Reviews

Apply for the Milestone® Mastercard® Credit Card: Fast Approval!

Take control of your credit journey with Milestone® Mastercard® Credit Card: pre-qualify easily without impacting your credit score.

Advertisement

Milestone® Mastercard®: Building a solid credit foundation

If you’ve come this far, then you’re looking for an easy way to apply for the Milestone® Mastercard® Credit Card. And we are here to provide that to you.

This unsecured credit solution offers an initial credit limit up to $700 and Mastercard benefits to give back your purchasing power.

This difficulty is because the small details important to consider when deciding are in the fine print. In other words, it is very easy to misunderstand how it works.

If you already have these details in mind, see how to apply for this card below.

Apply online

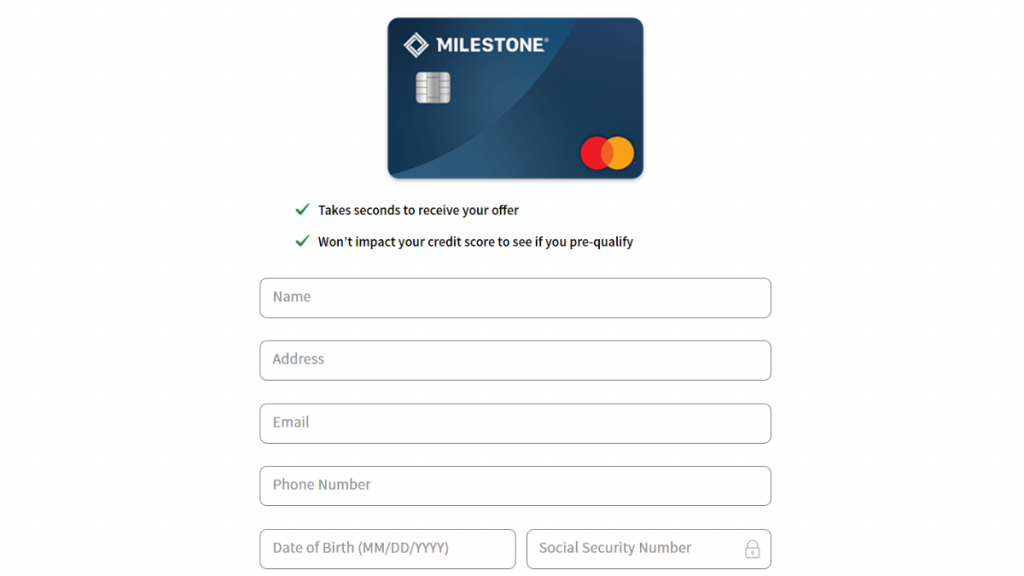

First, be aware that this credit card offers the option for you to pre-qualify. If you want to pre-qualify, you will have to share personal information about yourself with them.

Some of the information you will have to share is first and last names, full addresses, e-mail addresses, phone numbers, dates of birth, and also your Social Security Number (SSN).

This whole pre-qualification process happens in the blink of an eye. Moreover, there is no reason to worry. Because pre-qualifying does not hurt your score.

After that, you will have to wait for them to review your information. Once this is done, they will determine your annual fee. But please do not forget to read all the terms and conditions.

However, there is an interesting fact here. According to them, they will recommend other institutions if they do not accept your application, which is rare.

But be aware that pre-qualifying does not guarantee final approval. We recommend that you do all of these steps online.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Regarding other means to apply for the Milestone® Mastercard® Credit Card, there is no way to submit your application via a mobile application.

However, the Milestone® Mastercard® Credit Card website is mobile friendly. Therefore, you can seamlessly apply using your phone or tablet.

Milestone® Mastercard® Credit Card vs. Indigo® Mastercard® Credit Card

You may have already noticed that our recommendation for this card is not one of the most positive ones. And the reason is that better options on the market can help you more.

One example is the Indigo® Mastercard®, which has the same target audience, and no bonuses or rewards. But it can sometimes offer you a lower annual fee.

Milestone Mastercard®

- Credit Score: Fair – Good;

- Annual Fee: See terms – the annual fee depends on your creditworthiness;

- Regular APR: See terms – the APR depends on your creditworthiness;

- Welcome bonus: None;

- Rewards: None.

Indigo® Mastercard® Credit Card

- Credit Score: Poor – Fair;

- Annual Fee: $75 in the first year. Then, $99;

- Regular APR: 24.90%;

- Welcome bonus: N/A;

- Rewards: N/A.

If the Indigo® Mastercard® Credit Card can be the best for you, read our post below to learn how to apply for it!

Applying for the Indigo® Mastercard® Credit Card

The Indigo® Mastercard® Credit Card is perfect for helping you rebuild credit. See what are the steps to make the application!

Trending Topics

LendingPoint Personal Loan review: is it worth it?

Read our LendingPoint Personal Loan review and discover the main pros and cons of applying for this lender! Secure up to $36,500!

Keep Reading

Applying for the Journey Student Card from Capital One: learn how!

Want 1% cashback and increase the limit after 6 months of use? Then learn how to apply for Journey Student Card from Capital One.

Keep Reading

What is the FHA rate: an easy guide!

Before getting a subprime mortgage loan to buy your first house, learn what is FHA rate guide. It will give you a way better deal.

Keep ReadingYou may also like

Bank of America® Unlimited Cash Rewards credit card full review

The Bank of Bank of America® Unlimited Cash Rewards credit card offers up to 2.62% cash back on, unlimited redemptions and zero fees

Keep Reading

Merrick Bank Double Your Line Secured Visa credit card full review

With the Merrick Bank Double Your Line Secured Visa credit card you can double your credit limit within just a few months!

Keep Reading

Elevate your finances: Apply for the Sesame Cash Debit Card today

Upgrade your online banking experience! Apply today for the Sesame Cash Debit Card and earn cash back on select brands! Read on!

Keep Reading