Reviews

Credit One Bank® Platinum Visa® Review: Earn cashback

The Credit One Bank® Platinum Visa® is a cash back rewards card that helps rebuild your credit score. Read our review and get started on your road to financial recovery!

Advertisement

Credit One Bank® Platinum Visa®: Build credit easily

Finding a sound credit card when you have a bad credit score can be a daunting experience. In this Credit One Bank® Platinum Visa® review, we’ll talk about one of those products.

The Credit One alternative for rebuilding credit is one of the few credit cards on the market with a cash back program.

With it, you can repair damaged credit history and still get bonus points on eligible daily spending. Keep reading to learn more about this card.

| Credit Score | Low – Fair. |

| Annual Fee | $75 in the 1st year, then $99 (the fee is billed at $8.25 monthly). |

| Regular APR | 29.24% variable. |

| Welcome bonus | N/A. |

| Rewards | 1% cash back in eligible purchases. |

How does the Credit One Bank® Platinum Visa® work?

Issued by Credit One Bank, the Credit One Bank® Platinum Visa® is a helpful tool for those with low credit scores to get back on track with their finances.

This card has a few impressive perks, like a cash-back program and an automatic review for credit line increase opportunities every other month.

You can get 1% in return for eligible gas, groceries, mobile services, internet services, and cable purchases by prioritizing this card in your daily expenses.

All earned rates are automatically added to your account in statement credits.

Visa provides an optional Credit Protection Program that prevents your credit score from dropping in case you lose your job by covering your card’s minimum payments.

You can also get primary travel perks like accident insurance and roadside assistance.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Credit One Bank® Platinum Visa® pros and cons:

Before making a decision that could impact your credit score even further, you should know all the pros and cons a product may offer.

See what they are below in our Credit One Bank® Platinum Visa® review.

Pros

- 1% cash back on eligible purchases;

- No security deposit is required;

- Credit One rewards program;

- Automatic checks for credit line increase;

- $0 fraud liability.

Cons

- Annual fee;

- Limited cash back redemption;

- A lot of different fees;

- Risky credit protection program.

Want to apply for the Credit One Bank® Platinum Visa®?

Now that you know it’s possible to get a cash-back card while improving your credit score, how about applying for a Credit One Bank® Platinum Visa®?

The pre-qualification process is quick; you can get a response in under 60 seconds! Follow the link below to get all the details on applying and rebuilding your credit rate today!

Does my credit score need to be good?

Since this card is made to rebuild credit, you won’t need a high credit score to qualify for it.

Credit One performs a quick pre-qualification analysis of your financial profile before presenting an application form.

If you meet the bank’s requirements, you should be able to get this card at ease.

Requirements

- Age and Residency: Be at least 18 and be a U.S. resident.

- Credit History: This card is designed for individuals with fair to good credit scores, typically ranging from 580 to 740. However, those with lower scores may also be considered, as the card is aimed at helping users build or rebuild their credit.

- Income Verification: Demonstrate a reliable source of income to ensure you can meet the card’s payment obligations.

- Prequalification: Credit One Bank offers a pre-qualification process that allows you to check your eligibility without affecting your credit score. This step can help determine your likelihood of approval before submitting a formal application.

Apply online

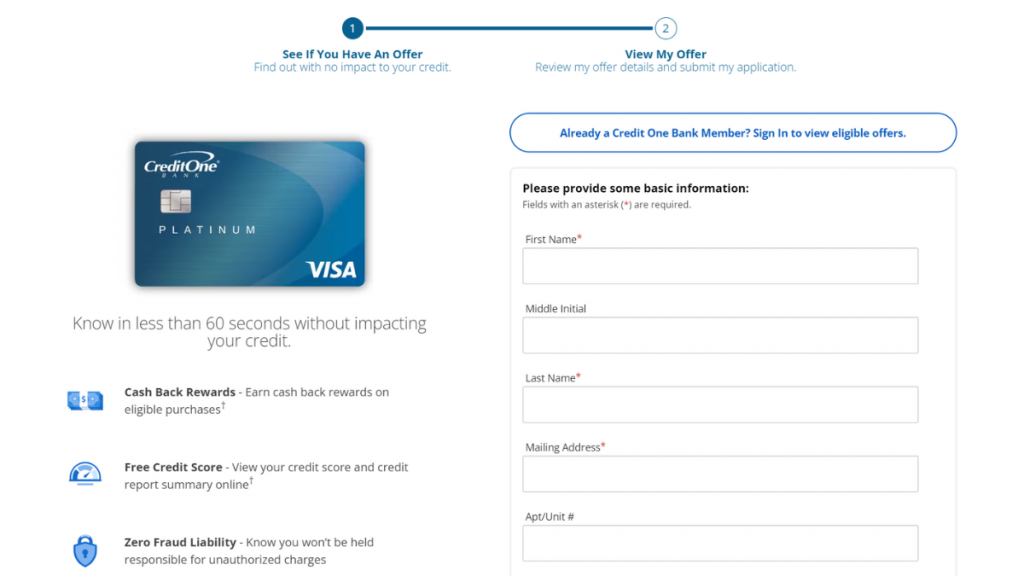

Applying for the Credit One Bank® Platinum Visa® online card is fast and easy. First, you must access Credit One’s website and locate the credit cards section on the menu.

Then, click the “see if you pre-qualify” button underneath the card’s picture. The next page will show you some of the product’s features next to an online form.

Fill in with your personal information and contact details. You must also provide your social security number and monthly income.

Then, click the “see card offers” below and wait until the Bank makes a quick financial check on your profile.

In under 60 seconds, you should get a response to whether or not the card is available to you. The pre-qualification process does not impact your credit score.

Apply using the app

Credit One provides an easy-to-use mobile app that allows all customers to manage their accounts on the go. You can pay your bills, see recent transactions, and update your preferences.

However, you cannot apply for a credit card via mobile. All new applications are made through Credit One’s official website.

Credit One Bank® Platinum Visa® Card vs. Destiny Mastercard®

If you’re unsure whether the Credit One Bank® Platinum Visa® card is the best choice, we’ve got you covered.

We brought you a similar product from the same category so you can compare their features. That way, you can make the best decision for your financial needs!

The Destiny Mastercard® brings amazing features to those who want to build credit. Check ir out.

| Credit One Bank® Platinum Visa® | Destiny Mastercard® | |

| Credit Score | Bad – Fair | Poor – Fair. |

| Annual Fee | $75 in the 1st year, then $99 (the fee is billed at $8.25 monthly). | $175 during your first year, then $49. |

| Regular APR | 29.24% variable | 35.9%. |

| Welcome bonus | N/A | None |

| Rewards | 1% cash back in eligible purchases | N/A |

If you’d like to learn more about Destiny Mastercard®’s features and how to apply, check the following link.

Destiny Mastercard® Review

If you have bad or fair credit, the Destiny Mastercard® can help you get back on your feet with a modest annual fee and a manageable initial credit limit.

Trending Topics

The current state of the stock market: is the US in a bear market?

The great world economic crisis is raising a question: is the US in a bear market? We have separated some information that will answer.

Keep Reading

What Is Career Trajectory? Learn How to Plan It!

Stuck in career limbo? Plot your epic escape with our guide to mastering your career trajectory! Find out more here!

Keep Reading

Horizon blockchain bridge targeted in massive crypto heist

$100 million-worth of cryptocurrency was stolen as part of a coordinated heist that targeted blockchain company, Horizon.

Keep ReadingYou may also like

Join the Carrabba’s Italian Grill Fam: Apply for a job!

Apply for a job at Carrabba's Italian Grill and start your career in the restaurant industry. Learn more here!

Keep Reading

Affordable loans: Apply for Republic Bank Loans

Need funding for your next big expense? Learn how to apply for Republic Bank Loans with our comprehensive guide.

Keep Reading

Luxury Titanium credit card full review

Want to travel in style and earn cash back? Check out our Luxury Titanium card review and see how its features can benefit you.

Keep Reading