Credit Cards

OpenSky® Secured Visa® Credit Card Review

Improve your credit with the OpenSky® Secured Visa® Credit Card. Quick application, flexible deposit, and no credit history required! Check our full review to learn more.

Advertisement

Build up your credit with zero credit checks required!

The OpenSky® Secured Visa® Credit Card is designed for people who have had some financial trouble in the past and need to rebuild their credit.

The great thing about this card is that it doesn’t need a credit check and bank account, which means you can start rebuilding your credit right away.

The company’s average approval rate has been more than 80% in the past five years. This means that there’s a high chance you’ll be able to improve your score with the card.

Besides, you can try to increase your credit line after six months with no additional deposit required!

And if that’s not enough incentive, then know this: you may start seeing improvement after just 3 months of timely payments.

| Credit Score | All credit levels are welcome |

| Annual Fee | $35 |

| Regular APR | 24.89% (variable) |

| Welcome bonus | It does not offer a welcome bonus |

| Rewards | Up to 10% cash back |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the OpenSky® Secured Visa® Credit Card work?

We’ve all been there: our credit score is lower than we’d like it to be, and we’re unsure how to improve it. One option is to get an OpenSky® Secured Visa® Credit Card.

First, you need to apply for the card. Ensure you meet the eligibility requirements, including having a valid SSN and being a U.S. citizen or permanent resident.

Once approved, you’ll need to make a security deposit of at least $200. This deposit will be your credit limit with the card.

OpenSky® Secured Visa® Credit Card pros and cons

You can be eligible for this secured card even if you don’t have a bank account. Plus, there’s no credit check. On the other side, the card charges an annual fee.

Pros

- No credit check is required.

- You set the credit limit starting with a fully refundable $200 security deposit.

- It can help you build credit like a traditional credit card.

- The application process is quick and easy, with instant approval or denial.

- Reports to all 3 major credit bureaus monthly.

- Up to 10% cash back on purchases.

Cons

- Has an annual fee.

- Requires minimum deposit.

Want to apply for OpenSky® Secured Visa® Credit Card?

This credit card is a great option for people with poor average credit scores. It’s easy to apply, and you can get approved in 5 minutes.

If you want a secure way to rebuild your credit, the OpenSky® Secured Visa® is perfect. So, learn how to apply for it below!

My credit score needs to be good?

OpenSky does not perform a pull on your credit score, so that means you can apply for the card regardless of your credit standing.

This credit card is designed for people with poor to average credit scores and a bad credit history.

Requirements

Here are the requirements to apply for the OpenSky® Secured Visa® Credit Card:

- Age: You must be at least 18 years old (or the legal age of majority in your state).

- Residency: Applicants must have a valid U.S. physical address. P.O. Boxes are not accepted.

- Identification: A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required for identity verification.

- Security Deposit: A refundable security deposit of at least $200 is required to open the account. This deposit determines your credit limit.

- Income: You must have a source of income or the ability to meet monthly credit card payments.

- No Credit Check: The OpenSky® Secured Visa® does not require a credit check, making it accessible to individuals with no credit history or past credit challenges.

These criteria make the OpenSky® Secured Visa® Credit Card a flexible and accessible option for building or rebuilding credit.

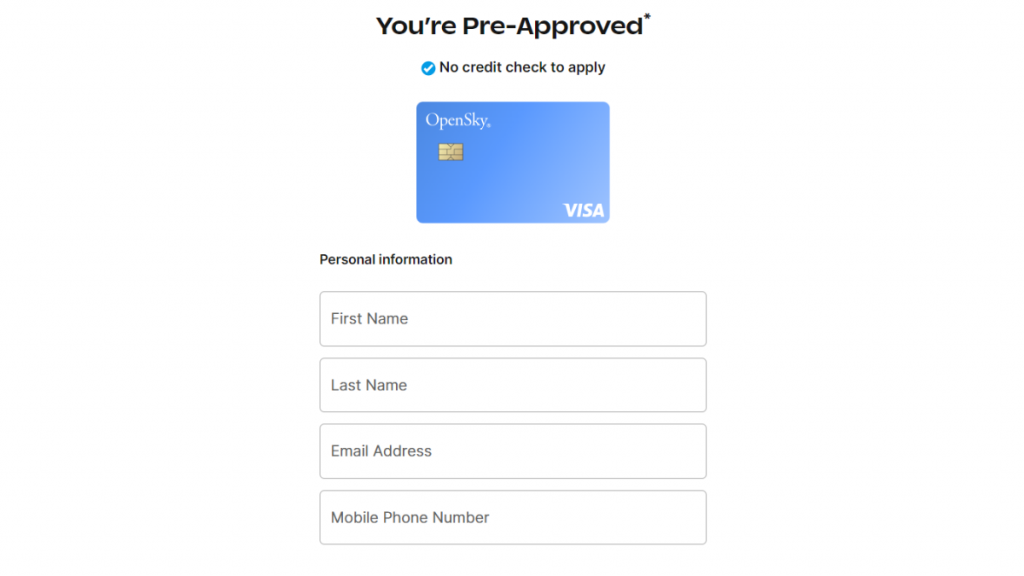

Apply for the OpenSky® Secured Visa® Credit Card online

In order to apply for OpenSky® Secured Visa® Credit Card:

- You must be 18 years or older

- Provide your Social Security Number

- Submit a refundable security deposit

After you get approved, you need to activate your card. Visit the company’s website and click the blue MyAccount button to access the online account management log in page.

You can find the Activate Card button on the top right if using a desktop.

Apply using the app

Using the app to apply isn’t an option available at this moment. However, you can use the app for everything else.

You can manage payments and transactions with a few taps on a screen from your phone or tablet. Additionally, you can also make payments using the app.

OpenSky® Secured Visa® Credit Card vs. Assent Platinum Secured Credit Card

But if you are still unsure if this card is the best option for your financial life, we can help you out!

Check out our comparison table below to learn more about another great credit card, the Assent Platinum Secured Credit Card.

| OpenSky® Secured Visa® Credit Card | Assent Platinum Secured Credit Card | |

| Credit Score | All credits are welcome to apply | All credits can request the card |

| Annual Fee | $35 | $0 |

| Regular APR | 24.89% (variable) | 29.24% (variable) |

| Welcome bonus | It does not offer a welcome bonus | None |

| Rewards | Up to 10% cash back | No rewards program is available |

Assent Platinum Secured Credit Card review

The secure way to rebuild your credit is here! Assent Platinum Secured Credit Card provides an easy solution for that! Read on and learn how!

Trending Topics

SavorOne Rewards for Good Credit credit card full review

The SavorOne Rewards for Good Credit credit card offers 3% cash back on dining, groceries, entertainment and more, 1% on all other purchases.

Keep Reading

Three types of fees: a guide for beginners

If you're thinking about asking for a loan, you should learn about the three different types of fees by reading this article.

Keep Reading

Applying for the Upgrade Triple Cash Rewards Visa® Card: Learn how!

The Upgrade Triple Cash Rewards Visa® Card is excellent for earning cashback if you don't like paying annual fees. Learn how to apply for it.

Keep ReadingYou may also like

Sky Blue review: repair your credit with confidence

Having a good credit score expands your trading possibilities. Therefore, this Sky Blue review will show you the benefits of this option.

Keep Reading

OppLoans: how to apply now!

Need financial relief? Learn how to apply for OppLoans easily. Borrow up to $4,000 for several purposes! Keep reading and learn more!

Keep Reading

Here’s why you should keep investing in the stock market despite its current conditions

With the recent market crash, many investors are too nervous to get into the stock market. But here's why you should invest anyway.

Keep Reading