Reviews

Applying for the Deserve EDU Student Credit Card: learn how!

The Deserve EDU Student Credit Card is great for students without a good credit score. See how to apply and get your approval fast.

Advertisement

Deserve EDU Student Credit Card: Easy and fast application!

The Deserve EDU Student Credit Card is an ideal option for students starting their financial life. After all, the card has no credit score requirement and still offers up to 1% cash back on all eligible card purchases.

However, for you to enjoy these benefits, it is essential to know how to apply. That way, you get the best interest rates and a quick response to your application. Find out how to do it!

Apply online

The Deserve EDU Student Credit Card has a simple and easy application. In this sense, you must assess whether you meet the requirements before applying.

The requirements are to be over 18 years old and a student of an accredited institution.

You can find out what your interest rate will be with pre-qualification on the website or app. This pre-qualification does not change your credit score and allows you to see your card’s conditions.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can also apply for this card through the official mobile app. You only need to download the app (available for Android and iOS) and follow the steps to provide the personal information required.

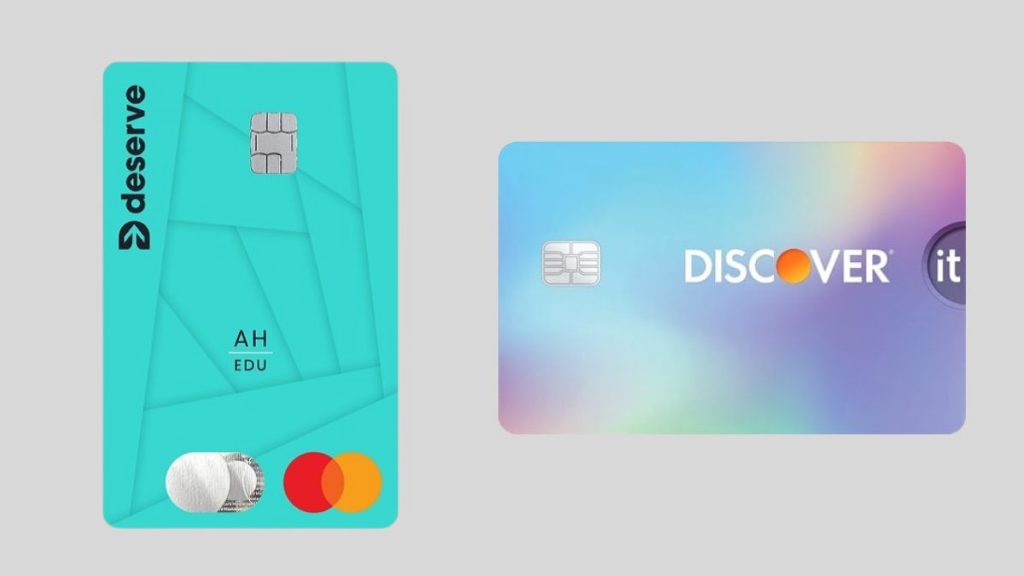

Deserve EDU Student Card vs. Discover it® Student Cash Back Card

The Deserve EDU Student Credit Card is an excellent choice for students. As you’ve seen before, it doesn’t require a good credit score and even brings a 1% cashback reward on all purchases.

However, this is not the only option available. The Discover it® Student Cash Back Card is also very interesting. He has a 1 to 5% cashback.

Check out this comparison and choose your option.

Deserve EDU Student Card

- Credit Score: Limited/No credit;

- Annual Fee: $0;

- Regular APR: 21.74% variable for purchases;

- Welcome bonus: One year of Amazon Prime Student free;

- Rewards: 1% Cash Back on all eligible purchases automatically.

Discover it® Student Cash Back Card

- Credit Score: Fair to good (580 to 740);

- Annual Fee: $0;

- Regular APR:0% intro APR for purchases for 6 months from the account opening date. Then, 15.99% – 24.99% variable APR for purchases;

- Welcome bonus: Dollar-for-dollar cash-back matching you earn at the end of your first year;

- Rewards: 5% cash back on quarterly revolving purchases after activation and 1% on other purchases made with the card.

Is the Discover it® Student Cash Back Card the best card for your finances? If so, read our post below to learn about the application process!

How to apply for Discover it® Student Cash Back

Every student looks for a good card like the Discover it® Student Cash Back Card. But to be approved, it is necessary to submit it correctly. See how to apply.

Trending Topics

10 best crypto to invest in 2023

Several exciting cryptocurrencies are set to make a big impact in the market. But what is the best crypto to invest in? Read on and find out!

Keep Reading

Simplify your finances: apply for the Pelican Prime Visa

Stop wasting time on needlessly complicated credit card applications. Use our easy guide to apply for a Pelican Prime Visa today. Read on!

Keep Reading

Here’s why you should keep investing in the stock market despite its current conditions

With the recent market crash, many investors are too nervous to get into the stock market. But here's why you should invest anyway.

Keep ReadingYou may also like

How to Save Money: The Best Tips and Tricks

Learn the best tips on how to save money effectively! Discover smart, easy strategies for maximizing your savings and financial growth.

Keep Reading

Different types of loans available: which one is right for you?

Need a loan but don't know which one to choose? Don't worry. We'll help you. Check out the different types of loans.

Keep Reading

Applying for the Net First Platinum card: learn how!

With the Net First Platinum credit card you can shop at the Horizon Outlet website. Applying is simple and approval is fast. Come get yours!

Keep Reading