Finances

Applying for The Credit Pros: get debt relief!

This post will give you the step-by-step to join The Credit Pros and fix your credit history once and for all.

Advertisement

The Credit Pros: One of America’s top fintech companies will help you repair your credit

If you’re feeling overwhelmed by your credit card debt it may be time to look into professional credit repair services and apply for The Credit Pros.

Looking for professional help is the first step on the road to financial freedom! This company can help you work through your debt and develop a plan to get back on track. Keep reading this content and we’ll show you how to get into their program.

Apply online

Get your finances back on track with The Credit Pros. You can apply online through the website, and we’ll tell you how.

On their website, you’ll see right on the first page the “get started” button. You can navigate through the website first to understand how they work and check their services.

Once you’re ready to start, you’ll be redirected to the application form. You’ll apply for a free consultation. The Credit Pros experts will contact you and analyze your specific debt situation and if it’s worth it for you to join the credit repair program.

You’ll get to schedule a call for this free consultation. Them, create your login with your full name, phone, and email. You can add any questions or tell them about your situation. Confirm your application, and wait for the call.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

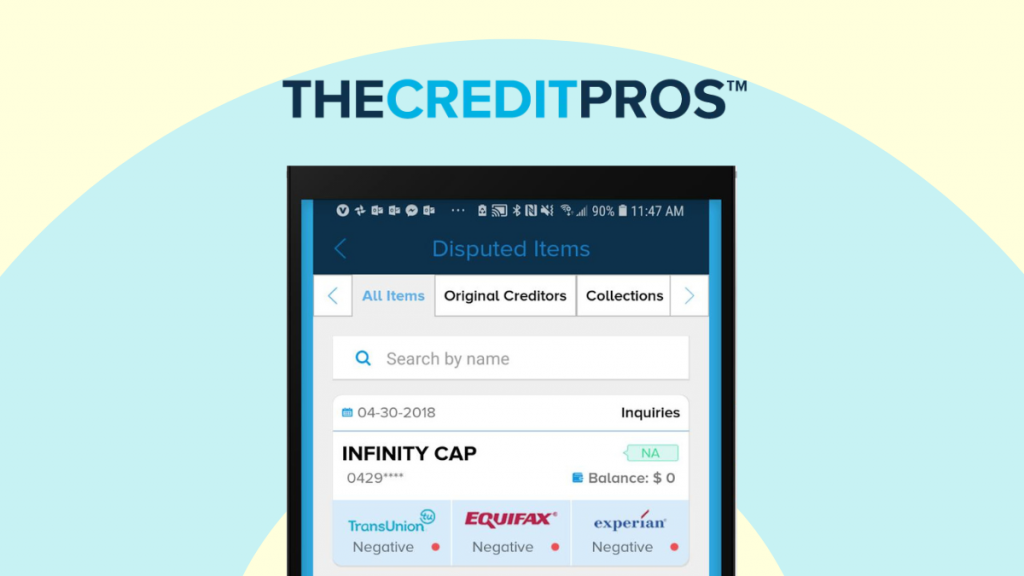

Apply using the app

You’ll get access to The Credit Pros mobile app once you get your free consultation and start your credit repair program.

Another recommendation: Curadebt

If you think that The Credit Pros is not the best choice for you, you can check another option. Curadebt provides the same service and will also help you repair your credit by checking your credit report and contacting your creditors.

You’ll find everything about Curadebt on the link below.

Curadebt review: pay off your debts

Many people struggle with debt. But if you need help to get out of this situation, Curadebt has a solution for you. Read this post to understand how they'll do it.

Trending Topics

Instant approval: apply for the Assent Platinum Secured Card!

Looking for a card with a hassle-free process? Read on a learn how to apply for the Assent Platinum Secured Credit Card! $0 annual fee!

Keep Reading

Apple Financing: minimum credit score and how to get it!

Do you think you have the credit score for Apple financing? It can help you to get the best products for your business. Learn how it works.

Keep Reading

Applying for the Regions Cash Rewards Visa® Credit Card: learn how!

Learn how to apply for the Regions Cash Rewards Visa® Credit Card. 1.5% cash back on purchases and no annual fee!

Keep ReadingYou may also like

7 best credit cards for no credit: find the right fit for you

Starting financial life can be difficult. Read on to see the best credit cards for no credit that can help you on your way!

Keep Reading

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now - get the money you need quickly and use it for several purposes! Keep reading and learn more!

Keep Reading

Bank of America® Unlimited Cash Rewards credit card full review

The Bank of Bank of America® Unlimited Cash Rewards credit card offers up to 2.62% cash back on, unlimited redemptions and zero fees

Keep Reading