CA

TFSA vs RRSP: which you should choose?

Which one is the best: TFSA or RRSP in Canada? Does it make sense to have both? Let’s shine a light over these two types of accounts and find out which one is for you. Read on for more!

Advertisement

TFSA vs RRSP in Canada: learn the pros and cons of each and what their roles they play in your financial life

Do you know the difference between a TFSA vs RRSP? Acronyms in general make things seem more complicated than they actually are, but choosing between a TFSA or RRSP in Canada is actually very simple. But first, let’s unpack the mysterious acronyms.

TFSA stands for Tax-Free Savings Account, while RRSP stands for Registered Retirement Savings Plan. Both of these accounts offer savings and investing options, but you should have preferably an investment account. We will work on this point later on in the text.

TFSAs are the type of account everyone should have. RRSPs, on the other hand, make more sense for high-income individuals, or people who have already maxed out their TFSA. This does not mean you are going to have to choose between one or the other. Actually, these accounts work just fine if you use them together.

As long as it makes sense in your broader financial plan, you can use these accounts either as a stand-alone account, or both at the same time. Whatever you decide to do, make sure you invest consistently. Ideally, you want to set up an automatic transfer to pay yourself first every month. Over time you can increase the amount until you top your account or accounts.

What is great about both TFSA and RRSP is that both of them are investment vehicles that protect your investment returns from taxes. A TFSA offers better tax benefits and is more flexible than an RRSP. However, Tax-Free Savings Accounts can not absorb that much money. An RRSP will do a much better job at that, but it imposes withdrawal limitations. So if you want to learn more about TFSA vs RRSP, read on for more information!

What are the pros and cons of a TFSA?

Now in our TFSA vs RRSP comparison, we’ll talk about TFFAs. They were first introduced back in 2009 with the purpose of giving Canadians a flexible tool for retirement savings. You can open one as soon as you turn 18, and if at any time you need to access the money you have invested, withdrawal is tax-free.

Within a TFSA you can keep a number of investments such as cash, GICs, stocks, bonds and mutual funds. As of 2022 the annual limit is $6,000, and the total limit is $81,500. Everything that is kept there is tax-exempt.

This means tax-free compound interest, which is every investor’s dream. However, the money you contribute to your TFSA is after-tax income money, and this type of account does not give you a tax refund for contributions.

A TFSA in Canada is an all-purpose account, and quite often people use it for things other than retirement savings. Some save for a dream trip, others for home renovations. But the most powerful use of these accounts is for protecting investments from taxes. Just imagine keeping all of your stocks, GICs, bonds or mutual funds earnings.

Of course nothing is perfect, and a TFSA in Canada can have a few downsides. Let’s have a look at what the pros and cons are for this type of account.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Pros

- Tax-Free

- Funds easily accessible

- Accepts a number of investment options

Cons

- Contribution limit of $81,500

- Contributions are not tax deductible

- Not protected from creditors

What are the pros and cons of RRSP?

The history of RRSP goes back to 1957. It was created to help Canadians save for retirement. One of the key characteristics of this type of account is that all the money you contribute to it is tax deductible. However, the refund must be reinvested for you to remain eligible for pre-tax advantages.

You do, however, pay tax when you withdraw the money, even if not the full amount. You will pay tax on the amount you have withdrawn. That’s why the maximum yearly contribution is either 18% of your gross income or $29,210. The lowest of the two. 18% isn’t something you are going to miss to the point of making a taxable withdrawal.

RRSP holders may withdraw the money tax free on only two occasions: if they withdraw up to $35,000 for a down-payment on a first home, or if they withdraw $10,000 to $20,000 for a year’s worth of full-time training or education. In both cases, the money must be repaid. Home buyers must repay in 15 years, and individuals attending courses must repay in 10.

Tax refunds aren’t that big of a deal for people in lower tax brackets. The higher your tax bracket, the more taxes you pay. So an RRSP makes a lot more sense for people who are making more money.

Now, in our TFSA vs RRSP comparison, let’s take a look at some key pros and cons of a RRSP.

Pros

- Contributions are tax deductible

- Interest earned is tax-free

- US dividends are tax-free

Cons

- Withdrawals are taxed

- Income-based contributions

- Must be closed by age 71

Is it better to invest in TFSA or RRSP?

As we have seen, whether you should invest in a TFSA or an RRSP is not a matter of which one is the best. Rather, it is a matter of which one is the best in your particular case. Are you a student who does some freelance work and does not make much money?

You are young, and hopefully full of dreams and projects. You might want to access that money to buy a piece of equipment you need to execute a job or a project. It doesn’t make sense for you to lock up the money in an RRSP. Go for the TFSA!

The opposite is true for a well-established professional or entrepreneur, whose gains are heavily taxed. If that is your case, you want to protect as much of your gains as possible. If you use a TFSA your hefty contributions remain taxable, making them less hefty. You don’t want that. Go for the RRSP!

Should I have both RRSP and TFSA?

Now that you’ve seen everything there is to know about TFSA vs RRSP, should you have to choose? Well, ideally you want to have both in any case. The question then is whether you should start with an RRSP or a TFSA. To know which one you should start with, check out the section above.

How to Start Investing in Canada

Follow our tips and learn the best and smartest ways to invest your money in Canada!

Trending Topics

Basket Up! The Best Apps to Watch NBA Online in 2023

Catch every NBA game no matter where you are with our selection of the best apps to watch basketball online. Learn more!

Keep Reading

Make up to $20 per hour working at Outback: see job vacancies

Outback is hiring now for different jobs! Join their team and make up to $20/hour. Keep reading to know the ones available today!

Keep Reading

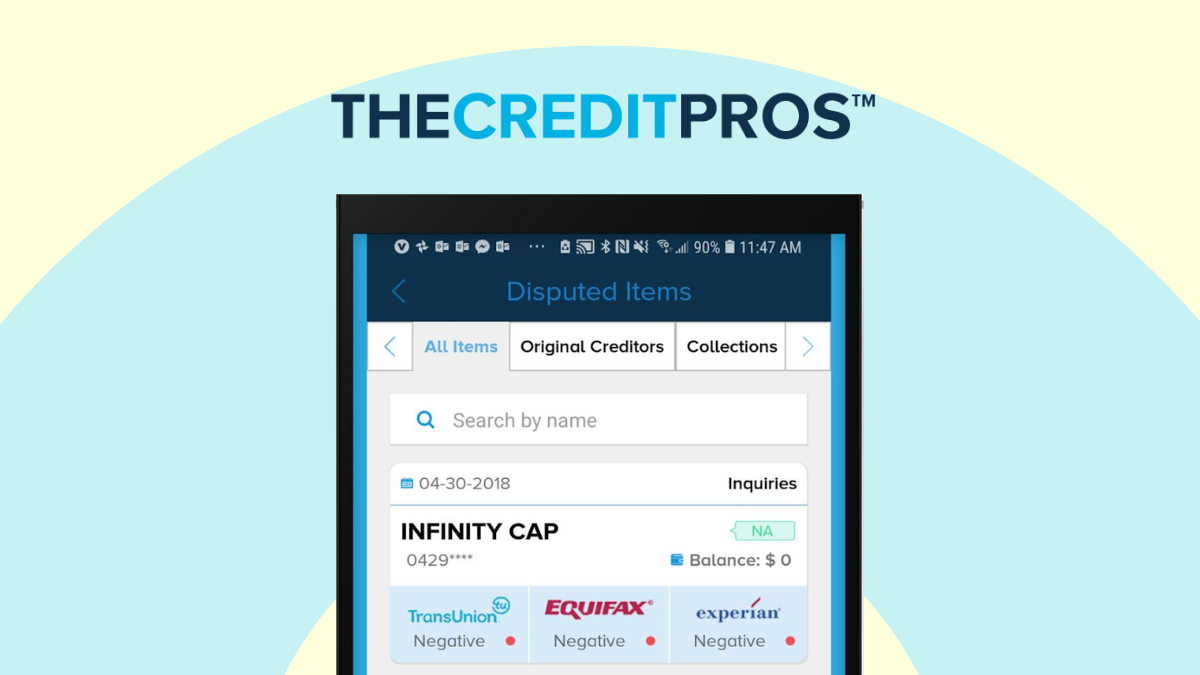

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep ReadingYou may also like

What is an NFT: understand how this digital asset works

Ever wondered what is an NFT? This digital asset works as a new fully digital currency. Learn more about this new technology.

Keep Reading

Prosper Loans review: is it worth it?

Check our Prosper Loans review to see if it’s the right fit for your financial needs. We’ll look over rates and terms to help you decide.

Keep Reading

Discover it® Miles Card Review: $0 annual fee

Check our Discover it® Miles credit card review and learn more about a card that offers many travel perks and charges no annual fee!

Keep Reading