Loans

ELFI Student Loan review: is it worth it?

Get the details on ELFI's student loan repayment program. See how much you could save by refinancing your student loans with ELFI.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

ELFI Student Loan review and benefits: Up to 100% coverage and flexible rates

Are you looking for an affordable, low-cost education loan that won’t break the bank? Then check our ELFI Student Loan review! This option might be worth considering for many prospective students and their families.

We will overview what makes ELFI unique, who is most likely eligible for it, and your potential. If you’re considering applying for student loans from ELFI, read on!

| APR | 2.69% (Fixed), 3.21% (Variable); |

| Loan Purpose | Undergraduate loan, Graduate loan, Parent loan, and Refinance; |

| Loan Amounts | $1,000 up to the amount approved by the schools for qualified educations expenses; |

| Credit Needed | 680 (good to excellent); |

| Origination Fee | None; |

| Late Fee | 5% of the past-due amount or $50, whichever is less; |

| Early Payoff Penalty | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

ELFI Student Loan: how does it work?

The ELFI Student Loan offers loans of up to 100% finance for students. Therefore, you can pay for your basic or advanced knowledge, such as postgraduate studies.

Also, it will have a small associated APR. Borrowers can count on 2.69% (Fixed) and 3.21% (Variable). Furthermore, payment is very flexible, and you can easily apply for refinancing.

The repayment terms of this loan can extend up to 10 years, with very affordable installments. In addition, you can count on the company’s online support to answer your questions 24 hours a day.

Is it worth it to apply for ELFI Student Loan?

The ELFI Student Loan has incredible benefits that can help every type of student. From graduation to post-graduation.

In addition, you, as a parent, can take out a loan in the child’s name to pay for school. However, you may encounter some fees associated with late payments. Check out what are the pros and cons!

Benefits

- Rates on refinancing and student loans below market;

- Repayment terms of up to 10 years;

- It is possible to finance loans in the Parent PLUS modality, in the name of the child;

- Exclusive student loan counselor assistance;

- Up to 100% financing.

Disadvantages

- Fee for late payments;

- It is not possible to associate co-signer to refinance any type of loan;

- Refinancing requires a high minimum amount of $1,000.

What credit scores are required for the application?

In this ELFI Student Loan review, you can see the main characteristics of this type of loan. However, what would be the credit score needed to apply?

According to the information on the site, you need a good or excellent score to apply. That is a score of more than 680 to be approved and have your money quickly.

ELFI Student Loan: applying for this loan today

Are you looking for an affordable way to pay for college? Then learn how to apply for ELFI Student Loan. It could be your perfect solution! We’ll show you everything you need to get started!

Read on as we break down the entire process from start to finish. That is, from researching rates and terms to ensure everything is in order when applying. Let’s get started!

Apply online

To apply for ELFI Student Loan, you can start the process online, wherever and whenever you want. All you need is a device with internet access and a browser. Then you will fill out a form with some information.

Firstly, you must provide your full name and address to start the registration. In addition, you will need to complete your date of birth, social security number, and family income.

You will also need to provide information about the location and type of study. The company asks for the name of the service school, the course cost, the expected graduation date, and the loan amount.

After filling in this data, you will be redirected to complete the application. Thus, the company may request payment receipts and photos of official documents. Approval should come out in less than a week.

Requirements

To apply for ELFI Student Loan, you must fulfill some important requirements. First, you must be a US citizen with a valid social security number.

In addition, it is essential to be over 18 years old or responsible for performing the procedure.

Moreover, the company requests proof of the study for which funding is required. In this sense, you can apply for a loan from courses in school years to graduation and post-graduation.

Apply on the app

You can only apply for ELFI Student Loan through their official website or phone. Therefore, you can call the company if you do not want to follow the previous procedure and provide all the necessary data.

ELFI Student Loan vs. Sallie Mae Student Loan: which one is the best for you?

ELFI Student Loan has unmissable conditions for those who need to finance their studies and provides high value. Also, the payment is flexible so that the budget does not become an issue for you.

However, you can also count on other interesting options. One of these is the Sallie Mae Student Loan. With it, you can have a specific APR according to your request. Check the comparison and choose your option.

| ELFI Student Loan | Sallie Mae Student Loan | |

| APR | 2.69% (Fixed), 3.21% (Variable); | Career Training Student Loans: 5.37% to 15.89% variable APR 4.50% to 15.10% fixed APR; For undergraduate students: 5.37% to 15.70% variable APR 4.50% to 14.83% fixed APR; Rates for graduate student loans vary depending on the loan; |

| Loan Purpose | Undergraduate loan, Graduate loan, Parent loan, and Refinance; | Funding for undergraduate, graduate, or technical career courses; |

| Loan Amounts | $1,000 up to the amount approved by the schools for qualified educations expenses; | $1,000 minimum and up to 100% of the school-certified cost of attendance; |

| Credit Needed | 680 (good to excellent); | Does not disclose; |

| Origination Fee | None; | None; |

| Late Fee | 5% of the past-due amount or $50, whichever is less, after a payment is 11 days late; | N/A; |

| Early Payoff Penalty | None. | N/A. |

Sallie Mae Student Loan can cover any type of study, up to 100% of the amount. However, you must meet certain requirements to apply. Find out what procedure to request with the post below!

How to apply for Sallie Mae student loan?

Completing your studies is not an easy task, is it? But with the Sallie Mae student loan you can have peace of mind. Learn about the Sallie Mae student loan application!

Trending Topics

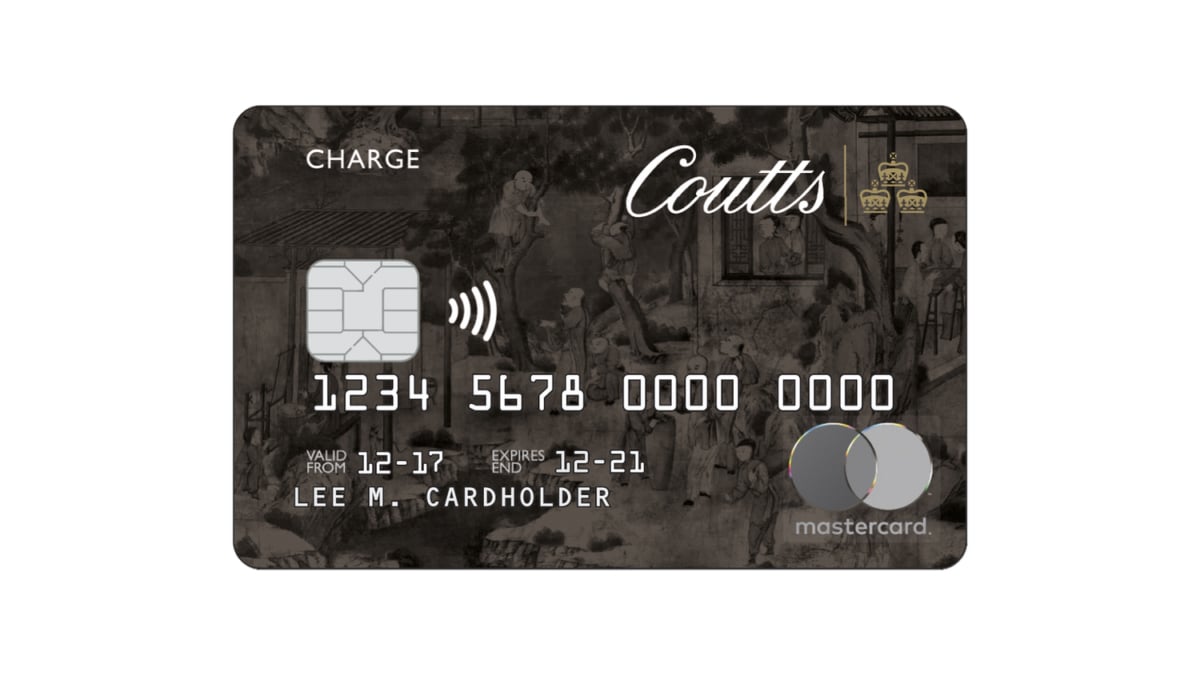

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading

Savings vs. Checking Accounts: A Comprehensive Comparison

Savings vs. checking accounts: Discover their contrasts and similarities to identify the right one. Learn more!

Keep Reading

Credit limit of up to $35K: Pelican Prime Visa Review

Are you ready to simplify your credit card experience? Then read our Pelican Prime Visa review. Access your FICO Score for free!

Keep ReadingYou may also like

Merrick Bank Personal Loan review: is it worth it?

In this Merrick Bank Personal Loan review you will learn if borrowing from this bank is a good deal, and whether it is for you.

Keep Reading

How to get a loan with bad credit: 5 easy tips

Are you trying to get a loan with bad credit? It is not easy but will get easier if you follow the tips we give you in this article.

Keep Reading

Make Money Online: 10 Proven Strategies to Boost Your Earnings

Do you want to make money working online? We reveal 10 secret ways to make money online, from side hustles to full-time ventures. Read on!

Keep Reading