Credit Cards

Destiny Mastercard® Review: Reach Better Credit!

Fast Approval, Smart Credit Building - This is your chance to reach better credit history and move forward. Ready for a fresh start? Learn how to apply here!

Advertisement

No Perfect Credit? No Problem – Get Up to $700 Credit with No Deposit!

In this Destiny Mastercard® review, we will show you how to get this unsecured credit card to help you repair your score.

The Destiny Mastercard® is designed for customers with a troubled credit history and anyone with a less-than-perfect credit score.

If you’re in the market for a product that can help you repair your financial status, keep reading to see what this card can do!

| Credit Score | Poor – Fair. |

| Annual Fee | $175 during your first year, then $49. |

| Regular APR | 35.9%. |

| Welcome bonus | N/A. |

| Rewards | None. |

How does the Destiny Mastercard® work?

The Destiny Mastercard® is an excellent choice for those with bad or fair credit who are looking for the purchasing power of a credit card.

It doesn’t require a security deposit like secured cards, and it’s accepted nationwide because of its Mastercard coverage.

The card charges a low annual fee and offers a 35.9% APR rate for purchases. There are also no monthly or service fees during your first year ($12,50 monthly thereafter).

After approval, Destiny provides its new cardholder a credit line of $700. However, the annual cost is deducted from the card as soon as it’s issued to you.

This is a credit card designed to repair your damaged credit history. Therefore, it reports to all three major credit bureaus in the country.

With sensible credit utilization, your credit score will improve in as little as a handful of months.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Enjoy the next level of security with the Destiny Mastercard®

The Destiny Mastercard® not only helps you build credit and ensures your financial safety with robust fraud protection features.

These protections give cardholders peace of mind while using their card for everyday purchases.

Zero Liability Protection

One of the standout features of the Destiny Mastercard® is Zero Liability Protection. This means you won’t be held responsible for unauthorized transactions made with your card. If your card is lost or stolen, you can report it immediately and avoid being charged for fraudulent activity.

Real-Time Alerts

The Destiny Mastercard® provides real-time alerts to help you monitor your account for suspicious activity. You’ll receive notifications via text or email for transactions that deviate from your usual spending patterns, enabling you to act quickly if something seems off.

24/7 Customer Support

In case of suspicious activity, the Destiny Mastercard® offers 24/7 customer support. You can reach out anytime to report fraud, freeze your card, or request a replacement. The support team is equipped to assist you promptly and help mitigate risks to your account.

EMV Chip Technology

The card also includes EMV chip technology, enhancing the security of in-person transactions. This chip encrypts your payment information, making it more challenging for fraudsters to clone or misuse your card details.

Secure Online Payments

The Destiny Mastercard® supports advanced security protocols for online purchases to protect your card information. Features like secure authentication and encrypted payment processes ensure your transactions remain private and safe.

Fraud protection is a critical component of any credit card, and the Destiny Mastercard® offers a solid safety net for its users.

These protections, combined with its credit-building capabilities, make it a reliable choice for those who manage their finances responsibly while staying protected from potential risks.

Destiny Mastercard® pros and cons

Before applying for a Destiny Mastercard®, you should know everything it offers and its drawbacks to make an informed decision.

So read on to learn the main features of this product and if it aligns with your spending habits and credit-building goals.

Pros

- Fast application process;

- Bad and fair credit scores are accepted;

- Nationwide acceptance;

- No security deposit is required;

- $0 Fraud liability;

- Reports to all major credit bureaus.

Cons

- High APR;

- Charges an annual fee;

- Increased rates for late and return payments.

Want to apply for a Destiny Mastercard®?

Applying for the Destiny Mastercard® is a straightforward process designed to help individuals with fair or poor credit take control of their financial future.

Whether you’re looking to rebuild your credit or establish a stronger financial foundation, this card offers an accessible way to start.

With a simple prequalification process that won’t impact your credit score, the Destiny Mastercard® makes it easy to determine your eligibility.

Once approved, you can enjoy the benefits of monthly reporting to all three major credit bureaus, helping you build a healthier credit profile over time.

Does my credit score need to be good?

You need a credit score between poor and fair to pre-qualify for the Destiny Mastercard®. However, the annual fee the company will charge you is based on your credit history.

Checking your financial health before applying is crucial if you want lower interest rates.

Once approved for the Destiny Mastercard®, you can build a stronger credit profile and enhance your financial future.

Qualification Requirements

Before applying, it’s essential to ensure you meet the Destiny Mastercard®’s basic requirements. Below are the qualifications you need to consider:

- Stable Income: Proof of consistent income is required to demonstrate your ability to manage monthly payments.

- Bankruptcy Status: Applicants who have completed bankruptcy proceedings are still eligible, but those with active bankruptcies may be disqualified.

- Basic Information: You’ll need to provide your Social Security Number, contact information, and proof of identity during the application process.

Also, to be eligible for this credit card, you must not currently hold a Destiny Mastercard® account or have had one previously closed due to delinquent payments.

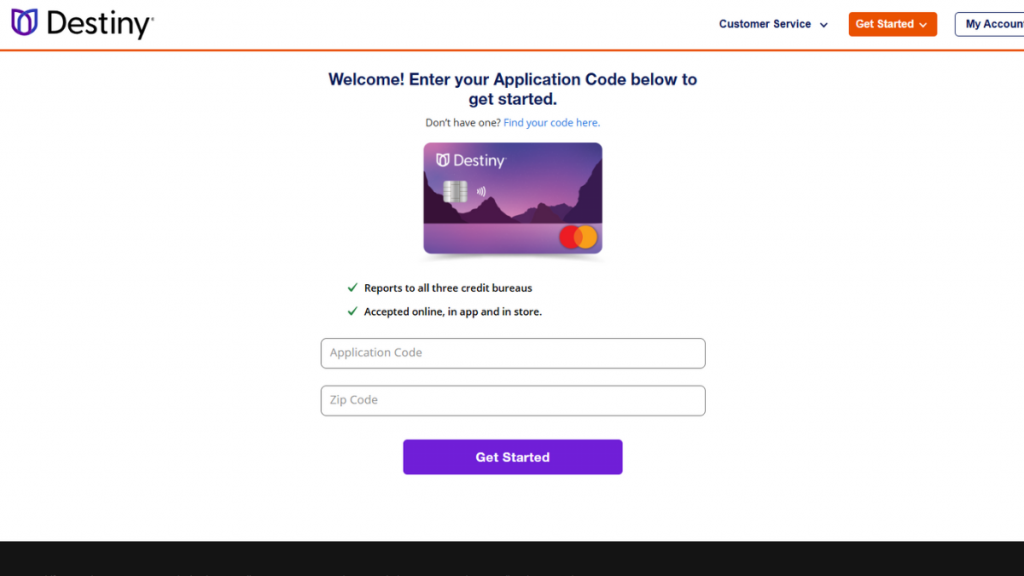

Apply Online

First, complete a pre-qualification form with your personal information and social security number.

The company will assess your financial profile by clicking the “pre-qualify” button at the bottom of the page.

Complete the prequalification form by entering your personal and financial details. This step does not affect your credit score.

Read the cardholder agreement carefully, noting fees, rates, and other terms. If prequalified, you can proceed to submit your full application.

Approval is typically quick, and your card will be mailed to you upon acceptance.

Apply using the app

Sadly, the Destiny Mastercard® doesn’t offer a mobile app for card requests or managing expenses. All new applications must go through their official website.

You can contact their toll-free customer service at 1-800-583-5698 for inquiries about the card or any other product the company provides.

Once you’re approved for the Destiny Mastercard®, the app becomes your go-to tool for managing your account. With just a few taps, you can:

- Track Your Spending: View real-time updates on your available credit and transaction history to stay within your limit.

- Make Payments: Set up one-time or recurring payments to ensure your bills are paid on time, helping you build a positive credit history.

- Monitor Credit Progress: Gain insights into how your responsible card use positively affects your credit score.

- Receive Alerts: Get instant notifications for upcoming payments, suspicious activity, or important account updates.

Destiny Mastercard® vs. FIT™ Platinum Mastercard®

Still unsure if the Destiny Mastercard® is the best option for your lifestyle? No worries!

There are a few options in the market for customers with low credit scores, and the FIT™ Platinum Mastercard® is one of them!

Learn its main features below and follow the recommended content to learn more about its application process!

| Destiny Mastercard® | FIT™ Platinum Mastercard® | |

| Credit Score | Poor – Fair. | Poor – Fair. |

| Annual Fee | $175 First Year, $49 every year after that. | $99. |

| Regular APR | 35.9%. | 29.99% variable. |

| Welcome bonus | N/A. | None. |

| Rewards | None. | N/A. |

FIT™ Platinum Mastercard® Review

Start repairing your damaged credit score with this easy-to-use everyday credit card! Learn all about the FIT™ Platinum Mastercard® today.

Trending Topics

R.I.A. Federal Credit Union Mastercard® Rewards Card review

Are you ready to get 1.5% cash back on purchases? Then keep reading our R.I.A. Federal Credit Union Mastercard® Rewards Card full review!

Keep Reading

Would a rise in corporate taxes help curb inflation?

Could a rise in corporate taxes help curb inflation? Learn more about how corporate taxes could impact prices and the economy as a whole.

Keep Reading

Capital One Venture Rewards Credit Card Review

If you love traveling the world, you will love the Capital One Venture Rewards Credit Card. Read this review to learn about its benefits.

Keep ReadingYou may also like

Is The Stealth Capitalist safe?

Are you wondering if the Stealth Capitalist is safe? So read this article to learn about it. We'll clarify everything about this website.

Keep Reading

Start today investing in Canada: an easy guide for beginners

This article will explain how you can start investing in Canada. It includes the steps needed and a few tips on making it work for you!

Keep Reading

How to Write a Winning CV in South Africa: Unlocking Opportunities

Looking for the perfect job opportunity? Use our tips to learn how to write a good CV and unlock doors of career in South Africa!

Keep Reading