Credit Cards

Applying for the Luxury Gold Credit Card: learn how!

Do you have your eye on a luxurious new lifestyle? The Luxury Card Mastercard Gold can help make your dreams a reality. Keep reading to learn more about the application process and what the Luxury Card Mastercard Gold has to offer.

Advertisement

Luxury Gold Credit Card application: add a touch of gold to your everyday life.

If you’re looking for a credit card that offers high-end services to accommodate your expensive lifestyle, the Luxury Gold card might be the perfect choice for you. Issued on a metal card with a 24K-gold plated front, this card will get you a world-class service everywhere you go.

With this card, you’ll get access to exclusive airport lounges, special discounts at luxury hotels and resorts, and much more. Plus, the 24/7 concierge service means you’ll always have someone there to help with whatever you need.

So if you want to feel like a VIP every time you use your credit card, read on to learn more about the Luxury Gold card application process.

Apply online

You can apply for this card through its official website in just a few minutes. First, you need to access the Luxury Cards online platform and click on the “apply now” button under the Mastercard Gold option.

Then, you’ll need to fill in a very detailed form with your personal information as well as your financial status. Luxury Cards also require you to provide your contact info and security information.

Once you’re through with the form, read the terms and conditions and make sure you agree with all that’s being asked before clicking the “apply” button. If your request is approved, the company should contact you with all the details about your new credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Exclusive to cardmembers, the Luxury Card mobile app provides everything you need to manage your account. You can check on your member benefits, such as travel services and earned rewards. However, you cannot request any of their credit cards on it. To do so, you’ll need to send an application through Luxury Card’s official site.

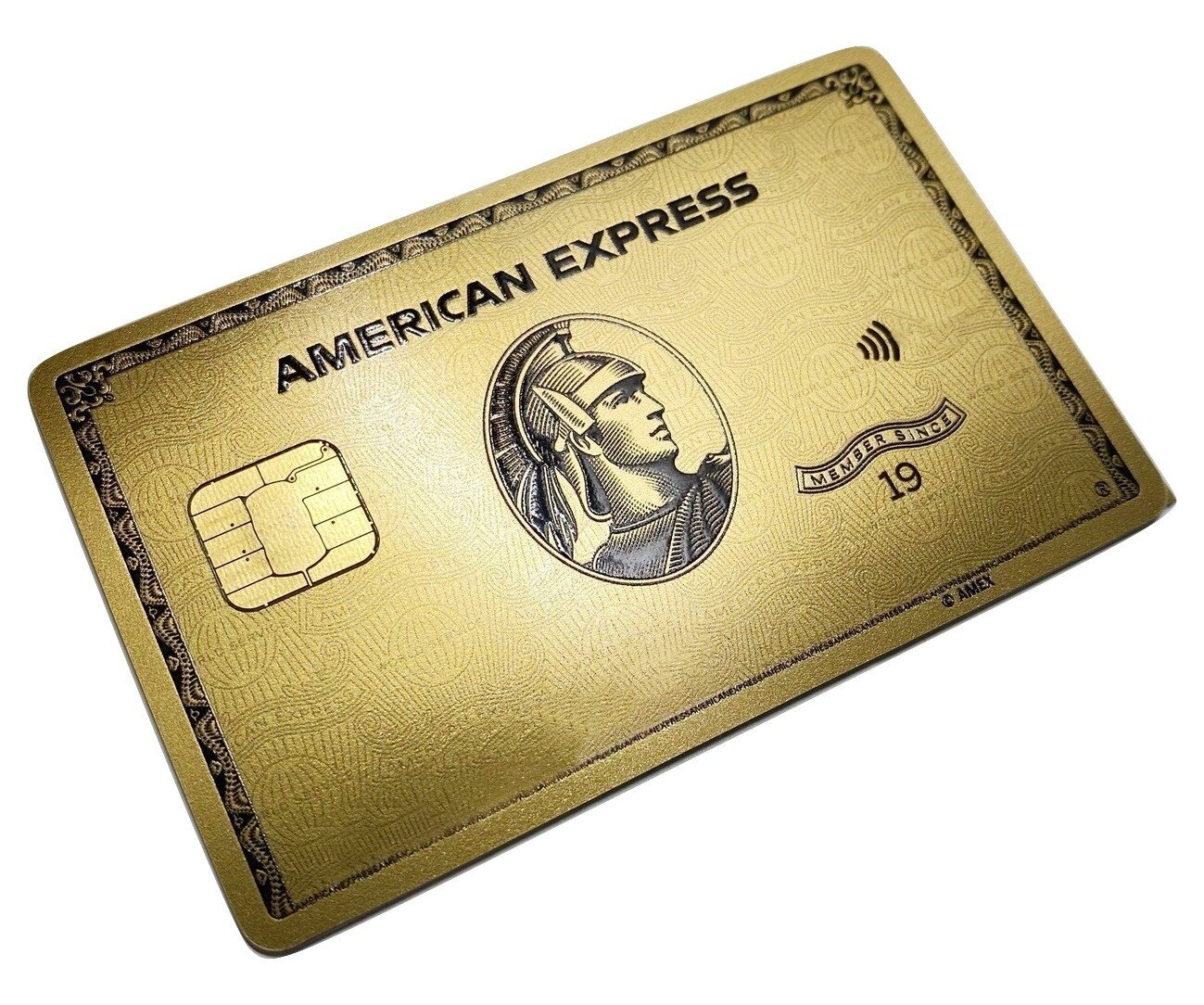

Luxury Gold credit card vs. American Express Gold credit card

If you’d like to get the Luxury Gold card, but the steep annual fee is too much for your taste, we have another option. With the American Express Gold credit card, you’ll get to experience the high life without having to pay $995 a year for it.

Some of its perks include a generous 60.000 points sign-up bonus and cash back on travel and dining expenses. See below for more of this product’s primary features and follow the recommended link to learn about its application process!

| Luxury Gold credit card | American Express Gold credit card | |

| Credit Score | Excellent | Good or Excellent |

| Annual Fee | $995 | $250 |

| Regular APR | 14.99% variable | 15.99% to 2.99% (variable) |

| Welcome bonus | N/A | 60,000 to 75,000 points after spending $4,000 in the first six months |

| Rewards | 2% airfare redemptions; 2% value for cash back redemptions; Annual airline credit; 24/7 concierge services | Membership Rewards program; No foreign transaction fees; Generous welcome bonus; Personalized travel services at your disposal |

Applying for the American Express Gold card

See how to apply for this card and enjoy its many dining and travel perks today!

Trending Topics

Milestone® Mastercard® – Mobile Access to Your Account full review

How can the Milestone® Mastercard® – Mobile Access to Your Account review help you build credit? Read on to find out!

Keep Reading

Sable account review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep Reading

ZippyLoan: how to apply now!

Ready to apply for ZippyLoan? Then we've got you! This loan marketplace offers a simple application and up to $15k for several purposes.

Keep ReadingYou may also like

Buy on Trust account review: read before applying

Looking for a lease-to-own program that offers the latest electronics from top brands? Check our Buy on Trust Account review!

Keep Reading

Applying for the SavorOne Rewards for Good Credit card: learn how!

Learn how to apply for a SavorOne Rewards for Good Credit card and get 3% cash back on all of your favorite everyday categories!

Keep Reading

Qtrade Investing brokerage platform full review

Qtrade Investing is a brokerage platform which offers you both a mobile and a web-based application, and the best customer service.

Keep Reading