect financial solution to buy a car. Borrow up to $35K and avoid hidden fees.

Trending Topics

4 best and easiest credit cards to get approved for: apply today!

Looking for the easiest credit cards to get approved for? We’ll show you the different types of cards and give you a few names to consider.

Keep Reading

Applying for the First Digital Mastercard®: learn how!

Improving your credit score is a big challenge, but the First Digital Mastercard® can help. Learn how to apply!

Keep Reading

Explore the Best Apps for Watching Soccer Matches Online

Get the scoop on 10 streaming apps to watch soccer online with live matches and analysis. Keep reading to learn more!

Keep ReadingYou may also like

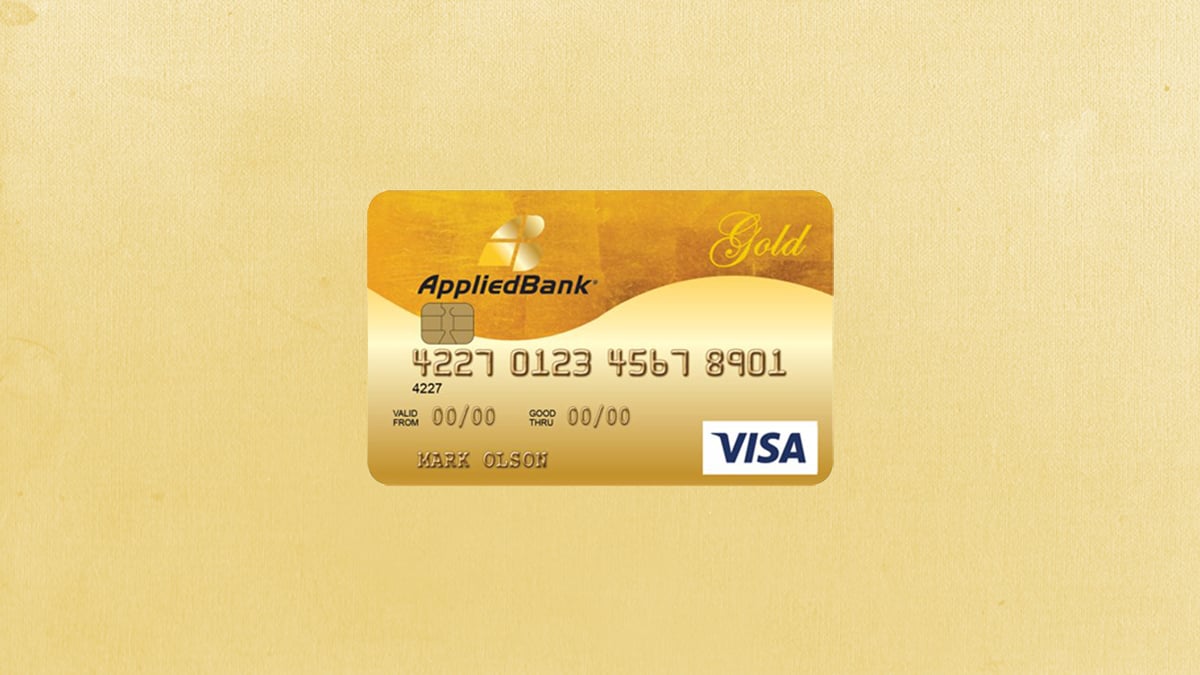

Applied Bank® Secured Visa® Gold Preferred® credit card full review

Looking for a secured credit card that offers a low-interest rate? Check our Applied Bank® Secured Visa® Gold Preferred® card review!

Keep Reading

Make up to $15.79/h working at Bubba’s 33: see job vacancies

Bubba's 33 is serving up open job positions with no experience needed! Learn about roles, salary, and benefits. Stay tuned!

Keep Reading

Applying for the PenFed Power Cash Rewards Visa Signature® Card: learn how!

Do you need a cashback card with 0% intro APR? If so, learn how to apply for the PenFed Power Cash Rewards Visa Signature® Card!

Keep Reading