Loans

Up to 25K: OnPoint Community Credit Union Personal Loan review

Take control of your finances with OnPoint Community Credit Union Personal Loan! Fast and simple process! Keep reading and get your money!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Unlock your financial dreams: quick funding and process!

If you need extra cash for unexpected expenses, you’re in the right place! Our Community Credit Union Personal Loans review will bring you all you need to know!

This credit union provides a package of useful financial services to help you achieve your goals. So keep reading and find out this is the best option for you! Let’s go!

| APR | 11.00% – 16.00% fixed APR; |

| Loan Purpose | Large purchases, unexpected expenses, debt consolidation, home repair, and more. You can basically use you as you need; |

| Loan Amounts | $100 up to $25,000; |

| Credit Needed | Fair – Good; |

| Terms | Up to 60 months; |

| Origination Fee | Not disclosed; |

| Late Fee | $35 (when offered); |

| Early Payoff Penalty | Not disclosed. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

OnPoint Community Credit Union Personal Loan overview

Taking a loan doesn’t have to be difficult, especially when you can count on a credit union for it! And that is why you may want to consider OnPoint Community Credit Union.

They provide great financial solutions to those looking for a hassle-free and quick process! Thus, you can count on a fixed rate, which helps you keep track of your money.

In addition, you can borrow from $100 up to $25,000 to use as you need! As a result, you can make large purchases, pay debts, cover expenses, and much more.

Once you get the loan amount, you can repay it in up to 60 months. Also, they provide several resources to those interested in their personal loans.

Once on their official website, you can count on several calculators to help you estimate your loan conditions and more! Therefore, you’ll enjoy a convenient experience!

Is it worth it to apply for OnPoint Community Credit Union Personal Loan?

As you can note in our review, OnPoint Community Credit Union Personal Loan might be the perfect lender when it comes to providing the money you need quickly!

In addition to their simple process, borrowers can enjoy excellent customer service, ready to help them when needed!

Are you still wondering if the OnPoint Community Credit Union Personal Loan is the right choice for your financial needs? Don’t worry!

To help you in your decision, we’ve gathered the pros and cons of this financial product! So check it out below!

Benefits

- Quick and simple process;

- Enjoy a fixed interest rate;

- It allows you to borrow as low as $100;

- You can spend the loan amount as you need;

- Grant flexible loan options.

Disadvantages

- Lower maximum loan amounts compared to other lenders;

- This lender lacks information about fees on their website.

What credit score is required for the application?

Indeed, OnPoint Community Credit Union Personal Loan might be the solution you need for your financial problems! You can borrow up to $25,000 in no time!

And know that you can qualify for this lender with fair credit! Still, having a higher credit score will help you get higher amounts and better conditions.

How does the application process work?

Applying for a new loan doesn’t have to be difficult; we’re here to show you that! So get ready to apply for the OnPoint Community Credit Union Personal Loans!

This lender provides a hassle-free process allowing you to borrow up to $25,000 over flexible conditions quickly! Are you ready to get some extra cash? Then let’s go!

Apply online

Applying for OnPoint Community Credit Union Personal Loans only takes a few minutes! First, you need to access their official website – you can find the link above.

Once there, take your time to check their page. When ready, select the “Apply Online” blue button! Next, you’ll access their application form, with is very intuitive!

First, provide the loan purpose, amount, and terms you want. Further in the application, provide your personal information, including Name, contact, and SSN.

Then, provide your financial information. At this point, you can even upload your documents. Continue your application. You’ll have to provide some additional info.

Once done, submit your application and wait for the result. If approved, the requested funds will be deposited in the informed account, and you can start enjoying it!

Requirements

You must meet some basic requirements to apply for the OnPoint Community Credit Union Personal Loans. For example, you need to be of legal age in your state.

In addition, you must provide proof of income and assets and have a valid Social Security number. Also, you’ll need a fair credit to qualify!

Apply on the app

If you want to apply for OnPoint Community Credit Union Personal Loans, note that you can only do so through their official website.

Still, they provide an excellent mobile app to help you manage your money if you open an account with them.

You can easily download the OnPoint Mobile app through the Apple App and Google Play stores! It is free and user-friendly!

OnPoint Community Credit Union Personal Loans vs. Quick Loan Link: which is the best for you?

If you feel like the OnPoint Community Credit Union Personal Loans isn’t the right option for you and want to explore higher amounts, we have the perfect option!

Meet Quick Loan Link, a lending platform that lets you connect with several borrowers and compare your options simultaneously!

Through their loan marketplace, you can borrow up to $50,000 according to your financial needs! And all this through a user-friendly and simple interface!

Great, isn’t it? Compare the main features below OnPoint Community Credit Union Personal Loans and Quick Loan Link!

| OnPoint Community Credit Union Personal Loans | Quick Loan Link | |

|---|---|---|

| APR | 11.00% – 16.00% fixed APR; | 4.99% to 450% – variable depending on the lender; |

| Loan Purpose | Large purchases, unexpected expenses, debt consolidation, home repair, and more. You can basically use you as you need; | Debt consolidation, large purchases, home renovation, vacation, medical expenses, and more; |

| Loan Amounts | $100 up to $25,000; | $100 and $50,000; |

| Credit Needed | Fair – Good; | 580 minimum; |

| Terms | Up to 60 months; | Variable by a lending partner; |

| Origination Fee | Not disclosed; | Variable by a lending partner; |

| Late Fee | $35 (when offered); | Variable by a lending partner; |

| Early Payoff Penalty | Not disclosed. | Variable by a lending partner. |

Do you want to learn more about Quick Loan Link? Then don’t miss our following article! We’ll bring a step-by-step process on how to apply for it! Let’s get started!

Quick Loan Link: how to apply now!

Discover how to apply for a loan with Quick Loan Link online or through their app! Borrow up to $50,000 with flexible terms! Read on!

Trending Topics

OpenSky® Secured Visa® Credit Card Review

Build credit confidently with the OpenSky® Secured Visa® Credit Card. No credit check needed to apply. Start your credit journey today!

Keep Reading

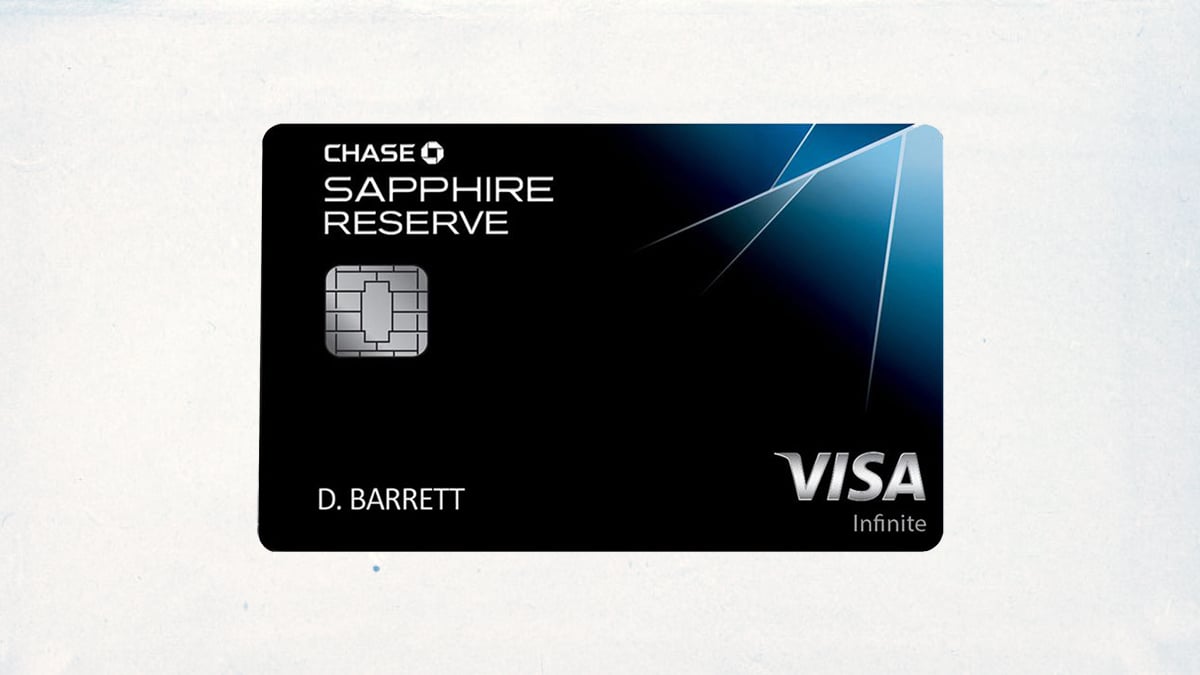

Chase Sapphire Reserve Credit Card Review

If you're looking for a premium travel rewards card, this is the one to get. Learn more in our Chase Sapphire Reserve credit card review.

Keep Reading

Up to $5K easily: CreditFresh Line of Credit review

Looking for a reliable line of credit option? Check out our CreditFresh Line of Credit review for all the details you need to know.

Keep ReadingYou may also like

TransUnion vs. Equifax: What is the difference?

Curious to know what sets apart TransUnion vs. Equifax? Check out our expert guide and get the lowdown on which credit bureau is best for you.

Keep Reading

The current state of the stock market: is the US in a bear market?

The great world economic crisis is raising a question: is the US in a bear market? We have separated some information that will answer.

Keep Reading

Milestone® Mastercard® Review: Easy Pre-Qualification

Looking for a credit card to help rebuild your credit? Read our Milestone® Mastercard® review to learn how to get back on track.

Keep Reading