Credit Cards

Applying for the Chase Freedom Flex® Credit Card: Learn how!

The Chase Freedom Flex® Card lets you enjoy the best of both worlds with fixed bonus categories and 5% bonus categories that change each quarter. See how to apply and benefit from this unique rewards credit card.

Advertisement

Chase Freedom Flex® credit card application: get a $200 sign-up bonus!

The Chase Freedom Flex® Credit Card is a great option for people who want cash back benefits and rewards.

With no annual fee and a 0% APR for the first 15 months, this card is a fantastic way to save money on interest payments.

You’ll also earn 5% back on up to $1,500 in combined purchases in rotating quarterly categories and 5% back on travel booked through Chase Ultimate Rewards.

Plus, you’ll get 3% cash back on dining and drugstore purchases and 1% on everything else. There’s no shortage of ways to earn bonus points with this card!

Using this card to cover daily expenses can maximize your savings potential. The Chase Freedom Flex® Credit Card can help you reach your financial goals.

So, learn how to apply today and take advantage of the $200 welcome bonus! Check the application process for the Chase Freedom Flex® below.

Apply online

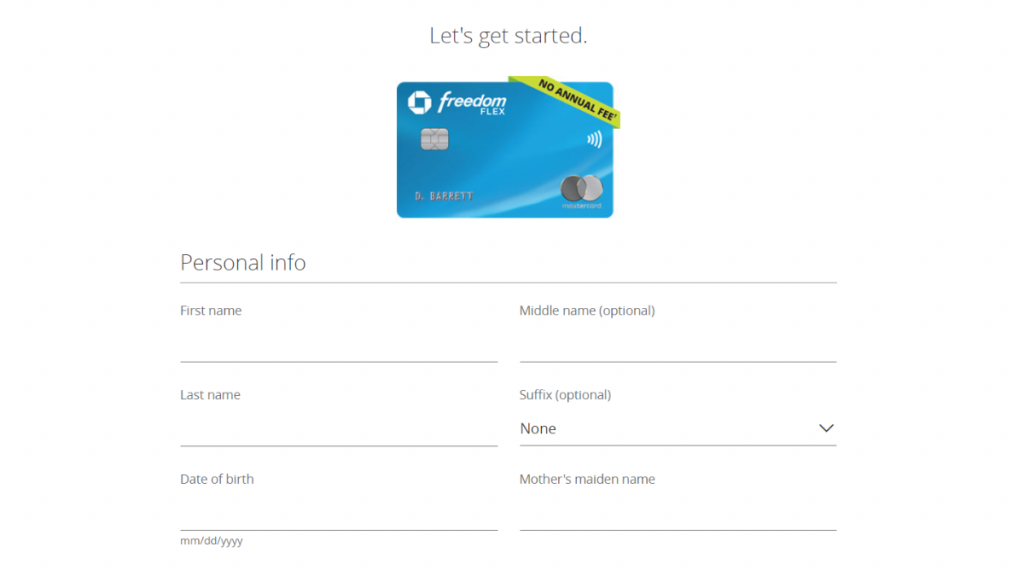

The online application for the Chase Freedom Flex® Credit Card is simple and takes no longer than 5 minutes. First, you need to access the Chase Credit Cards website.

In the “cash back” category, the Freedom Flex alternative is right under Freedom Unlimited. Click on “learn more”.

You can log in and speed up the process if you’re already a Chase customer. If you don’t have an account with the bank, you can click on the “apply as a guest” button.

Fill out the online form with your personal, financial, and contact details and agree with the terms & conditions before clicking the “submit” button.

Chase will verify your financial profile, and the response to your request should come quickly via phone call or e-mail.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can also apply for a Chase Freedom Flex® Credit Card by using their mobile app.

The process is very similar to the online application. However, you might need to create an account before requesting a product.

Chase Freedom Flex® Card vs. Chase Freedom Unlimited® Card

If you feel like the Chase Freedom Flex℠ credit card doesn’t fit your needs; it’s okay!

We brought another recommendation from Chase: the Freedom Unlimited® credit card.

Check the comparison below and follow the recommended link for the application process!

| Chase Freedom Flex® | Chase Freedom Unlimited® | |

| Credit Score | Good – Excellent | Good – Excellent |

| Annual Fee | $0 | $0 |

| Regular APR | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 20.49%–29.24% | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 20.49%–29.24% |

| Welcome bonus | $200 after spending $500 on purchases within 90 days of account opening, plus an extra 5% rebate on gas and grocery stores | $200 after spending $500 on purchases within 90 days of account opening, plus an extra 5% rebate on gas and grocery stores |

| Rewards | 5% cash back on 2 fixed bonus categories; 5% cash back on travel booked through Chase Ultimate Rewards; 3% cash back on dining and drug stores; 1% cash back on all other purchases. | 5% cash back on travel purchased through Chase Ultimate Rewards; 3% cash back on dining and takeout; 3% back on drugstore; 1.5% cash back on all other purchases. |

How to apply for Chase Freedom Unlimited® Card?

Check the easy and fast application for the Chase Freedom Unlimited® Credit Card and start earning today!

Trending Topics

Applying for the Capital One SavorOne Cash Rewards card: learn how!

Every food enthusiast will love the Capital One SavorOne Cash Rewards card. Learn how to apply for it and enjoy cash back rewards.

Keep Reading

What type of account is a cash management: the same as a bank account?

What type of account is a cash management account? In this article we cover the basics of this type of account, and whether it is for you.

Keep Reading

Rewards credit cards: learn their pros and if they are worth it!

Learn about the pros of credit card rewards and how you can use them to save money. Also, are rewards credit cards worth it? Find out here!

Keep ReadingYou may also like

No fees and no hassle: Sesame Cash Debit Card review

You just found a game changer debit card! Read our Sesame Cash Debit Card review and learn how to build credit and pay no fees! Let's go!

Keep Reading

Study Abroad in Canada: A Guide for International Students

Check out these exclusive scholarships and Canadian government grants for international students to study abroad in Canada. Dive in now!

Keep Reading

Applying for the PREMIER Bankcard® Mastercard® Card: learn how!

Need to build credit and improve your score? The PREMIER Bankcard® Mastercard® Card can help! See how to apply for this simple option.

Keep Reading