Finances

Sky Blue review: repair your credit with confidence

Sky Blue is a great service for credit recovery, with refund security. See how you can benefit from this option.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Sky Blue: 90 days guarantee and simplified fees to help you

Repairing your credit with a reliable service can be quite a challenge. So, this Sky Blue review came to show you more about an interesting option that can be very useful in recovering credit.

With Sky Blue, you can challenge incorrect and outdated records before the main agencies in the country.

Also, you get a refund within 90 days if you are dissatisfied with the services. Check out more about how this option works.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does Sky Blue work?

This Sky Blue review brings you the main way this service works. As you saw earlier, it is a type of service for recovering credit upon a dispute over records.

However, it is a company that does not charge a subscription fee for new users. However, after 6 days of use, a $79 fee is charged for dispute services to continue. In addition, this amount is billed monthly.

There is also the option to add a second member for an additional $40 each month. That way, the beneficiary would pay a fee of $119 per month for personalized services.

Sky Blue has a variety of services, from the most general to the most personalized. In this regard, you rely on credit disputes, debt validation letters, and professional credit analysis.

In addition, you have access to suggestions for improving your credit score and tips for acquiring a new credit card. In addition, you can also customize Sky Blue through add-ons such as mortgage preparation.

Sky Blue: learn the advantages and disadvantages

As you can see in this review, Sky Blue is a viable option to get your credit back. However, like other options of this same service available on the market, it has pros and cons. Check out the pros and cons.

Pros

- Refund within 90 days of hiring if you are dissatisfied with the service;

- Canceling or pausing the subscription at any time, from login to the portal and simple request;

- For an extra fee, a range of customizable services, such as mortgage preparation or coaching calls.

Cons

- Absence of constant credit monitoring service to accompany the evolution;

- Small dispute letter possibilities, especially related to debt validation and goodwill removal;

- Absence of a mobile application that would facilitate assistance in case of need.

Who is it suitable for?

As you may have seen in this Sky Blue review, this service is ideal for anyone with a bad credit history. So, Sky Blue might be the ideal option if you need to rebuild credit.

This service will help you with disputes, debt validation letters, and personalized advice. Thus, within a short period, you will be able to recover your credit and access new possibilities.

Want to apply for Sky Blue? We help you affiliate

Recovering your credit can lower interest rates and expand your dream home or car financing. In this sense, knowing how to apply Sky Blue can help to achieve all these dreams and possibilities.

This great option to help with credit recovery is available online and through an app. Therefore, it is easier to make the request and hire the service.

After all, the faster, the less time your score increases. Learn how to apply.

Apply online

To apply Sky Blue, you must fulfill some essential requirements like similar services. In this regard, you must be over 18 and have an official US citizen license.

In addition, it is essential to have a residency within the United States in your name. You also need to have a bad credit score and possible accounts that need to be challenged.

However, with these requirements, you can apply online. For this, you need a computer or laptop with internet access. It is important to have access to a secure network to prevent data theft.

Then, you need to go to the official Sky Blue website and fill in a form to get started. In this form, you enter your personal data and select the plan you want. Finally, submit and wait for the next steps by email.

Apply using the app

The only way to apply and start using this credit repair service is to do it online through the official website.

So, within a few months, you can see the change in your credit score and financial health.

Another recommendation: Lexington Law

Lexington Law’s services aim to do two things: repair your credit and bring in new customers.

Also, Lexington Law, a legal aid company, provides customers with a credit repair service.

Similar to other credit repair agencies, they look into potentially damaging reports and records when they suspect suspicious behavior.

Doing so will remove the negative information and open up more transaction possibilities.

In addition to providing this service, the organization also employs attorneys who have experience with such matters.

Your chances of having your credit repaired using this way improve. So, read our post below to learn how to apply for this credit repair option!

How to apply for Lexington Law

Lexington Law can help you rebuild credit. Check out how to apply for Lexington Law and succeed.

Trending Topics

247LoanPros review: is it worth it?

Want to settle your debts? Follow this 247LoanPros review and see what benefits it can bring to your financial life.

Keep Reading

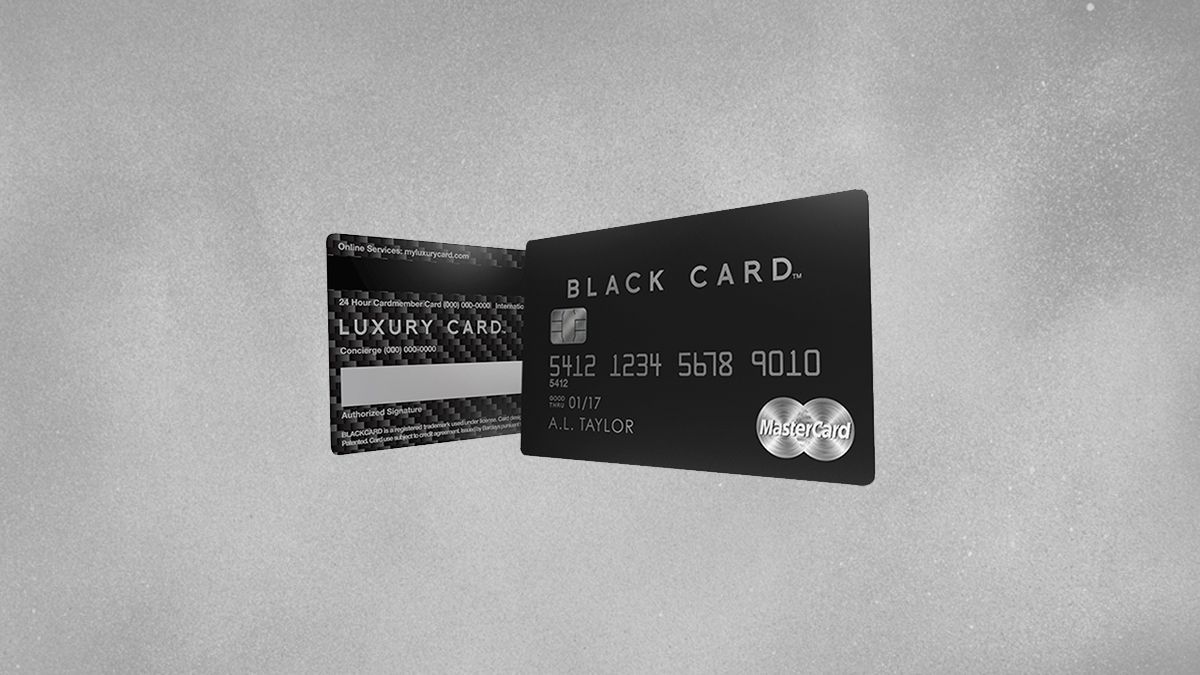

Luxury Black credit card full review

Check out our Luxury Black credit card full review to learn all about its exclusive travel rewards and high-end experiences.

Keep Reading

Supplemental Nutrition Assistance Program (SNAP)

The Supplemental Nutrition Assistance Program (SNAP) was designed to lift families from food insecurity. Learn all about this!

Keep ReadingYou may also like

Wedding loans in Canada: financing your big day

Wedding loans in Canada can make your dream come true. Understand how this loan works and get married the way you deserve!

Keep Reading

Home Depot’s quarterly earnings are better than expected

Home Depot had a strong growth in its first quarter. It might be a sign that the housing market is alive and well despite mortgage rates.

Keep Reading

Learn how to Make Money with Online Trading

Learn how to make money with online trading and turn a small investment into big profits. Start earning money today!

Keep Reading