Credit Cards

Applying for the Capital One SavorOne Cash Rewards Card: Learn How!

Better than going out for dinner with friends is to earn 3% cash back on it. This and much more you will get with your Capital One SavorOne Cash Rewards. This article will show how you can get one.

Advertisement

Up to 8% cash back to enjoy the best entertainment events

Capital One SavorOne Cash Rewards card is a champion when it comes to the best rewards credit cards. It’s hard to find a single flaw in it, and almost every review gives it 5 stars.

If you doubt it, look at this card’s features. If you don’t like paying for your credit cards, you will love the $0 annual fee.

And if you enjoy having dinner with your family and friends, or going out to attend the best cultural events, you will love the 3% bonus cash back.

Also, if you like doing these things traveling around the world, enjoy the 0% foreign transaction fee.

As you can see, this card is worth it. Keep reading to see how the application process works and the eligibility requirements.

Apply online

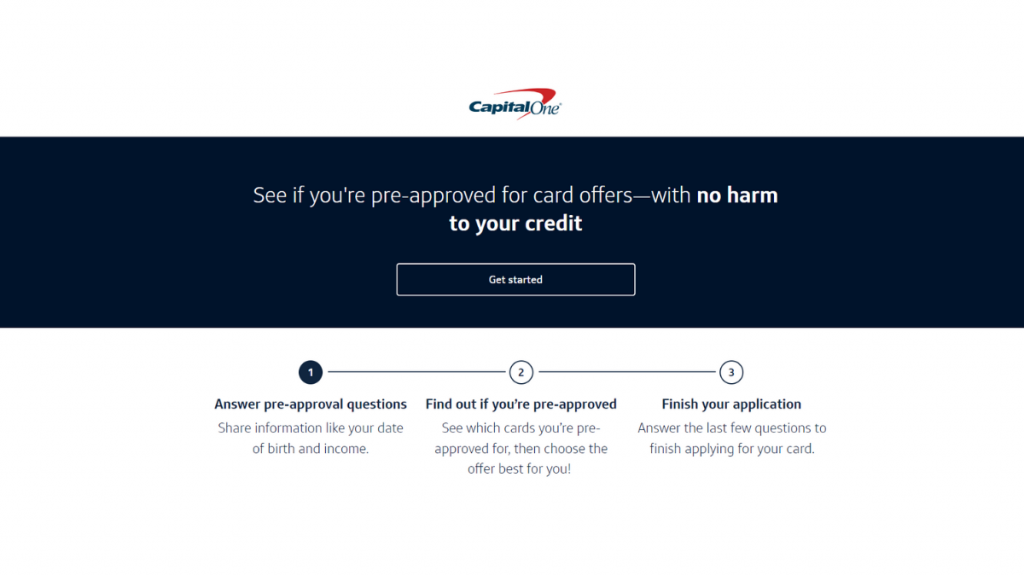

The internet has its pros and cons. One of the good things about the internet is how much it has streamlined bureaucratic processes such as applying for a new credit card.

If you have a good or excellent credit score, you can give it a try.

Access the Capital One website, look for the SavorOne Cash Rewards, and hit the “apply now” button. You can check the card details and read important disclosures about it.

There will be a small form to fill out. Inform your full name, date of birth, and SSN. Once you submit it, you will receive an offer, that you can accept or decline.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Capital One mobile app will help you manage your account and control your expenses and rewards. As soon as you got approved, you can download it to use all its features.

But the application has to be done on the Capital One website.

Capital One SavorOne Cash Rewards credit card vs. Capital One Venture Rewards card

If you’re looking for an excellent card, Capital One has many. The Capital One SavorOne is good for everyday expenses. If you prefer a travel card, take a look at the Venture Rewards.

Capital One SavorOne Cash Rewards

- Credit Score: Excellent

- Annual Fee: Does not charge an annual fee

- Regular APR: 0% for the first 15 months, then a variable 19.99% – 29.99%

- Welcome bonus: Spend $500 within the first 3 months to earn $200

- Rewards: 1% cash back on everything, and 3% cash back on selected categories, like dining and entertainment

Capital One Venture Rewards

- Credit Score: Excellent

- Annual Fee: $95

- Regular APR: 19.99% – 29.99% variable, based on your creditworthiness

- Welcome bonus: 75,000 bonus miles after spending $4,000 on the first 3 months

- Rewards: 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel

Learn how to apply for the Capital One Venture Rewards and enjoy its travel benefits.

How to apply for the Capital One Venture Rewards?

This card has an excellent reputation in the market for giving great rewards to its cardholders. Consider applying for the Capital One Venture Rewards credit card.

Trending Topics

4 best and easiest credit cards to get approved for: apply today!

Looking for the easiest credit cards to get approved for? We’ll show you the different types of cards and give you a few names to consider.

Keep Reading

Applying for the Applied Bank® Secured Visa® Gold Preferred® credit card: learn how!

Learn how to apply for the Applied Bank® Secured Visa® Gold Preferred® card and start rebuilding your credit score today!

Keep Reading

OakStone Platinum Secured Mastercard credit card full review

Looking for a card to help rebuild your credit? We've got you! Check out our review of the Oakstone Platinum Secured Mastercard.

Keep ReadingYou may also like

Top 6 best rewards cards in Canada: enjoy the benefits in 2022!

Looking for the best rewards cards in Canada? We've got you covered with top cash back, travel points, and sign-up bonus offers for 2022!

Keep Reading

Applying for the Discover Bank account: learn how!

Discover Bank is a great option to open your account. Want to know how to do it? Then find out here how to apply.

Keep Reading

Binance is moving to protect its users after Luna’s collapse

Binance CEO Changpeng Zhao has announced that the exchange will provide support for Luna investors affected by the crash.

Keep Reading