Reviews

Indigo® Mastercard® with Fast Pre-qualification credit card full review

If you’re looking for a way to rebuild credit, we can help! In this Indigo® Mastercard® with Fast Pre-qualification card review, you learn how to boost your credit score within months.

Advertisement

Indigo® Mastercard® with Fast Pre-qualification credit card: improve your financial future in 60 seconds.

Are you looking for an unsecured card to improve your credit ratings? You’ve found it! In this Indigo® Mastercard® with Fast Pre-qualification card review, we’ll take a look at all the main features this product has to offer to help you build a better financial future.

While most credit card issuers require a security deposit for customers with bad or fair credit scores, Indigo lets you keep your money. Its pre-qualification process is super quick and will give you a response in under 60 seconds. Plus, it won’t affect your credit score!

With a 24.90% APR, this product stands among all other credit cards in its category. The Indigo card reports to all three major credit bureaus in the country. Therefore, with good use of the card, you’ll be able to repair your damaged credit in just a few months.

The Indigo® Mastercard® with Fast Pre-qualification credit card was created to assist customers with a challenging credit history. It will give you a chance to rebuild your score while living the life you’ve always dreamed of.

So, read on for our review of this card and learn everything it can do for you.

| Credit Score | Bad – Fair |

| Annual Fee | $75 First Year, $99 every year after that |

| Regular APR | 24.90% |

| Welcome bonus | N/A |

| Rewards | None |

How do you get the Indigo® Mastercard®

Learn how to apply for an Indigo® Mastercard® with Fast Pre-qualification card and start working on a better financial future today!

How does the Indigo® Mastercard® with Fast Pre-qualification card work?

The Indigo® Mastercard® with Fast Pre-qualification card is an excellent option for people with bad credit looking to improve their credit score. This card reports to all three major credit bureaus, so using it responsibly can help you boost your ratings in no time.

The card charges a modest annual fee of $75 during its first year and $99 every year after that, which is on par with most subprime unsecured credit cards on the market. Its APR of 24.90% on purchases is also nothing new in this line of credit.

The Indigo provides nationwide Mastercard coverage for online or in-person shopping and requires no security deposit for new cardholders. Issued by Celtic Bank, it gives a $0 liability for unauthorized charges.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Indigo® Mastercard® with Fast Pre-qualification card pros and cons:

Before applying for the Indigo® Mastercard® with Fast Pre-qualification card, take a look at its main perks and drawbacks so you can make an informed decision.

Pros

- Available for people with bad or fair credit scores

- Reports to all major credit bureaus

- Provides $0 liability for unauthorized charges

- Has a nationwide acceptance

- Fast pre-qualification

Cons

- Charges an annual fee

- High APR

- Increased rates for late and return payments

- No welcome bonus, and no perks

Does my credit score need to be good?

You need a credit score between bad and fair to apply for this card. However, Indigo welcomes customers with no credit history to pre-qualify as well. That said, the annual fee charged by the company depends on your creditworthiness.

Want to apply for the Indigo® Mastercard® with Fast Pre-qualification card?

Rebuilding a damaged credit takes time, but the Indigo® Mastercard® with Fast Pre-qualification card can be a helpful tool to help you get there. This card offers fast pre-qualification, so you can find out if you’re likely to be approved before applying.

If you’re interested in the process, follow the link below to learn more about it.

How do you get the Indigo® Mastercard®

Learn how to apply for an Indigo® Mastercard® with Fast Pre-qualification card and start working on a better financial future today!

Trending Topics

Capital One Venture Rewards Credit Card Review

If you love traveling the world, you will love the Capital One Venture Rewards Credit Card. Read this review to learn about its benefits.

Keep Reading

Apply for Sky Blue: quick online and in-app help

Recovering your credit can be an outsourced service, but hiring is necessary. Learn how to apply Sky Blue and earn back a good credit score.

Keep Reading

Applying for the Chase Ink Business Cash® Credit Card: learn how!

Wondering how to apply for the Chase Ink Business Cash card? Wonder no more! Enjoy cash back, 0% intro APR, and more. Read on!

Keep ReadingYou may also like

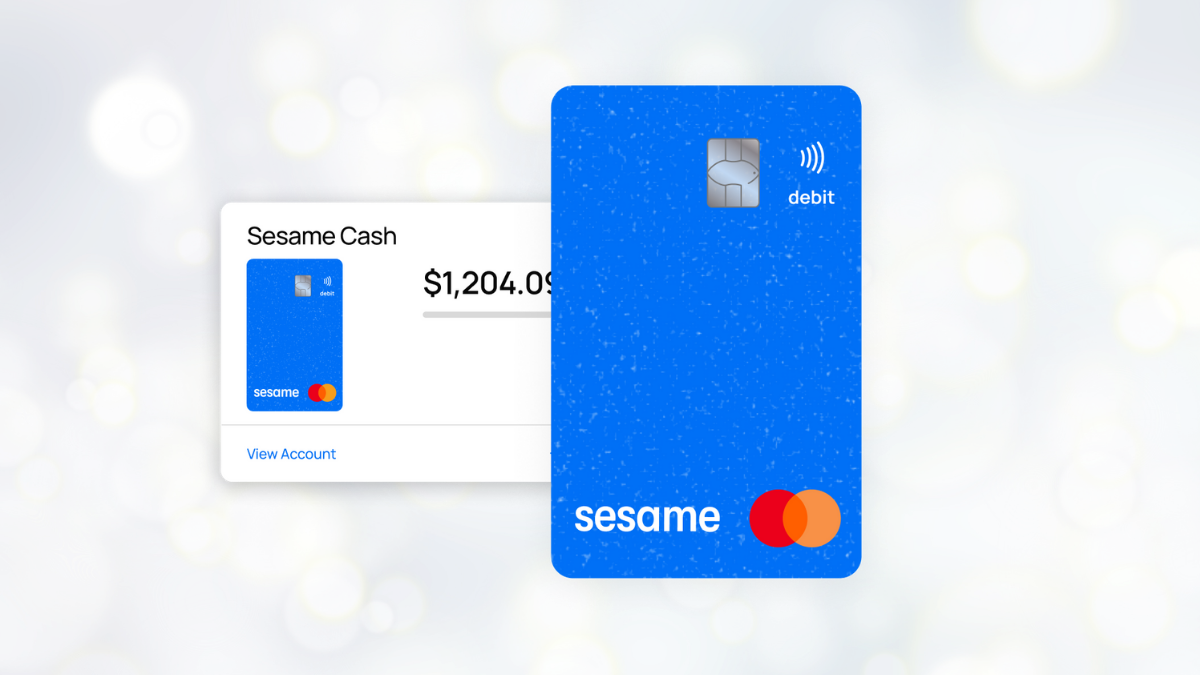

Elevate your finances: Apply for the Sesame Cash Debit Card today

Upgrade your online banking experience! Apply today for the Sesame Cash Debit Card and earn cash back on select brands! Read on!

Keep Reading

Happy Money Personal Loan review: is it worth it?

Read our comprehensive Happy Money Personal Loan review and learn everything about this lender. Borrow up to $40K fast! Read on!

Keep Reading

Neo Financial credit card full review

Neo Financial credit card is changing the way online banking works. It has no annual fee and valuable rewards. Read on to learn about it.

Keep Reading