Credit Cards

Capital One Venture Rewards Credit Card Review

Do you love to travel but don't want to spend a fortune on flights and hotels? If so, check out the Capital One Venture Rewards Credit Card. It will give you miles in every purchase.

Advertisement

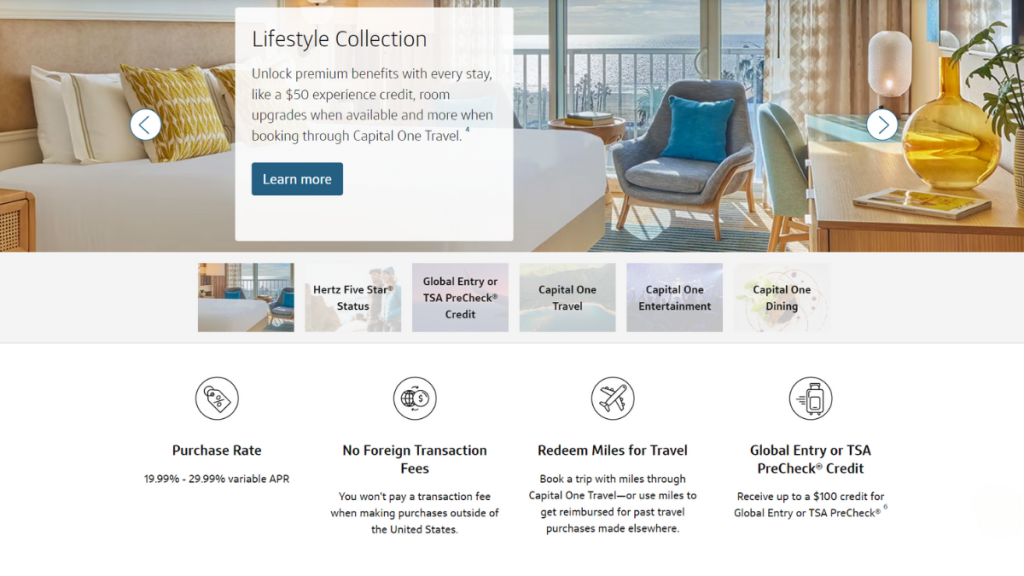

Capital One Venture Rewards Credit Card: Rewards are available for every purchase and travel benefit for you!

If you’re a traveler who likes to earn rewards, the Capital One Venture Rewards Credit Card may be great for you.

With this card, you’ll earn miles on every purchase, and you can redeem them for travel-related expenses. Plus, there’s no fee for foreign transactions and more benefits.

So, if you’re looking for a great travel rewards credit card, look at the Capital One Venture Rewards card. You may just want to add it to your wallet.

| Credit Score | Excellent. |

| Annual Fee | $95. |

| Regular APR | 19.99% – 29.24% variable, based on your creditworthiness. |

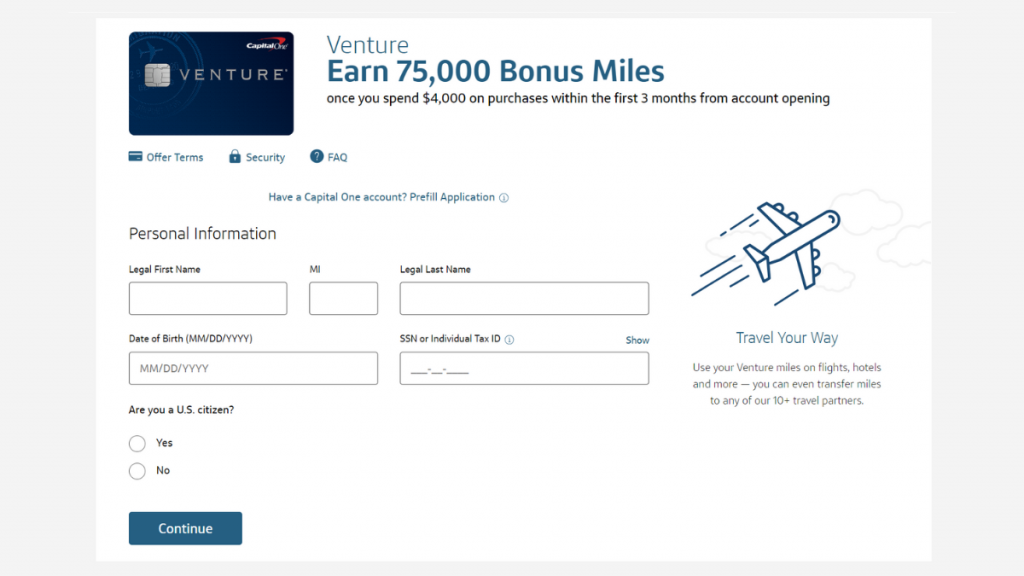

| Welcome bonus | 75,000 bonus miles after spending $4,000 on the first 3 months. |

| Rewards | 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel. |

How does Capital One Venture Rewards credit card work?

This card is an excellent recommendation for frequent travelers. It will give you 2 miles as a reward for every purchase and travel expense worth 5 miles in the rewards program.

In addition, your miles are valued more if you redeem them with the partner airlines in the Capital One Travel service as well. So the more you travel, the more you’ll travel!

The welcome bonus is generous and has great potential value. New members receive 75,000 miles (after spending just $4,000 in 3 months, which is not difficult).

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Capital One Venture Rewards Credit card pros and cons

To consider applying for a new credit card or not, you should look at the pros and cons, not just the pros.

Remember that every hard inquiry and new credit account will have a certain effect on your credit history.

Here, you can take a look at some highlights of this card’s benefits and downsides:

Pros

- There are no foreign transaction fees.

- Earn 5 miles per dollar in travel purchases and 2 miles in every other purchase (terms apply).

- As long as your account stays open, your miles won’t expire.

- Travel and rental insurance.

- Complimentary access to Capital One Lounge (two times).

Cons

- It doesn’t offer domestic travel options to redeem miles.

- You need a good/excellent score to be approved.

- Redeem your miles as cashback will significantly decrease its value.

Want to apply for Capital One Venture Rewards card?

With the Capital One Venture Rewards card, you can travel the world and get rewarded for it.

This card lets you earn unlimited miles on every purchase you make. Plus, you can use your rewards to book any type of travel— plane tickets, hotel rooms, car rentals, and more.

So, if you’re looking for a versatile and rewarding travel credit card, the Capital One Venture Rewards is a great option. Keep reading to learn how to apply for it.

Does my credit score needs to be good?

Your credit score must be excellent to be approved for this card. The majority of travel rewards credit cards require a high credit score.

If you need to improve your credit history, you can work on it with less demanding credit cards.

Requirements

Here are the application requirements for the Capital One Venture Rewards Credit Card, rephrased:

- Minimum Age: You must be at least 18 years old (or the legal age of majority in your state).

- Residency: Applicants need to have a valid U.S. physical address.

- Identification: A Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required for identity verification.

- Credit Score: This card is geared towards individuals with excellent credit, typically a credit score of 740 or higher.

- Proof of Income: You need to demonstrate a steady income to ensure you can meet payment obligations.

- Contact Details: Provide an active phone number, mailing address, and a valid email address.

- Financial Responsibility: A history of on-time payments and responsible debt management will strengthen your application.

Meeting these qualifications will improve your chances of approval for the Capital One Venture Rewards Credit Card, a great choice for earning travel rewards.

Apply online

You can apply for this card online. It is easy, and you get the answer in your email.

On the Capital One website, you can see all the credit cards it has to offer. Search for the Capital One Venture Rewards credit card.

There will be an “apply now” button that will redirect you to the application form. You’ll answer questions about your personal and financial information.

You’ll find the terms and conditions to apply at the end of the form. Read everything to know which payment conditions you’ll face and how the rewards program works.

Once you complete the form and accept the terms and conditions, send your application. You’ll get the answers in your email.

If you’re not approved for this card, you may receive another Capital One credit card offer.

Apply using the app

Capital One has a great app allowing cardholders to administer their accounts. However, you can’t apply for a new credit card on it. To apply, go to the Capital One website.

However, if approved, you can use their mobile app to manage your credit card easily.

Capital One Venture Rewards Credit Card vs. Chase Sapphire Preferred® Credit Card

To help you decide whether you should apply for this card, we present you with a comparison with another card in the same category.

The Chase Sapphire Preferred credit card has similar benefits. Instead of miles, you’ll get reward points, but you can also exchange them for travel and hotel booking.

| Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Credit Card | |

| Credit Score | Excellent. | 690 or higher. |

| Annual Fee | $95. | $95. |

| Regular APR | 19.99% – 29.24% variable, based on your creditworthiness. | 21.49% – 28.49% variable APR. |

| Welcome bonus | 75,000 bonus miles after spending $4,000 on the first 3 months. | 60,000 bonus points after $4,000 spent in the first 3 months |

| Rewards | 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel. | 5x points on travel purchased through Chase Ultimate Rewards; 2x points on other travel buys; 3x points on dining at restaurants; 3x points on select streaming services and online grocery purchases; 1 point per $1 spent on all other purchases. |

If you find the Chase Sapphire Preferred® Credit Card an interesting option, you can check the post for more information. Check the content below to learn how to apply for it.

Chase Sapphire Preferred® Credit Card Review

This is a full review of the Chase Sapphire Preferred®, one of the best travel credit cards in the matter of rewarding. Read this article to learn more about it!

Trending Topics

Lexington Law review: repair your credit with confidence

Need to rebuild credit? This review will show you how Lexington Law can be an excellent option and help you.

Keep Reading

What Is the Lowest Credit Score Possible? (And How to Improve It)

Discover the lowest credit score possible, learn how it affects your finances, and how to improve it for better financial health. Read on!

Keep Reading

American Express Platinum or American Express Gold card: choose the best!

Choosing between American Express Platinum or American Express Gold is a win-win decision. We'll help you decide between these amazing cards.

Keep ReadingYou may also like

Chime® Debit Card Review

Are you in need of a debit card that is practical and has no monthly or overdraft fees? Read our Chime® Debit Card review to learn more!

Keep Reading

Is it possible to make money during a bear market?

Learn about the opportunities that exist in a bear market and how you can take advantage of them to grow your portfolio long-term.

Keep Reading

Universal Credit Personal Loans review: up to $50K

Get full insights into what Universal Credit Personal Loans has to offer in this full review! Flexible rates and terms! Read on!

Keep Reading