Credit Cards

Chase Freedom Flex® Credit Card Review

The Chase Freedom Flex® Credit Card is a cash-back credit card that regularly offers 5% back. But does this versatile cash-back card have other strengths? Find out in our full review!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Earn 5% cash back on rotating categories!

If you’re looking for a solid card with cash back benefits, you’ve found it! Read our Chase Freedom Flex® Credit Card review to learn all about this one-of-a-kind product.

The card offers 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate and 1% to 3% cash back on other purchases.

Plus, there is no annual fee! Do you want more information about this card’s features and benefits? Then let’s get started!

| Credit Score | Good – Excellent |

| Annual Fee | $0 |

| Regular APR | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 18.49%–27.99%. |

| Welcome bonus | $200 after spending $500 on purchases within 90 days of account opening |

| Rewards | 5% cash back on fixed bonus categories; 5% cash back on travel booked through Chase Ultimate Rewards; 3% cash back on dining and drug stores; 1% cash back on all other purchases. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Chase Freedom Flex® Credit Card work?

The Chase Freedom Flex® Credit Card is a World Elite Mastercard product, Issued by Chase and Mastercard.

That means you get exclusive perks like cell phone insurance, discounts in services like Lyft and Fandango, and hotel benefits through the Mastercard Luxury Hotel program.

The card charges no annual fee and provides a 0% intro APR for 15 billing cycles on balance transfers and purchases. The recommended credit score for applications is between 690 and 850.

Its welcome bonus for new cardholders provides a $200 bonus after spending just $500 within the first 3 months of card membership.

Since this is primarily a cash-back card, you get a lot of bonus points for everyday spending.

In that sense, you can earn up to 5% cash back in quarterly bonus categories. There is a 3% cash back on dining and drug stores and 1% on all other purchases.

The flexible redemption options allow Chase Freedom Flex® customers to get a statement credit or direct cash deposit into a checking or savings account.

That means the more you spend, the more you’ll earn. Since the bonus points never expire, prioritizing this card on daily purchases can mean a profitable return.

Chase Freedom Flex® Credit Card pros and cons:

To help you make the best decision for your financial profile, we’ve compiled this product’s perks and drawbacks in our Chase Freedom Flex® Credit Card review.

Pros

- Exciting $200 sign-up bonus;

- $0 annual fee;

- 5% cash back in rotating categories;

- 0% intro APR

- 1% cash back on every purchase.

Cons

- Require Good/Excellent category;

- Needs bonus rewards tracking;

- Complicated rewards system

Want to apply for the Chase Freedom Flex® Credit Card?

Now that you’ve seen how beneficial this card can be for your finances, how about applying for one?

Read on for a quick and easy application process with Chase and get your Chase Freedom Flex® Credit Card today!

Does my credit score need to be good?

Since this product has cash back benefits, Chase requires all new clients to have a credit score between Good and Excellent.

Therefore, the recommendation for a new Chase Freedom Flex® Credit Card is between 690 and 850.

Requirements

- Age: Must be at least 18 years old (or the legal age of majority in your state).

- Residency: Requires a valid U.S. physical address (P.O. boxes may not be accepted).

- Identification: A valid Social Security Number (SSN) or ITIN is required.

- Credit Score: Designed for individuals with good to excellent credit (FICO score 690+).

- Income: Proof of sufficient income to handle monthly payments is required.

- Credit History: Must demonstrate responsible credit use (e.g., on-time payments).

- Chase 5/24 Rule: May be denied if you’ve opened 5 or more credit cards in the past 24 months.

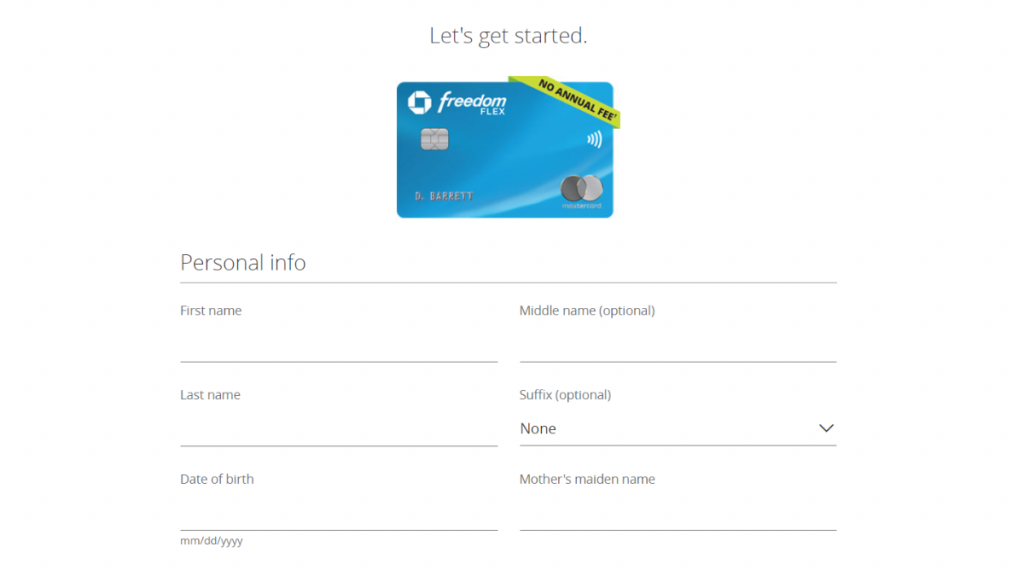

Apply online

The Chase Freedom Flex® Credit Card online application is simple and takes no longer than 5 minutes. First, you need to access the Chase Credit Cards website.

In the “cash back” category, the Freedom Flex alternative is under Freedom Unlimited. Click on “learn more”.

You can log in and speed up the process if you’re a Chase customer. If you don’t have an account with the bank, you can click on the “apply as a guest” button.

Fill out the online form with your personal, financial, and contact details and agree with the terms & conditions before clicking the “submit” button.

Chase will verify your financial profile, and the response to your request should come quickly via phone call or e-mail.

Apply using the app

You can also apply for a Chase Freedom Flex® Credit Card by using their mobile app.

The process is very similar to the online application. However, you might need to create an account before requesting a product.

Chase Freedom Flex® Card vs. Chase Freedom Unlimited® Card

If you feel like the Chase Freedom Flex℠ credit card doesn’t fit your needs; it’s okay!

We brought another recommendation from Chase: the Freedom Unlimited® credit card.

Check the comparison below and follow the recommended link for the application process!

| Chase Freedom Flex® | Chase Freedom Unlimited® | |

| Credit Score | Good – Excellent | Good – Excellent |

| Annual Fee | $0 | $0 |

| Regular APR | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 18.49%–27.99%. | 0% intro APR for 15 months from account opening on purchases and balance transfers. Then, a variable 20.49%–29.24% |

| Welcome bonus | $200 after spending $500 on purchases within 90 days of account opening | $200 after spending $500 on purchases within 90 days of account opening |

| Rewards | 5% cash back on fixed bonus categories; 5% cash back on travel booked through Chase Ultimate Rewards; 3% cash back on dining and drug stores; 1% cash back on all other purchases. | 5% cash back on travel purchased through Chase Ultimate Rewards; 3% cash back on dining and takeout; 3% back on drugstore; 1.5% cash back on all other purchases. |

Chase Freedom Unlimited® Review

Check the easy and fast application for the Chase Freedom Unlimited® Credit Card and start earning today!

Trending Topics

Great news! Based on your selection, we’ve listed the best cards for you below

Explore the top credit cards tailored to your score! Navigate your choices and pick the right card for your financial health and lifestyle!

Keep Reading

Up to $100K quickly: Wells Fargo Personal Loan Review

Renovate your home, conquer debt, or make a major purchase- Discover how easy in our Wells Fargo Personal Loan review! Enjoy flexible rates!

Keep Reading

Regions Premium Visa® Signature Credit Card full review

Check this Regions Premium Visa® Signature Credit Card review. Earn a welcome bonus of 30,000 points in the 1st 90 days!

Keep ReadingYou may also like

Pay $0 annual fee: Assent Platinum Secured Credit Card review

You just found the card that works for you! Read our Assent Platinum Secured Credit Card review and learn how! Build credit quickly!

Keep Reading

The 5 best secured credit cards options: apply with no credit check

Want to know what are the best secured credit cards with no credit check? Here are 5 excellent choices for individuals with bad credit.

Keep Reading

Universal Credit Personal Loans review: up to $50K

Get full insights into what Universal Credit Personal Loans has to offer in this full review! Flexible rates and terms! Read on!

Keep Reading