Reviews

Apply for the Milestone® Mastercard® Credit Card: Fast Approval!

Take control of your credit journey with Milestone® Mastercard® Credit Card: pre-qualify easily without impacting your credit score.

Advertisement

Milestone® Mastercard®: Building a solid credit foundation

If you’ve come this far, then you’re looking for an easy way to apply for the Milestone® Mastercard® Credit Card. And we are here to provide that to you.

This unsecured credit solution offers an initial credit limit of up to $700 and Mastercard benefits to give back your purchasing power.

If you’ve decided to apply for the Milestone® Mastercard®, continue reading below to learn about the application process.

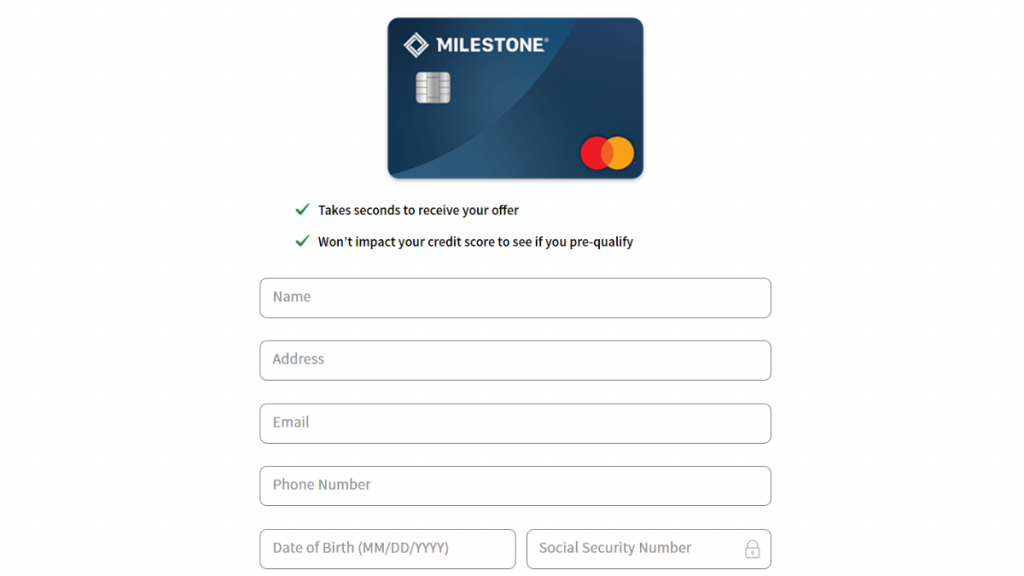

Apply online

First, be aware that this credit card offers the option for you to pre-qualify. If you want to pre-qualify, you will have to share personal information about yourself with them.

Some of the information you will have to share is first and last name, full address, e-mail address, phone number, date of birth, and also your Social Security Number (SSN).

This whole pre-qualification process happens in the blink of an eye. Moreover, there is no reason to worry. Because pre-qualifying does not hurt your score.

After that, you will have to wait for them to review your information. Once this is done, they will determine your annual fee. But please do not forget to read all the terms and conditions.

But be aware that pre-qualifying does not guarantee final approval. We recommend that you do all of these steps online.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Regarding other means to apply for the Milestone® Mastercard® Credit Card, there is no way to submit your application via mobile.

However, the Milestone® Mastercard® Credit Card website is mobile-friendly. Therefore, you can seamlessly apply using your phone or tablet.

Milestone® Mastercard® Credit Card vs. Indigo® Mastercard® Credit Card

If you’re considering alternatives, the Indigo® Mastercard® offers a similar experience to the Milestone® Mastercard®, making it a good choice for those with low credit scores.

Both cards share key features, including no security deposit requirement, regular credit bureau reporting, and comparable fees.

They are designed to help individuals rebuild credit while providing essential tools for managing their financial progress.

Milestone Mastercard®

- Credit Score: Bad – Fair – Good;

- Annual Fee: $175 for the first year; $49 annually after that;

- Regular APR: 35.9%;

- Welcome bonus: None;

- Rewards: None.

Indigo® Mastercard® Credit Card

- Credit Score: Poor – Fair;

- Annual Fee: $175 the first year; then $49 annually;

- Regular APR: 35.9%;

- Welcome bonus: N/A;

- Rewards: N/A.

If the Indigo® Mastercard® Credit Card can be the best for you, read our post below to learn how to apply for it!

Applying for the Indigo® Mastercard® Credit Card

The Indigo® Mastercard® Credit Card is perfect for helping you rebuild credit. See what are the steps to make the application!

Trending Topics

5 Best Apps to Turn Your Photos Into Cartoons

Turn your photos into funny cartoons using these 5 apps. Here is a full list of options to explore. Stay tuned!

Keep Reading

Exploring life in the LCOL area: pros, cost of living, and more!

Are you considering a move to the LCOL area? Here's what you need to know about the cost of living, amenities, and more!

Keep Reading

Prosper Loans review: is it worth it?

Check our Prosper Loans review to see if it’s the right fit for your financial needs. We’ll look over rates and terms to help you decide.

Keep ReadingYou may also like

Wayfair Credit Card full review

Are you looking for a Wayfair Credit Card review? Look no further! Learn what this card offer, including cash back and no annual fee.

Keep Reading

Chase Sapphire Preferred® Credit Card Review

The Chase Sapphire Preferred® Credit Card has everything you need to travel and get a lot of rewards for using it. Keep reading to learn how!

Keep Reading

Credit limit of up to $35K: Pelican Prime Visa Review

Are you ready to simplify your credit card experience? Then read our Pelican Prime Visa review. Access your FICO Score for free!

Keep Reading