Rebuild your credit for free or get plans to boost your credit repair

Dovly: Real-time monitoring and credit score improvement in a short time

Advertisement

If you want to rebuild your credit safely and effectively, Dovly is the ideal option. After all, the company carries out an automated dispute process that can bring results in a very short time with the use of the algorithm. And best of all, you can have this service for free or for plans with super affordable prices. It’s worth checking out the benefits that Dovly can bring you.

If you want to rebuild your credit safely and effectively, Dovly is the ideal option. After all, the company carries out an automated dispute process that can bring results in a very short time with the use of the algorithm. And best of all, you can have this service for free or for plans with super affordable prices. It’s worth checking out the benefits that Dovly can bring you.

You will remain in the same website

Dovly is a great credit-rebuilding service and could be the right choice for you. Check out the main benefits that Dovly services offer.

This service is ideal for anyone who must dispute credit record errors. In this sense, people with many records and those with few can join the plans. Therefore, using the program’s algorithm will contest incorrect and outdated records according to the contracted plan. That way, you will see a change in your credit score on the team.

Hiring Dovly to rebuild credit brings many benefits to hiring. Firstly, it’s the Only credit recovery app with a free customer plan. It also has a Free application with artificial intelligence that uses algorithms. Offers Real-time credit monitoring for greater convenience and daily monitoring of score changes. It also brings up the possibility of being notified about queries instantly. Finally, it has extensive customer support within the US territory.

Hiring any service provided by Dovly must be done through the company’s official channels. That is, you can access the website or download the original app for iOS or Android from your device’s official store. However, checking if you meet the requirements before applying is important. Therefore, you must be over 18 years of age, have legal registration as a US citizen, and have a residential address. To apply online, you need a computer or notebook. To apply through the app, you need a smartphone or tablet with internet access.

How to apply for Dovly

Dovly is a great credit-rebuilding service. Learn how to apply online and through the app to hire this service today.

Dovly is a great credit-rebuilding service. But The Credit People is a similar credit reconstruction service with different values. Want to know how to apply this option? Then check out the post we separated for you.

How to apply for The Credit People

The Credit People is a great option to restore your name in the financial market. Learn how to apply for The Credit People and succeed.

Trending Topics

Applying for the Discover it® Student Cash Back Card: learn how!

The Discover it® Student Cash Back Card offers great rewards. Here's how to apply for this card and take advantage of these rewards.

Keep Reading

Make up to $15.79/h working at Bubba’s 33: see job vacancies

Bubba's 33 is serving up open job positions with no experience needed! Learn about roles, salary, and benefits. Stay tuned!

Keep Reading

Join the Carrabba’s Italian Grill Fam: Apply for a job!

Apply for a job at Carrabba's Italian Grill and start your career in the restaurant industry. Learn more here!

Keep ReadingYou may also like

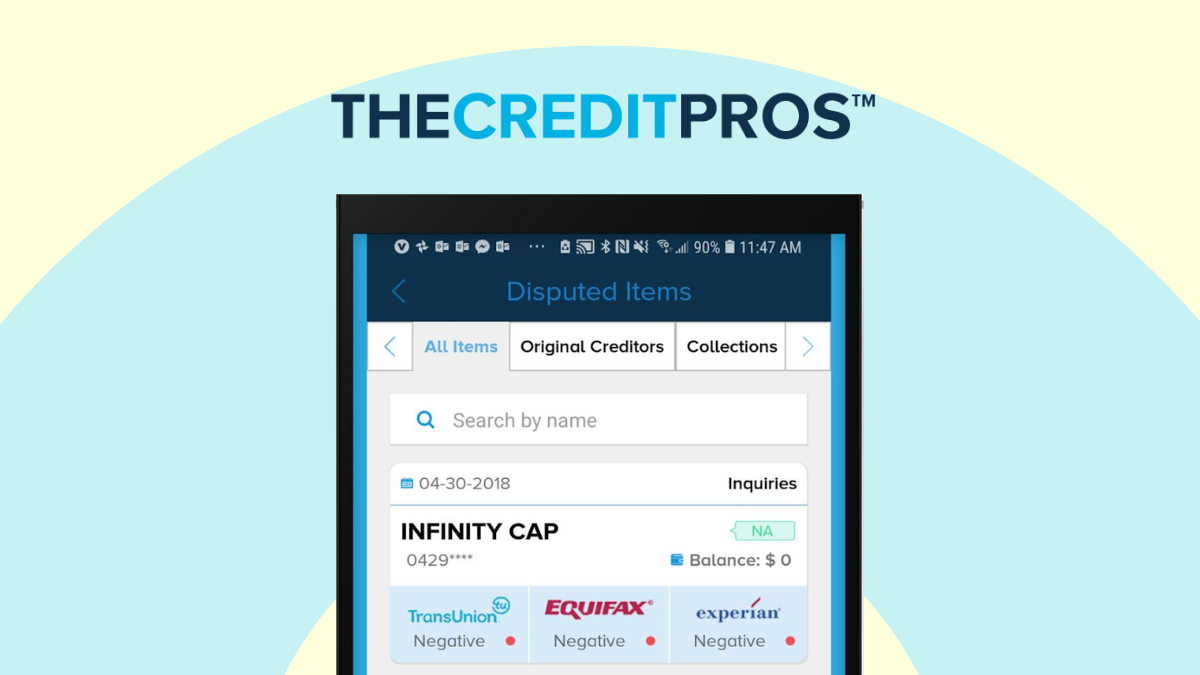

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep Reading

What is a debt consolidation loan?

A debt consolidation loan can help you pay off your debts faster and more easily. Find out what is a debt consolidation loan! Red on!

Keep Reading

Applying for the Chime® Debit Card: learn how!

Need a debit card to help you save money and pay no monthly fees? Then the Chime® Debit Card can help you! Learn how to apply to be approved!

Keep Reading