Finances

The Credit People review: repair your credit with confidence

To repair your credit, it is important to rely on a reliable service. So, you can get to know The Credit People review and see how it works. Read on!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

The Credit People: credit score restoration, discounts for couples, and free score consultation

A good credit score helps you achieve your dreams, like owning a home or buying a car. Therefore, this The Credit People review has shown you an interesting, useful option.

The Credit People is a consulting service that helps you remove negative credit reports.

That way, you gradually increase your score and improve your financial health. Learn more about how this option works.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How do The Credit People work?

The Credit People is a consulting service that helps rebuild credit. In this sense, the company provides services that help remove the negative name at credit agencies.

To access The Credit People, you must subscribe to a $419 flat-rate plan. On the other hand, you can opt for a monthly fee of $79. However, in both cases, there is an initial fee of $19.

After contracting one of the plans, you will have access to the range of services offered. You may have ongoing credit reports and negative reporting disputes. That is, the company contests its negative records.

You can also access late payment removal reports to major credit bureaus. Finally, you can also count on debt validation and some optional add-ons.

The Credit People: learn the advantages and disadvantages

The Credit People, featured in this review, helps rebuild credit by paying a fee. However, like other options on the market, it has positives and negatives. Check out the pros and cons of this option.

Pros

- Free access during the first week, with free credit consultation and monitoring;

- Cancellation at any time, according to dissatisfaction, and refund for the previous month;

- Discount in the case of double plans where the spouses close the service simultaneously.

Cons

- Fixed price plan with a high associated cost of $419, flat rate. You can also opt for monthly services;

- Customer support is very limited as it does not offer 24/7 support as it is only available over the phone;

- There is no possibility of additional add-ons, such as identity theft insurance.

Who is it suitable for?

This review by The Credit People showed that it is an ideal service for people who need to rebuild their credit. For this, the agents must pay a monthly or unit fee to carry out the operations.

So, if you have any negative history or creditor reports to be disputed, this service is for you. By hiring The Credit People, you can recover your credit score and have good business options.

If you want to have lower interest rates and better financing conditions, this option is also recommended for you. With The Credit People’s monthly report, you can see how your score is improving.

Want to apply for The Credit People? We help you affiliate

Recovering credit can bring lower interest rates and enable financing for large purchases. Therefore, applying for The Credit People can be a great way out for financial health.

However, to have access to these services, it is important to know how to apply them. That way, you will have quick access and increase your credit score. Check out how you can apply online and through the app.

Apply online

For you to have a successful application, it is important to follow some steps. However, before understanding the processes, you must check that you meet the requirements.

In this sense, for you to be able to hire this service, it is important to be a US citizen and be over 18 years old. Also, you must have a residency in your name in the United States to apply.

The online application can be performed using a computer or notebook with internet access. First, you can get a free, no-obligation assessment by filling out a form.

Afterward, the company may contact you by phone to inform you about your conditions. Thus, you can sign the service contract and successfully complete your application.

Apply using the app

If you’re the type of person, who likes to solve things over the phone. You can easily apply for the Credit People service through your mobile device. However, you cannot download an app.

You’ll need to call them on their official phone number to complete the application!

Another recommendation: Lexington Law

Lexington Law is a service that aims to help you restore your credit score and win new business.

This service offers 3 main plans: Premier Plus, Concord Premier, and Concord Standard. All plans offer inquiries about registrations.

So, check out our post below to learn how to apply for the Lexington Law credit repair service!

How to apply for Lexington Law

Lexington Law can help you rebuild credit. Check out how to apply for Lexington Law and succeed.

Trending Topics

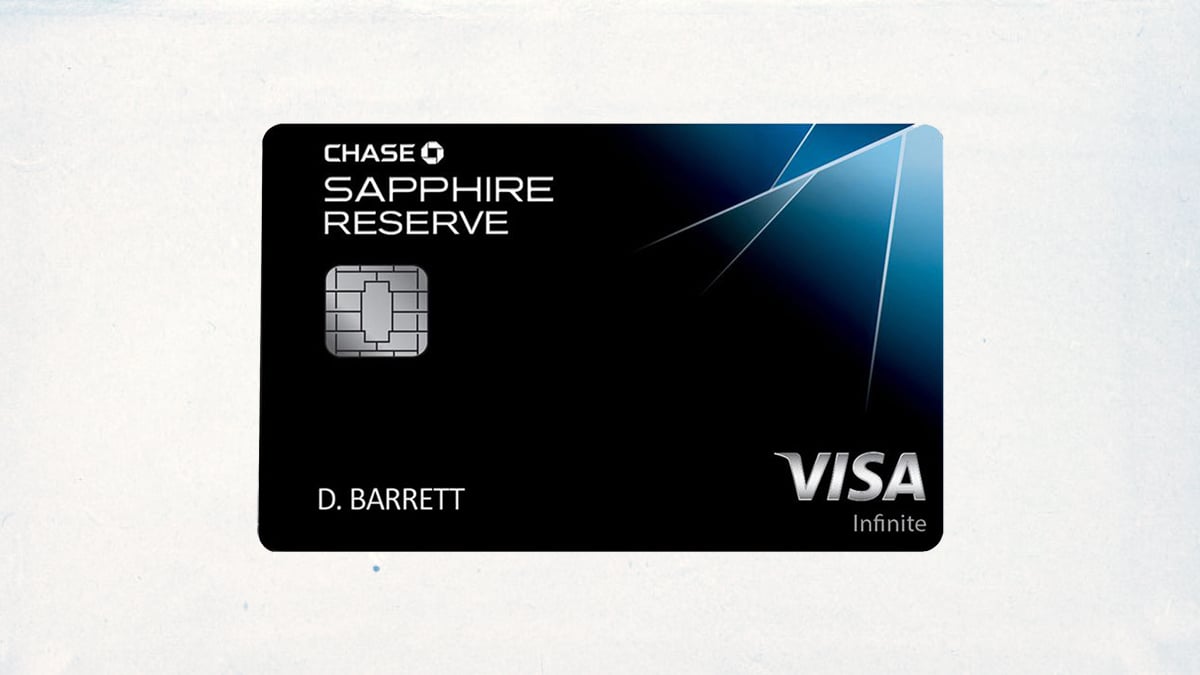

Chase Sapphire Reserve Credit Card Review

If you're looking for a premium travel rewards card, this is the one to get. Learn more in our Chase Sapphire Reserve credit card review.

Keep Reading

What is an annual fee on a credit card?

Annual fee on a credit card is a common thing, but do they make sense? How can you get rid of them? When should you accept them?

Keep Reading

Elon Musk has secured even more funding for his Twitter deal

In filings released Wednesday, it was revealed that Musk has raised personal funding to complete his deal to purchase Twitter.

Keep ReadingYou may also like

Flexible financing options: MyPoint Credit Union HELOC review

Read our MyPoint Credit Union HELOC review and discover the perfect product for you! Enjoy a promotional 1.01% off on your APR and more!

Keep Reading

Is $5000 enough to move out, and how to save money?

Are you considering moving out but not sure if your budget is enough? Find out if $5000 is enough to cover your moving expenses.

Keep Reading

Credit Versio Review: repair your credit with confidence

Struggling with bad credit? Check out our Credit Versio review. A unique credit repair company that puts you in the driver's seat.

Keep Reading