Credit Cards

Luxury Gold Card Review: Earn Rewards

Do you like to travel in style? If so, the Luxury Card Mastercard Gold might be the perfect credit card for you. This card offers many perks and features that will make your next trip a truly VIP experience. Check our review to learn more!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Luxury Gold credit card: Get exclusive access to the benefits you deserve!

The Luxury Gold card definitely lives up to its name. Every card is made with a 24K-gold-plated stainless steel front and weighs an impressive 22 grams. Are you’re on the market for a product that offers high-end travel benefits and cash back rewards? If so, read on for a comprehensive Luxury Gold card review and see what this product can do to your lifestyle.

The card comes with a host of extravagant benefits, including airport lounge access, a 24/7 concierge service, and elite hotel perks. But is the high annual fee worth it? Below, we’ll break down all of its main features to help you decide. Let’s get started!

| Credit Score | Excellent |

| Annual Fee | $1,199 annual fee ($349 for each Authorized User) |

| Regular APR | 19.74% to 27.74% |

| Welcome bonus | N/A |

| Rewards | 2% airfare redemptions; 2% value for cash back redemptions; 2x earn on Airgare and Hotel Up to $200 Annual Dining Credit Up to $300 annual Airline Credit Up to $200 Ship&Play Credit |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does Luxury Gold work?

The Luxury Gold card is indeed all about splendor! Not only does it provide a unique design with a 24k-gold plated front, but it is also made in metal. It offers exciting travel benefits for anyone who loves the royal treatment, and the 2% value cash back makes it a solid choice for everyday use.

This card has a 0% intro APR for the first 15 billing cycles on balance transfers made within the first 45 days of account opening. Luxury Gold customers get a $200 annual credit toward selected purchases and a $100 Global Entry Application fee credit.

The downside? There is a whopping $995 annual fee, with an extra $295 for each authorized user added to the account. And if you’re expecting a big sign-up bonus to make it up for such a high rate, there isn’t one.

Luxury Gold Credit Card pros and cons

Before applying to any product that can impact your credit history, consider how it can affect your credit history. It’s also crucial that the product in question offers more advantages than drawbacks. That said, let’s take a look at the pros and cons of the Luxury Gold card.

Pros

- 2% cash back and travel redemptions

- $200 annual airline credit

- 0% APR for the first 15 billing cycles

- No foreign transaction fees

- An array of travel-related benefits

Cons

- A hefty $995 annual fee

- No welcome bonus

- Requires an excellent credit score

Does my credit score need to be good?

In short: yes. This is a premium card designed for people who lead a luxurious lifestyle. Like most products with high-end travel-related perks as their main benefit, it requires an excellent credit score to apply. Therefore, your FICO score should range between 800 and 850.

Want to apply for Luxury Gold Credit Card?

If you’re looking for a credit card that offers high-end services to accommodate your expensive lifestyle, the Luxury Gold card might be the perfect choice for you. Issued on a metal card with a 24K-gold plated front, this card will get you a world-class service everywhere you go.

With this card, you’ll get access to exclusive airport lounges, special discounts at luxury hotels and resorts, and much more. Plus, the 24/7 concierge service means you’ll always have someone there to help with whatever you need.

So if you want to feel like a VIP every time you use your credit card, read on to learn more about the Luxury Gold card application process.

Apply online

You can apply for this card through its official website in just a few minutes. First, you need to access the Luxury Cards online platform and click on the “apply now” button under the Mastercard Gold option.

Then, you’ll need to fill in a very detailed form with your personal information as well as your financial status. Luxury Cards also require you to provide your contact info and security information.

Once you’re through with the form, read the terms and conditions and make sure you agree with all that’s being asked before clicking the “apply” button. If your request is approved, the company should contact you with all the details about your new credit card.

Apply using the app

Exclusive to cardmembers, the Luxury Card mobile app provides everything you need to manage your account. You can check on your member benefits, such as travel services and earned rewards. However, you cannot request any of their credit cards on it. To do so, you’ll need to send an application through Luxury Card’s official site.

Luxury Gold credit card vs. American Express Gold credit card

If you’d like to get the Luxury Gold card, but the steep annual fee is too much for your taste, we have another option. With the American Express Gold credit card, you’ll get to experience the high life without having to pay $995 a year for it.

Some of its perks include a generous 60.000 points sign-up bonus and cash back on travel and dining expenses. See below for more of this product’s primary features and follow the recommended link to learn about its application process!

| Luxury Gold credit card | American Express Gold credit card | |

| Credit Score | Excellent | Good or Excellent |

| Annual Fee | $1,199 annual fee ($349 for each Authorized User) | $250 |

| Regular APR | 19.74% to 27.74% | 15.99% to 2.99% (variable) |

| Welcome bonus | N/A | 60,000 to 75,000 points after spending $4,000 in the first six months |

| Rewards | 2% airfare redemptions; 2% value for cash back redemptions; 2x earn on Airgare and Hotel Up to $200 Annual Dining Credit Up to $300 annual Airline Credit Up to $200 Ship&Play Credit | Membership Rewards program; No foreign transaction fees; Generous welcome bonus; Personalized travel services at your disposal |

Applying for the American Express Gold card

See how to apply for this card and enjoy its many dining and travel perks today!

Trending Topics

Curious about the crypto millionaires? Find out who they are!

Want to see who crypto millionaires that are famous in the world are? Then check out the list we prepared in this post!

Keep Reading

Milestone® Mastercard® Review: Easy Pre-Qualification

Looking for a credit card to help rebuild your credit? Read our Milestone® Mastercard® review to learn how to get back on track.

Keep Reading

How to get out of debt: 10 tips to get your finances back on track

Debt can bring a lot of headaches. But, after all, how to get out of debt? Find out everything in this guide that we've created for you.

Keep ReadingYou may also like

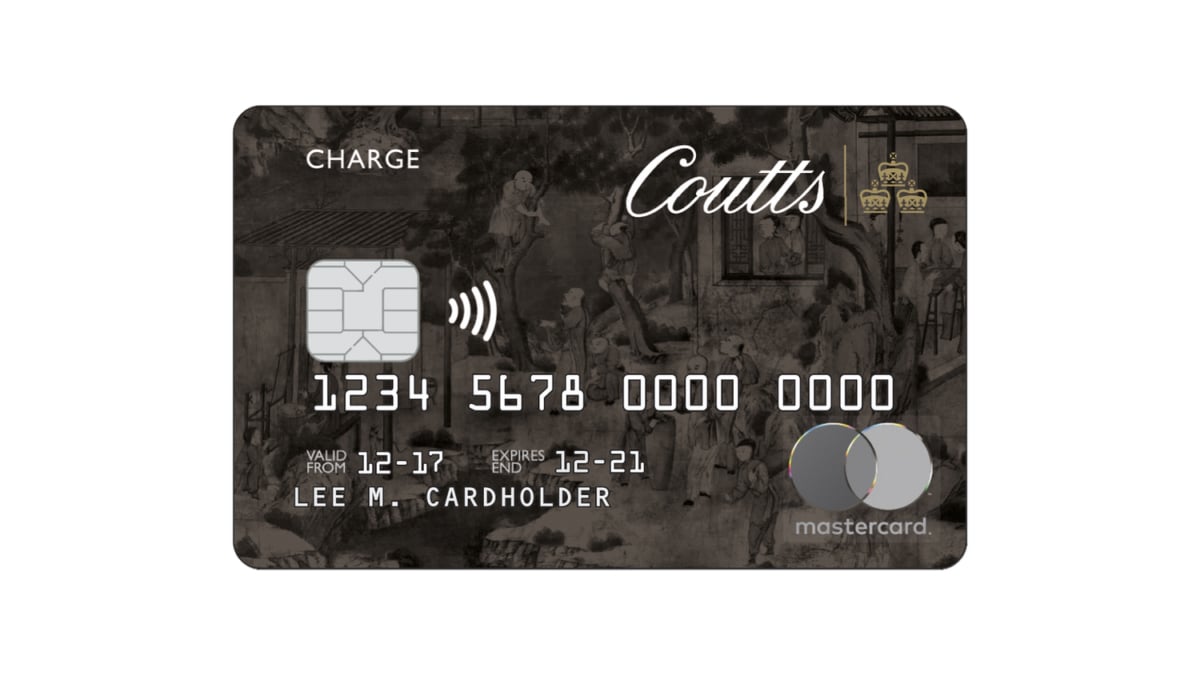

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading

Choose the perfect loan for your finances: compare the options!

Need a new car, home repairs, money for a wedding, or just some extra cash? Compare options and choose a loan for you.

Keep Reading

Chase Freedom Flex℠ or Chase Freedom Unlimited® card: find the best choice!

Want to know if the Chase Freedom Flex℠ or Chase Freedom Unlimited® is right for you? Learn more about both cards to help you decide.

Keep Reading