Credit Cards

Applying for the BMO CashBack® Mastercard® Card: Learn how!

If you're looking for a cash back credit card, the BMO CashBack® Mastercard® is worth checking out. Learn how to easily apply for it!

Advertisement

BMO CashBack® Mastercard®: The most generous cash back offer on groceries in Canada!

If you’re looking for a great way to earn cash back on your everyday purchases, the BMO CashBack® Mastercard® Card is a card worth considering.

This entry-level card offers 3% back on groceries, 1% back on bills, and 0.5% cash back on all other purchases. There is no annual fee, and new cardholders get a triple bonus!

That means 5% cash back in the first 90 days of account opening, and a 0,99% APR intro for card balances with a 2% transfer fee.

So, if you’re interested in applying for this card, keep reading! We’ll tell you everything you need to know before submitting your application.

Apply online

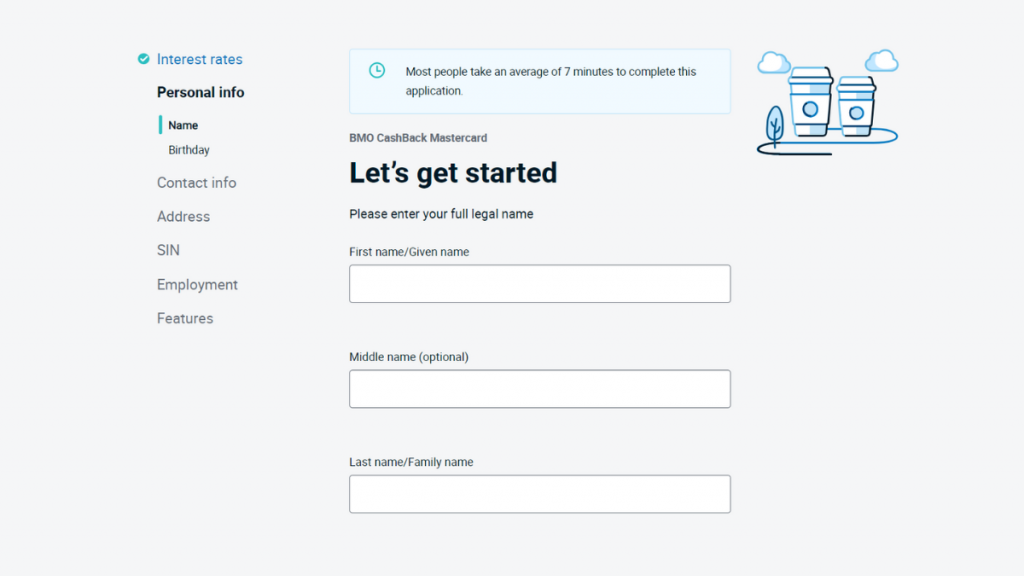

Applying for the BMO CashBack® Mastercard® Card is easy! Just go to the BMO website and click on “Credit Cards.” Then, select “CashBack Mastercard” from the list of cards.

Next, you’ll be asked to provide some personal information, including your name, date of birth and Social Insurance Number.

Then, you’ll be asked to provide some financial information, including your annual income and your monthly housing costs.

Finally, you’ll be asked to agree to the terms and conditions of the card. Once you’ve filled out all the required information, click on “Submit” and you’re done!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

If you’d rather apply for the BMO CashBack Mastercard on your mobile device, just download the BMO Mobile Banking app and select “Credit Cards”.

Then, select “CashBack Mastercard” from the list of cards. The process is the same as the online application.

BMO CashBack® Mastercard® vs. BMO Ascend World Elite® Mastercard®

If you don’t think the BMO CashBack® Mastercard® card is the best choice for your financial needs, don’t worry! We brought another option.

The BMO Ascend World Elite® Mastercard® is an excellent product for customers looking for higher rates.

It has a generous sign-up bonus, and the $150 is waived during the first year of card membership.

So, which card is right for you? It really depends on your spending habits and priorities. Check the comparison between the two cards below.

| BMO CashBack® Mastercard® | BMO Ascend World Elite® Mastercard® | |

| Credit Score | Good – Excellent | Excellent |

| Annual Fee | $0 | $150 (waived during its first year) |

| Regular APR | 20.99% variable | 20.99% variable |

| Welcome bonus | 5% cash back in your first 3 months, plus a a 0.99% introductory interest rate on Balance Transfers for 9 months with a 2% transfer fee. | Up to 60.000 points and the annual fee waived during your first year as a cardmember. |

| Rewards | 3% cash back on groceries; 1% cash back on bills; 0,5% cash back on all other purchases. | 5 BMO points on travel; 3 BMO points on dining, recurring bills, and entertainment; 1 BMO points per dollar on all else. |

Interested in the BMO Ascend World Elite® Mastercard®? Check the following link to learn more about it, including how to apply.

How to apply for a BMO Ascend World Elite®

Learn the application process to request a BMO Ascend World Elite® Mastercard®.

Trending Topics

TFSA vs RRSP: which you should choose?

TFSA vs RRSP. Which one should you pick? Should you have both? We answer these and other common questions about these types of accounts.

Keep Reading

American Express Platinum credit card full review

Discover everything you need to know about the American Express Platinum credit card, including eligibility requirements and rewards offered.

Keep Reading

What are the real advantages of cashback?

The advantages of cashback are powerful in the long term, and in this article you will learn how this works. Read on to find out more!

Keep ReadingYou may also like

BMO CashBack® Mastercard® Review

Check our BMO CashBack® Mastercard® review and learn just how much cash back you can earn with this $0 annual fee card!

Keep Reading

Merrick Bank Double Your Line Secured Visa credit card full review

With the Merrick Bank Double Your Line Secured Visa credit card you can double your credit limit within just a few months!

Keep Reading

Applying for the Chase Freedom Unlimited® Credit Card: learn how!

Learn how to apply for Chase Freedom Unlimited® card today and find out why this is one of the best cash back cards available in the market!

Keep Reading