Credit Cards

Upgrade Triple Cash Rewards Visa® Credit Card Review

Are you looking for a credit card with low costs and high rewards? Stop looking and check the Upgrade Triple Cash Rewards Visa® Credit Card benefits on this review. It might suit your needs.

Advertisement

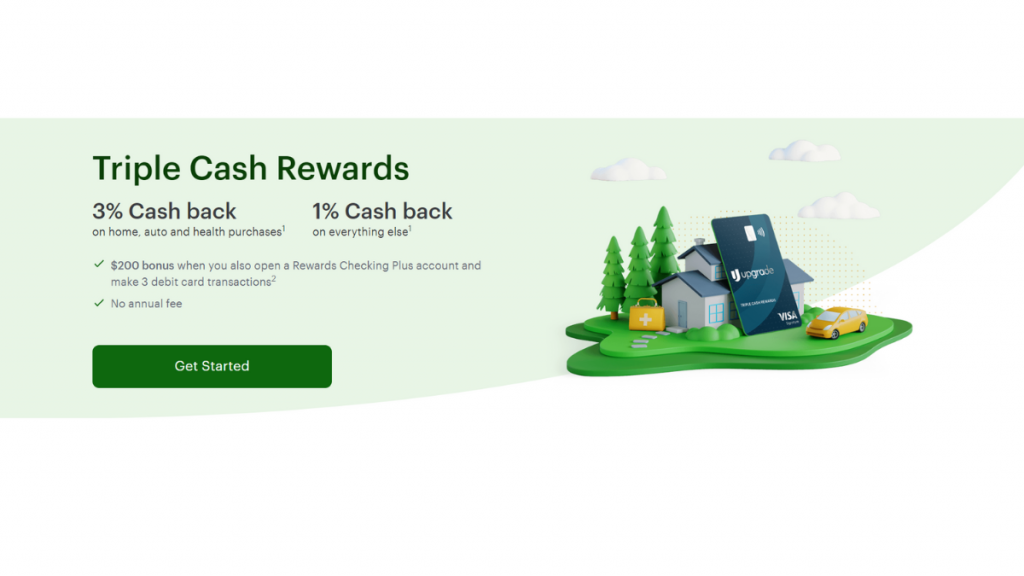

Upgrade Triple Cash Rewards Visa®: a 3% cash back to fill your pockets with rewards

The Upgrade Triple Cash Rewards Visa® Credit Card is one of the best cards offered by Upgrade, a financial start-up issued by Sutton Bank.

This review will show you what’s the deal about this interesting card. After all, is it a credit card, a line of credit, or a personal loan?

If you need a new credit card to earn cash back, this card might be a good option for you.

With up to 3% cash back on selected categories to enjoy it, many people will surely like this card. Let’s see what else the Upgrade Triple Cash Rewards has to offer.

How do you get the Upgrade Triple Cash Rewards?

The Upgrade Triple Cash Rewards Visa® is excellent for earning cashback if you don't like paying annual fees. Learn how to apply for it.

- Credit Score: Good to excellent.

- Annual Fee: No annual or monthly fee.

- Regular APR: Get 14.99% up to 29.99% APR, depending on your creditworthiness.

- Welcome bonus: None.

- Rewards: Cash back, with bonus on selected purchases.

How does the Upgrade Triple Cash Rewards Visa® work?

Some credit card specialists are suspicious about how this card works. It works like a credit card but has a lot of personal loan features.

The credit limit can be as high as $25,000 – some even get a $50,000. This is not something you can easily find on a credit card with a $0 annual fee.

But if you make a purchase this big on this credit card, you don’t need to worry about carrying a balance.

It will be split into installments at a fixed rate that gives you excellent predictability to budget and plan payments.

On top of that, the card will give you cash back, a Visa signature, and a physical card with contactless technology.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Upgrade Triple Cash Rewards Visa® Credit Card pros and cons

Pros

- If you agree with setting your bill into your checking account auto pay you can get the lowest APR.

- Your balance will be split into installments and you’ll have 12 to 60 months to pay it at a fixed rate and with no pre-payment fee.

- Earn 1% unlimited cash back when you pay your credit card bill, and up to 3% on selected purchases.

- The Visa signature will give you exclusive benefits, and your card will be accepted in virtually every corner of the world.

Cons

- Upgrade doesn’t allow balance transfers.

- If your credit score is not that great the APR can be high.

- It’s not available in DC, IA, WV, WI, NC, NH, or HI.

Does my credit score need to be good?

It is important to have this in mind: a good or excellent credit score will always grant you better offers.

With that in mind, know that you can apply with an average credit score for an Upgrade Triple Cash Rewards.

However, your APR and credit limit will not be as good as for someone with a better credit score.

Want to apply for the Upgrade Triple Cash Rewards Visa® Credit Card?

Having an Upgrade Triple Cash Rewards Visa® Credit Card can will grant you some cash back to your hands.

If you’d like to add this card to your wallet, we have some tips for you. Read the following content and learn how to apply for it.

How do you get the Upgrade Triple Cash Rewards?

The Upgrade Triple Cash Rewards Visa® is excellent for earning cashback if you don't like paying annual fees. Learn how to apply for it.

Trending Topics

Custom Choice student loan review: is it worth it?

Do you need money to complete your studies? The Custom Choice student loan may be what you are looking for. Learn more!

Keep Reading

The Quick Way To Apply For A Job At TGI Friday’s

Build your career from the ground up with the entry-level training programs for a job at TGI Friday's - Learn to apply here!

Keep Reading

Ethereum successfully completes its first test merge

Ethereum, the world's second largest cryptocurrency by market cap, completed a major development milestone this past week with a test merge.

Keep ReadingYou may also like

Applying for the Fortiva® Credit Card: learn how!

The Fortiva® Credit Card has a good credit limit, and you don't need a good score to qualify. Find out how to apply!

Keep Reading

Applying for The Credit Pros: get debt relief!

You can repair your credit with The Credit Pros. Just read this content and learn how to fix your credit and get your finances on track.

Keep Reading

Should you invest in dividend-paying stocks?

Are dividend-paying stocks right for you? Here's what you need to know about this tried and true stock market strategy. Read on for more.

Keep Reading