Credit Cards

Applying for the Regions Premium Visa® Signature Credit Card: learn how!

Take advantage of all the Regions Premium Visa® Signature Credit Card. Earn 30,000 bonus points and 1.5 points per dollar spent! Read on!

Advertisement

The Regions Premium Visa® Signature Credit Card is no longer accepting applications for new accounts. See our best credit cards for other options. Below is our application guide for the card from when it was still available.

Enjoy 0% intro APR for 12 months!

Are you looking for an easy way to elevate your credit card rewards game? Then apply for the Regions Premium Visa® Signature Credit Card!

Applying for the IHG® Rewards Traveler Credit Card

IHG® Rewards Traveler Credit Card offers several benefits for travelers. Pay no annual fee and earn points on every dollar spent! Read on!

This card offers a great points system and exclusive perks and benefits. Get ready to join the discerning credit card holders who maximize their rewards.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply online

Applying for the Regions Premium Visa® Signature Credit Card is easy: you must be 18 or older and have a valid social security number.

You can apply with just one phone call to 1-888-IN-A-SNAP (462-7627), by visiting Regions.com, or by dropping by your local Regions branch.

At the application, you will be asked to provide basic information, including your name, address, social security number, credit score, and other financial data.

With these simple steps, you can apply quickly and be ready to start experiencing the convenience and advantages of this great card.

Apply using the app

Applying for Regions Premium Visa® Signature Card is done online, personally, or by phone.

That is, you cannot apply by the app. If you want to apply, follow the tips from the previous topic.

Regions Premium Visa® Signature Card vs. IHG® Rewards Traveler Card

The Regions Premium Visa® Signature Card and the IHG® Rewards Traveler Card are excellent cards that offer similar benefits but have different pros and cons.

First, the Regions Premium Visa® Signature Card has an annual fee of $125, while the IHG® Rewards Traveler card has no annual fee.

Additionally, those who apply for the Regions Premium Visa® Signature Credit Card may be eligible for up to 30,000 bonus points.

On the other hand, with the IHG® Rewards Traveler Credit Card, you can earn 120,000 bonus points – the highest welcome bonus of all IHG-issued cards!

It is important to consider your spending habits before making a decision. So check our comparison to help you decide.

Regions Premium Visa® Signature Credit Card

- Credit Score: 690 – 850 (Good – Excellent);

- Annual Fee: $125;

- Regular APR: 0% intro APR for 112 months and on balance transfers for 60 days. After that, 18.49% variable APR;

- Welcome bonus: 30,000 points after spending $ 2,000 in the first 3 months;

- Rewards: 1.5 points for each dollar on specific purchases at any time.

IHG® Rewards Traveler Credit Card

- Credit Score: 690-850 (Good – Excellent);

- Annual Fee: $0;

- Regular APR: 20.49% – 27.49% – Variable APR;

- Welcome bonus: Earn 120,000 bonus points after spending $2,000 in purchases in the 1st 3 months from account opening;

- Rewards: Up to 17X points per dollar spent at IHG Hotels and Resorts. 3X points per dollar spent at select gas stations and streaming services, utilities, and dining. 2X points per dollar spent on other purchases and more.

The IHG® Rewards Traveler Credit Card has amazing rewards and can be a good alternative.

However, to apply, it is important to fulfill the requirements, such as Credit Score. Learn the step-by-step in this post.

Applying for the IHG® Rewards Traveler Credit Card

IHG® Rewards Traveler Credit Card offers several benefits for travelers. Pay no annual fee and earn points on every dollar spent! Read on!

Trending Topics

Fortiva® Mastercard® Credit Card Review

Explore our Fortiva® Mastercard® Credit Card review for insights on earning cash back on everyday purchases and building credit easily.

Keep Reading

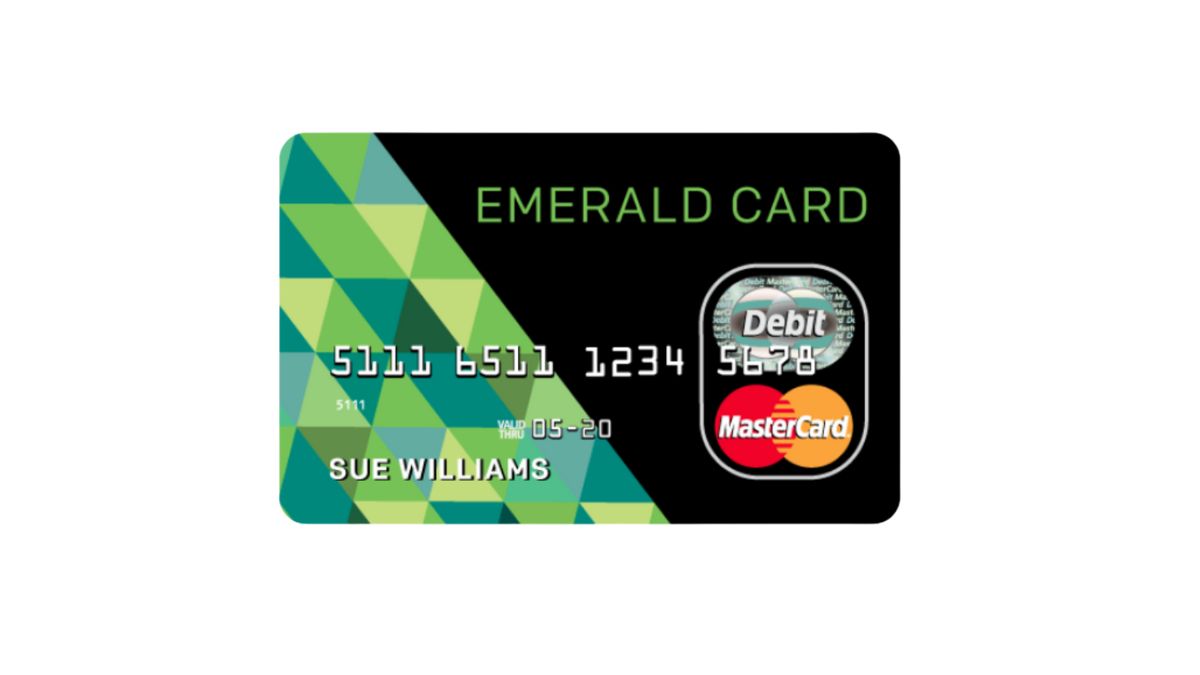

Applying for the H&R Block Emerald Prepaid Mastercard®: learn how!

The H&R Block Emerald Prepaid Mastercard® might be what you're looking for if you don't have a good credit score. Learn how to apply today!

Keep Reading

Ethereum successfully completes its first test merge

Ethereum, the world's second largest cryptocurrency by market cap, completed a major development milestone this past week with a test merge.

Keep ReadingYou may also like

Upgrade Triple Cash Rewards Visa® Credit Card Review

The Upgrade Triple Cash Rewards Visa® Credit Card has an excellent performance, with good cashback rates. It will optimize your money.

Keep Reading

Get the Funds You Need with Ease: Republic Bank Loans review

Need a personal loan? Republic Bank offers unsecured loans with terms up to 180 months. Discover the benefits and drawbacks before you apply.

Keep Reading

247LoanPros review: is it worth it?

Want to settle your debts? Follow this 247LoanPros review and see what benefits it can bring to your financial life.

Keep Reading