Credit Cards

Milestone® Mastercard® Review: Easy Pre-Qualification

Empower your credit score with the Milestone® Mastercard®: wide acceptance in the U.S., no security deposit needed!

Advertisement

Milestone® Mastercard®: Credit builder that works perfectly

Have you recently experienced a decline in your score? We may have a solution for you! Read this Milestone® Mastercard® review and see if it matches your needs.

This card’s main benefit is credit building. And this is a fact because it offers no significant benefits and high-interest rates. Therefore, it is a poor choice for those who seek other perks.

- Credit Score: Bad – Fair – Good;

- Annual Fee: $175 for the first year; $49 annually after that;

- Regular APR: 35.9% (the APR may vary depending on your creditworthiness);

- Welcome bonus: None;

- Rewards: None.

How does the Milestone® Mastercard® work?

When discussing the Milestone® Mastercard®, it’s important to note that this card is specifically designed for individuals looking to build or rebuild their credit.

While it may not offer the extensive features or rewards associated with premium cards, its straightforward approach is a key benefit for those focused on improving their credit history.

The card doesn’t offer cash-back rewards, points, or travel perks, but it does provide an opportunity to access a line of credit without requiring a security deposit, making it a solid option for those who may not qualify for more traditional credit cards.

The simplicity of the Milestone® Mastercard® is intentional, focusing on ease of use rather than a long list of features.

It offers a basic structure with manageable terms, which can be especially helpful for users aiming to keep track of their payments and fees.

The card comes with an annual fee, which varies depending on your creditworthiness, and it’s important to be aware of this cost upfront.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Milestone® Mastercard® pros and cons

It’s important to weigh the advantages and potential drawbacks of credit cards. Let’s meet the pros and cons next in our Milestone® Mastercard® review.

Pros

- Ideal for customers with poor or damaged credit history.

- Offers complete protection from legal responsibility and identity monitoring.

- Simplifies building credit history with the Milestone® Mastercard®, with pre-qualification taking less than ten minutes.

- Reports account activity and payments to the three major U.S. credit reporting agencies—TransUnion, Equifax, and Experian—helping to build or improve your credit score over time.

Cons

- The card is very simple, which comes with significant disadvantages.

- Does not offer any rewards, welcome bonus, or introductory APR offer.

- Fees and rates may not be ideal for a card aimed at improving credit life.

Want to apply for the Milestone® Mastercard®?

If you’ve come this far, then you’re looking for an easy way to apply for the Milestone® Mastercard® Credit Card. And we are here to provide that to you.

This unsecured credit solution offers an initial credit limit of up to $700 and Mastercard benefits to give back your purchasing power.

If you’ve decided to apply for the Milestone® Mastercard®, continue reading below to learn about the application process.

Does my credit score need to be good?

As mentioned earlier in our Milestone® Mastercard® review, this card is specifically designed for those with less-than-perfect credit. In fact, it’s best suited for individuals whose credit scores are below average.

In other words, the Milestone® Mastercard® is perfect for demonstrating to better credit card companies that you can commit to a higher credit limit.

You can even demonstrate to the market that you deserve to receive some rewards. How? By making timely monthly payments.

This will for sure prove to lenders that you are financially responsible. Making on-time payments can help your credit go up.

Eligibility Requirements

- Age Requirement: Applicants must be at least 18 years old.

- Residency Status: You must have a physical address in the United States (P.O. Boxes are not accepted) and a valid U.S. IP address.

- Social Security Number: A valid Social Security Number (SSN) is required; applications with an Individual Taxpayer Identification Number (ITIN) are not accepted.

- Credit Qualification: Applicants should meet certain credit criteria, which include a review of income, debt levels, and identity verification.

- Prior Account Status: You should not have had a previous Milestone Mastercard account that was charged off due to delinquency.

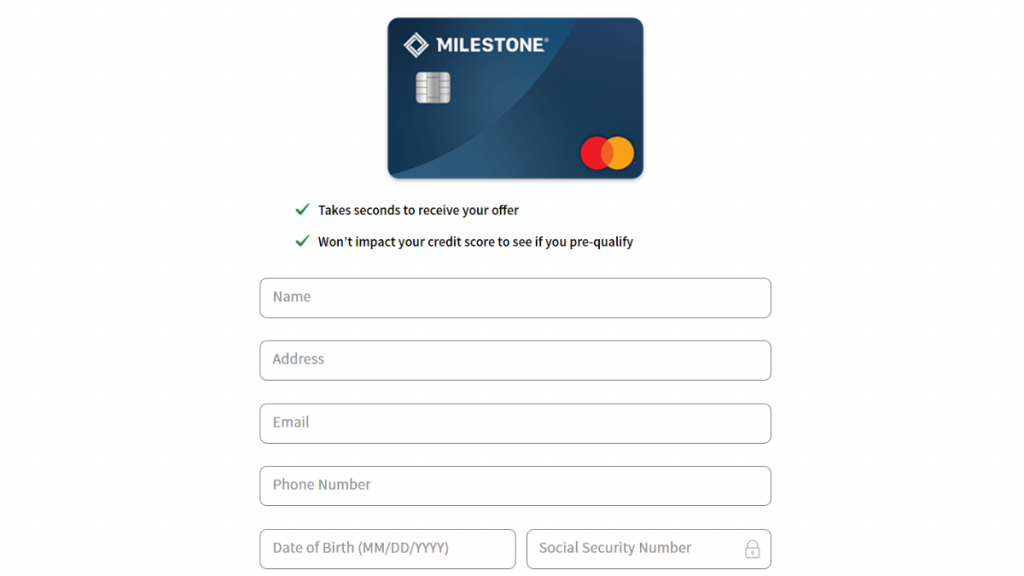

Apply online

First, be aware that this credit card offers the option for you to pre-qualify. If you want to pre-qualify, you must share your personal information with them.

Some of the information you must share is your first and last name, full address, e-mail address, phone number, date of birth, and your Social Security Number (SSN).

This whole pre-qualification process happens in the blink of an eye. Moreover, there is no reason to worry because pre-qualifying does not hurt your score.

After that, you must wait for them to review your information. Once this is done, they will determine your annual fee. But please do not forget to read all the terms and conditions.

However, be aware that pre-qualifying does not guarantee final approval. We recommend that you do all of these steps online.

Apply using the app

Regarding other means to apply for the Milestone® Mastercard® Credit Card, there is no way to submit your application via mobile.

However, the Milestone® Mastercard® Credit Card website is mobile-friendly. Therefore, you can seamlessly apply using your phone or tablet.

Milestone® Mastercard® Credit Card vs. Indigo® Mastercard® Credit Card

If you’re considering alternatives, the Indigo® Mastercard® offers a similar experience to the Milestone® Mastercard®, making it a good choice for those with low credit scores.

Both cards share key features, including no security deposit requirement, regular credit bureau reporting, and comparable fees.

They are designed to help individuals rebuild credit while providing essential tools for managing their financial progress.

Milestone Mastercard®

- Credit Score: Bad – Fair – Good;

- Annual Fee: $175 for the first year; $49 annually after that;

- Regular APR: 35.9%;

- Welcome bonus: None;

- Rewards: None.

Indigo® Mastercard® Credit Card

- Credit Score: Poor – Fair;

- Annual Fee: $175 the first year; then $49 annually;

- Regular APR: 35.9%;

- Welcome bonus: N/A;

- Rewards: N/A.

If the Indigo® Mastercard® Credit Card can be the best for you, read our post below to learn how to apply for it!

Indigo® Mastercard® Credit Card full review

Want to rebuild credit and need a card? We may have the best option for you! Read our Indigo® Mastercard® Credit Card review to learn more!

Trending Topics

Earn Big Rewards: Apply for Pelican Points Visa

Get straightforward instructions to apply for the Pelican Points Visa! Earn points on every purchase and make the most of your money!

Keep Reading

Rocket Loans personal loan application: how to apply now!

Do you need a loan with no hidden fees and that you can apply for online? Read on to learn about the Rocket Loans personal loan application!

Keep Reading

Curadebt application: learn how to relieve your debt!

Say goodbye to your debts. Curadebt will help you find debt relief to live your life in peace. Apply for a debt settlement program today.

Keep ReadingYou may also like

Upgrade Rewards Checking Account review: read before applying

Want to have the best checking account in town? Don't miss out on our Upgrade Rewards Checking Account review to learn more!

Keep Reading

Auto Loan Zoom: how to apply now!

Need a car but don't know where to start? Then apply for Auto Loan Zoom today! Borrow up to $35,000! Keep reading to learn!

Keep Reading

Destiny Mastercard® Review: Reach Better Credit!

In our Destiny Mastercard® review, you’ll learn about this product that can help you repair your credit and build a strong financial future.

Keep Reading