Debit Cards

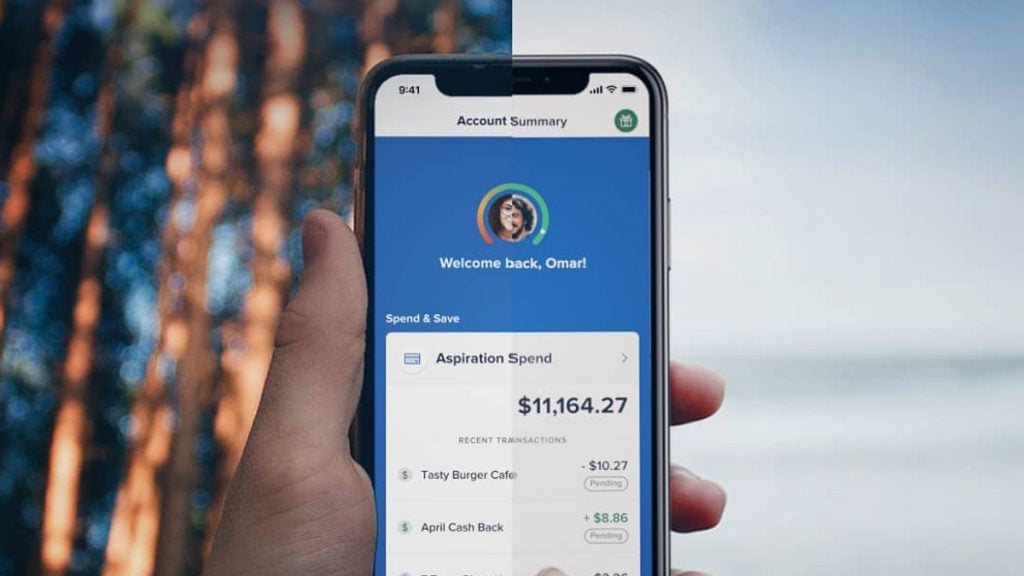

Aspiration Spend & Save™ debit card full review

The new Aspiration Spend & Save™ debit card offers a positive and transparent way to spend and save your hard-earned money. Find out how it works in this comprehensive review!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Aspiration Spend & Save™ debit card: monthly fees are optional, and you still contribute with fighting climate change

Wondering how to manage your money better? The Aspiration Spend & Save™ debit card might be right for you! This card lets you “spend smart” and save money on fees, all while supporting good causes. Read on to learn more about how the Aspiration Spend & Save™ debit card works. Plus, find out if this card is the right fit for your lifestyle!

| Intro Balance Transfer APR | N/A |

| APY | Up to 3% |

| Balance Transfer Fee | N/A |

| Monthly Fee | Pay What Is Fair (even if it’s $0) |

| ATM Fee | Fee-free in over 55,000 ATMs |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does Aspiration Spend & Save™ debit card work?

Aspiration is not a bank. It is a cash management company which splits your money up among different banks. This means your money is insured by the FDIC up to the amount of $2.5 million, and you have access to the Aspiration Spend & Save debit card.

What’s appealing about Aspiration is its social and environmental commitment. Everytime you make a purchase with the Aspiration Spend & Save™ debit card you are given the option of rounding up to the next dolar, and the extra cents you pay are converted into trees.

The Aspiration Spend & Save will also use that same money to offset your carbon emissions every time you use the card to fill up the tank, and the plastic used in its cards is made of recycled ocean plastic.

When it comes to monthly or annual fees, the company follows the “Pay What Is Fair” model, where you can pay as much as you think the service is worth, but you don’t have to if you don’t feel like it.

It’s important to keep in mind, though, that the highest APYs are only available to fee-paying accounts, and the interest you will be getting for your deposit only partially offsets the service fees.

However the company is very straightforward about its fees, and you don’t have to worry about sneaky surprise ones. Of course, if Aspiration sells itself as an ethical and socially conscious company, they could never do otherwise.

Get your Aspiration Spend & Save debit card now!

Aspiration Spend & Save™ debit card pros and cons

We know it makes it easier to decide if we can clearly see pros and cons, so here are a few quick takeaways.

Pros

- Pay as little as $0 for the service

- Socially & Environmentally conscious company

- FDIC Insured

Cons

- Highest APY available only fee-paying accounts

- No cash deposits available

- No in-person customer service

Does my credit score need to be good?

Because it is not a credit card issuer, credit scores do not apply to the Aspiration Spend & Save™ debit card. Aspiration is a money management company which issues debit cards while engineering cash flow among different banks.

Want to apply for the Aspiration Spend & Save™ card?

Looking for a way to easily and securely manage your finances? The Aspiration Spend & Save™ card may be just what you need! This card allows you to spend money and save money in a variety of ways, making it a great option for those looking for both convenience and value.

So, after doing your due diligence and learning about a number of debit card options, their pros and cons, benefits and perks, you have finally decided the Aspiration Spend & Save debit card is the right fit for your needs. Awesome! Now it’s time to roll up your sleeves and get that application going.

Applying for the Aspiration Spend & Save debit card is a very straightforward process which shouldn’t take you more than a few minutes. To make it even easier for you, we put together a step-by-step guide on how to apply. Check it out.

Apply Online

Log on to the Aspiration Spend & Save website where you will find the button “get started” at the top right corner of the page. Click on that button.

You will be taken to a page where you should add your email address. That will immediately take you to your card options.

After you have picked your card, you will be required to add some personal info such as your first and last name and birthday.

Once you have done that, click next and add in your social security number so that the platform can verify your identity. You will also be asked to enter your contact information with your mobile phone number and home address.

As soon as you confirm your home address, the website is going to send you a PIN number so that you can verify your phone number, and you are on your way to getting approved for the Aspiration Spend & Save debit card.

Another card recommendation: Revvi credit card

If you’re not sure that the Aspiration Spend & Save™ card is the best choice for you, we brought another option! The Revvi card is a great option for those looking to repair damaged credit. Besides, you can earn 1% cash back after just 6 months. Check its main features below and follow the recommended content for the application process!

| Revvi credit card | |

| Credit Score | Bad or limited |

| Annual Fee | $75 |

| Regular APR | 34.99% |

| Welcome bonus | N/A |

| Rewards | 1% cash back on every purchase |

How to apply for Revvi Credit Card?

See how to apply for a Revvi card and earn cash back while you rebuilt your credit score!

Trending Topics

How to get a loan with bad credit: 5 easy tips

Are you trying to get a loan with bad credit? It is not easy but will get easier if you follow the tips we give you in this article.

Keep Reading

What are the seven levels of financial freedom?

Discover what it takes to reach financial freedom and secure a comfortable early retirement just by shifting the way you manage your money.

Keep Reading

ELFI Student Loan review: is it worth it?

Read our ELFI Student Loan review and find out if it is worth it. Up to 100% coverage and flexible rates! Stick around and learn more.

Keep ReadingYou may also like

Flexible financing options: MyPoint Credit Union HELOC review

Read our MyPoint Credit Union HELOC review and discover the perfect product for you! Enjoy a promotional 1.01% off on your APR and more!

Keep Reading

Truist Future Credit Card full review: 0% APR for the first 15 months

Read our comprehensive Truist Future Credit Card review. Pay $0 annual or foreign transaction fees! Keep reading and learn more!

Keep Reading

Credit limit of up to $35K: Pelican Prime Visa Review

Are you ready to simplify your credit card experience? Then read our Pelican Prime Visa review. Access your FICO Score for free!

Keep Reading