Credit Cards

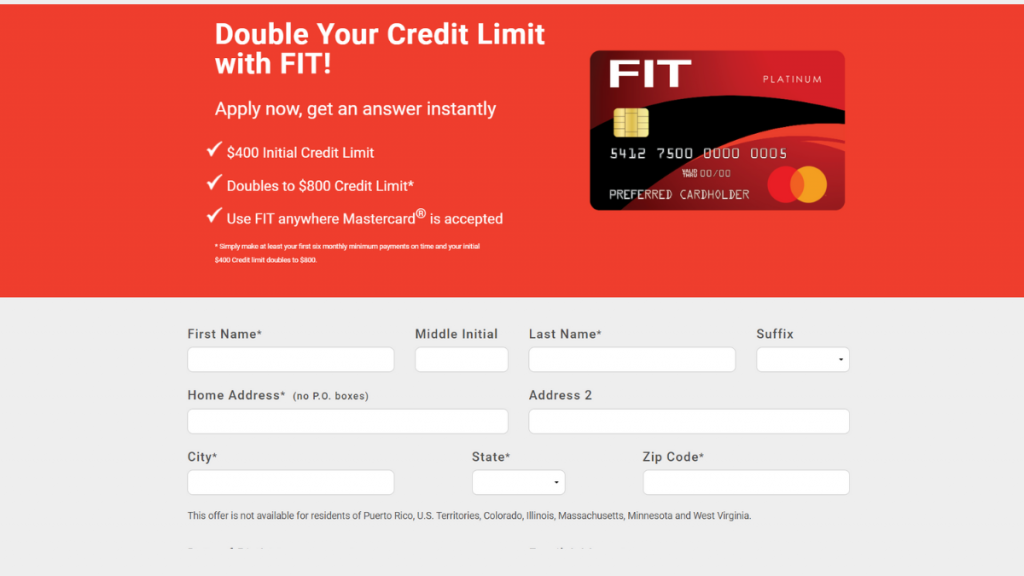

Apply for the FIT™ Platinum Mastercard®: Learn how!

Facing financial trouble can happen to everybody. But you can always rebuild your economic life with good information and discipline. The FIT™ Platinum Mastercard® can help you by providing a credit card for you. This content will show you how to get yours.

Advertisement

FIT™ Platinum Mastercard®: Easy application process and $400 initial credit limit

You can apply for the FIT™ Platinum Mastercard® online, quickly, regardless of your credit score. This card excels in credit building features!

You can receive up to a $400 credit limit to use responsibly and reestablish your score. As it is a card without many requirements for approval, it has some fees to be paid.

It is not a card for your lifetime, but it can be a stepping stone on your climb to getting cards with lower interest rates and more benefits.

Apply online

This FIT™ Platinum Mastercard®® is issued by The Bank of Missouri and doesn’t require a good credit score to apply.

The application is made online, and you’ll have an answer in a few minutes. Go to the Fit card website, and fill out the form to apply.

They’ll ask for basic personal and contact info. As soon as you submit the form, you will receive the offers available to you in your email.

The issuer may ask to check your identity through your driver’s license or another identification document.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

The only way to apply for this card is on the website. You can make the whole process without leaving your house, and soon you’ll be receiving your credit card.

FIT™ Platinum Mastercard® vs. OpenSky® Secured Visa® Credit Card

To have a better overview of the FIT™ Platinum Mastercard®, let’s compare it with another card in the same category.

The OpenSky® Secured Visa® Credit Card also has a simplified application process that does not require a minimum credit score.

However, it is a secured card, requiring a deposit. In both cases, after six months of utilization, you can be considered for a credit line with a higher limit.

| FIT™ Platinum Mastercard® | OpenSky® Secured Visa® Credit Card | |

| Credit Score | Poor/Fair. | All credit levels are welcome. |

| Annual Fee | $99 annual fee. | $35. |

| Regular APR | 29.99% variable | 25.64% variable. |

| Welcome bonus | No welcome bonus. | It does not offer a welcome bonus. |

| Rewards | No rewards. | This card does not offer rewards. |

If you want to apply for the OpenSky® Secured Visa® Credit Card instead, check the following link to learn more about the process.

Applying for the OpenSky® Secured Visa®

If you have no credit, getting a card might be challenging. But if you apply to OpenSky® Secured Visa® Credit Card, you'll easily have tons of benefits!

Trending Topics

Instant approval: apply for the Assent Platinum Secured Card!

Looking for a card with a hassle-free process? Read on a learn how to apply for the Assent Platinum Secured Credit Card! $0 annual fee!

Keep Reading

Top online brokers in Canada: find the most popular ones!

Learn about the top online brokers in Canada, and the best trading apps for you to make sound investment decisions for your investor profile.

Keep Reading

Apply for Credit Strong: no credit check is required

Read on and learn how to apply for Credit Strong. This platform will help you build credit and teach you how to save money!

Keep ReadingYou may also like

0% APR Credit Card: Discover the Best Offers Today

Explore 0% APR credit cards – save on interest, manage debt, and make informed financial decisions. Choose wisely!

Keep Reading

Avant Personal Loan review: is it worth it?

Read our comprehensive Avant Personal Loan review and determine whether this lender is worth it! Borrow up to $35K fast!

Keep Reading

Lending Tree Personal Loan: how to apply now!

If you want to apply for the Lending Tree Personal Loan, you're in the right place. Enjoy fast funding. Qualify with lower credit. Read on!

Keep Reading