Reviews

Applying for the Deserve EDU Student Credit Card: learn how!

The Deserve EDU Student Credit Card is great for students without a good credit score. See how to apply and get your approval fast.

Advertisement

Deserve EDU Student Credit Card: Easy and fast application!

The Deserve EDU Student Credit Card is an ideal option for students starting their financial life. After all, the card has no credit score requirement and still offers up to 1% cash back on all eligible card purchases.

However, for you to enjoy these benefits, it is essential to know how to apply. That way, you get the best interest rates and a quick response to your application. Find out how to do it!

Apply online

The Deserve EDU Student Credit Card has a simple and easy application. In this sense, you must assess whether you meet the requirements before applying.

The requirements are to be over 18 years old and a student of an accredited institution.

You can find out what your interest rate will be with pre-qualification on the website or app. This pre-qualification does not change your credit score and allows you to see your card’s conditions.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

You can also apply for this card through the official mobile app. You only need to download the app (available for Android and iOS) and follow the steps to provide the personal information required.

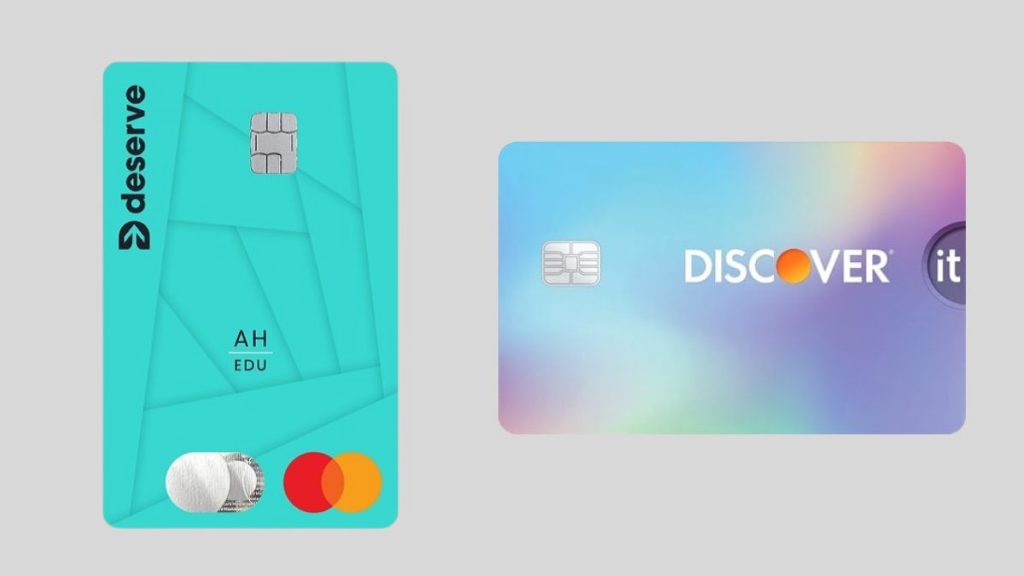

Deserve EDU Student Card vs. Discover it® Student Cash Back Card

The Deserve EDU Student Credit Card is an excellent choice for students. As you’ve seen before, it doesn’t require a good credit score and even brings a 1% cashback reward on all purchases.

However, this is not the only option available. The Discover it® Student Cash Back Card is also very interesting. He has a 1 to 5% cashback.

Check out this comparison and choose your option.

Deserve EDU Student Card

- Credit Score: Limited/No credit;

- Annual Fee: $0;

- Regular APR: 21.74% variable for purchases;

- Welcome bonus: One year of Amazon Prime Student free;

- Rewards: 1% Cash Back on all eligible purchases automatically.

Discover it® Student Cash Back Card

- Credit Score: Fair to good (580 to 740);

- Annual Fee: $0;

- Regular APR:0% intro APR for purchases for 6 months from the account opening date. Then, 15.99% – 24.99% variable APR for purchases;

- Welcome bonus: Dollar-for-dollar cash-back matching you earn at the end of your first year;

- Rewards: 5% cash back on quarterly revolving purchases after activation and 1% on other purchases made with the card.

Is the Discover it® Student Cash Back Card the best card for your finances? If so, read our post below to learn about the application process!

How to apply for Discover it® Student Cash Back

Every student looks for a good card like the Discover it® Student Cash Back Card. But to be approved, it is necessary to submit it correctly. See how to apply.

Trending Topics

OpenSky® Secured Visa® Credit Card Review

Build credit confidently with the OpenSky® Secured Visa® Credit Card. No credit check needed to apply. Start your credit journey today!

Keep Reading

How to Find a Career You Love: 6 Practical Tips

Learn how to get a fulfilling future with these 6 practical tips to find a career you love. Keep reading to learn more!

Keep Reading

Walmart MoneyCard full review

This card is ideal for you if you frequently use the Walmart network. Check out this Walmart MoneyCard review and learn more.

Keep ReadingYou may also like

Apply for StellarFi Account: convert bills into payments

Learn how to easily and quickly apply for a StellarFi Account and turn your bills into payments. Get the most out of your money today!

Keep Reading

Earn up to $20 per hour working at AutoZone: see job vacancies

AutoZone is hiring with competitive pay and benefits- Check out job vacancies on our website and find your perfect fit!

Keep Reading

247LoanPros: how to apply now!

A loan from 247LoanPros is great for your finances. Check out how to apply 247LoanPros and determine if this is the best option.

Keep Reading