Credit Cards

Freedom Gold Credit Card Review: $750 credit limit

If you are running into trouble trying to get approved for a new credit card, read our Freedom Gold card review and see why this one might just quickly solve that problem for you.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

A simple way to get a card with no credit, employment or income checks

The Freedom Gold can be an interesting option if you have difficulty getting approved for a new credit card.

This card will accept applicants with bad or no credit at all, without running employment or credit checks.

All you need to do is complete their online application, and you are ready. The card offers an initial $750 in unsecured credit, which can be used in Horizon Outlet online purchases.

Spending this credit responsibly will help you build a solid credit history and become eligible for better credit card offers. This card charges no interest on purchases, with a nice 0% APR.

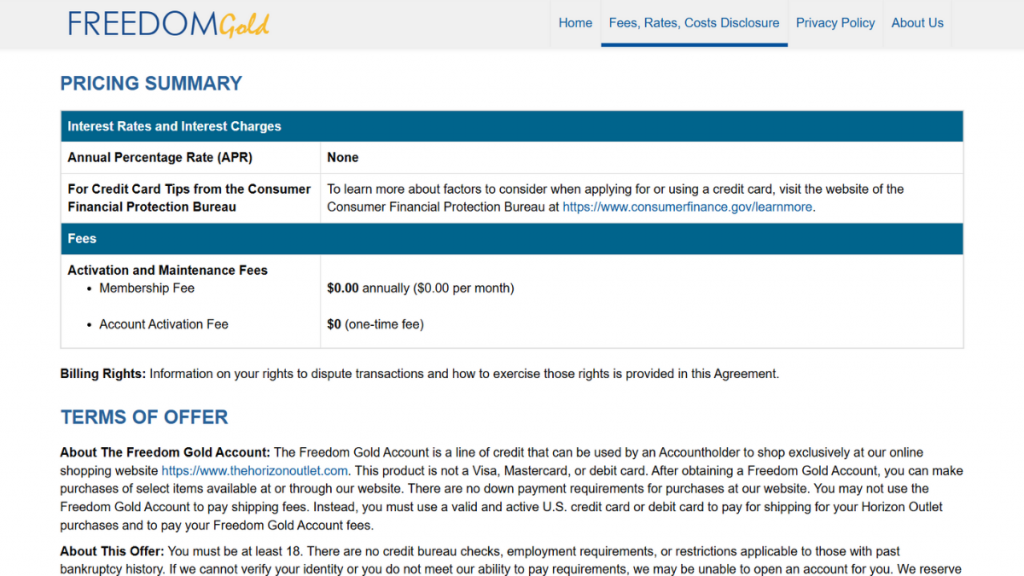

Have a look at a few valuable numbers about this card.

| Sign-up bonus | N/A |

| Annual fee | $0 |

| Rewards | N/A |

| APR | 0% |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Freedom Gold credit card work?

The Freedom Gold Credit Card stands out for its simplicity and exclusive access to shopping privileges. Here are some of the most notable features:

- Zero Interest Rate: Enjoy no interest on purchases made using the card. This makes it an excellent choice for managing spending without accumulating debt.

- No Credit Check Required: Unlike traditional credit cards, you can qualify for the Freedom Gold Credit Card without undergoing a hard credit check.

- Exclusive Shopping Benefits: The card grants access to the Horizon Outlet, an online shopping platform offering various products.

- Credit Line of $750: You’ll start with a credit line of $750, perfect for building credit and managing expenses.

Indeed, this can be an interesting offer to those who want to make the most of their money; however, it’s important to remember that this card can only be used at the Horizon Outlet.

Freedom Gold credit card pros and cons

If you’re considering the Freedom Gold Credit Card, it’s important to weigh its benefits and drawbacks.

While it’s a great option for those wanting exclusive shopping perks, it may not suit everyone’s financial goals.

Pros

- Accepts applicants with all credit scores

- Easy application process

- Instant approval

- No activation and maintenance fees

- Instant $750 merchandise credit line

- Exclusive shopping access

Cons

- No signup bonus

- Does not report to credit bureaus

- Can only be used at the Horizon Outlet

Want to apply for the Freedom Gold card?

The application process for this card is quite simple. Everything is done online, with zero red tape, and the approval is instant.

If you would like a complete guide on applying for this card, just keep reading and learn everything you need.

Does my credit score need to be good?

The Freedom Gold is ideal for individuals facing difficulties getting a new credit card due to poor or non-existent credit history.

The card issuer does not run credit checks on applicants, and almost all applications get accepted.

Qualification Requirements

To qualify for the Freedom Gold Credit Card, you’ll need to meet the following basic requirements:

- U.S. Residency: Applicants must be residents of the United States.

- Steady Source of Income: Proof of a reliable income is required to ensure you can handle monthly fees and payments.

- Minimum Age: You must be at least 18 years old to apply.

- Bank Account: A valid checking account is required to set up payments and manage your account.

Apply Online

Go to Freedom Gold’s website. On their homepage, you will find an empty slot where you must enter your email address.

Once you have done that, check the boxes to confirm you have read and understood the terms and conditions. Then, click on the “Continue Activation Process” button.

The website will direct you to a page where you will create your profile. Enter your first and last names, date of birth, home address, financial information, and phone number.

Note that a few fields may already have been pre-filled with the information you provided earlier. Also, the checkboxes offer products and services you do not have to hire if you don’t want to.

After filling out the empty spaces, click on “Submit My Profile.” Now, on yet another page, you must enter your credit card information and check the boxes to confirm you are following the terms established by the company.

Then, hit the “Activate My Card Now” button, and you are all set!

Freedom Gold vs Luxury Gold Card

If you are looking for a more rewards-oriented credit card, the Luxury Gold Card might be an option worth considering.

This expensive card charges a hefty fee of nearly a grand per year. If you want to make this baby worthwhile, you must maintain a certain spending level.

This will help you make the most out of your points, which can be redeemed for airfare or cash back.

Other perks include a monthly $5 Lyft credit, a monthly $5 off Doordash purchases (3 months of DashPass for free), and a 24/7 luxury card concierge.

Not to mention the card’s luxurious gold-plated appearance, with a 24-karat front and a carbon back.

Take a look at the comparative table to put things into perspective.

| Freedom Gold Card | Luxury Gold Card | |

| Credit Score | Bad | Good – Excellent |

| Annual Fee | $0 | $995 |

| Regular APR | 0% | 21.24% to 29.24% (variable) |

| Welcome bonus | N/A | 0% intro APR for 15 billing cycles |

| Rewards | N/A | 2% redemption value on airfare, cash back or statement credits |

Applying for the Luxury Gold card

A step-by-step guide for you to get your Luxury Gold in a few simple steps.

Trending Topics

Apple Financing: minimum credit score and how to get it!

Do you think you have the credit score for Apple financing? It can help you to get the best products for your business. Learn how it works.

Keep Reading

Medical loans: see how to finance your medical treatments

Medical loans are a great way to pay for medical treatments. See information on how they work and the pros and cons of taking them out!

Keep Reading

700 credit score: is it good enough?

Wondering if a 700 credit score is good enough to get you the best interest rates and terms on loans? Find out now.

Keep ReadingYou may also like

Truist Enjoy Cash Secured Card Review: $0 annual fee

Read our Truist Enjoy Cash Secured Credit Card review to learn how this card can help you. Earn up to 3% cash back on purchases!

Keep Reading

What are the retirement accounts alternative to a 401(k) plan?

If you're looking for retirement accounts that will give you the most financial freedom, skip the 401(k). Here are two better options.

Keep Reading

A guide on building and establishing business credit: 6 steps!

Building your business credit profile can be daunting, but it's crucial if you want to grow. Here are some steps on how to get started!

Keep Reading