Credit Cards

American Express® Gold Card Review: 100K bonus points

The American Express Gold card is the best option if you enjoy going out for dinner and buying food at grocery stores. You'll get credits and earn Membership Reward Points for it! So, learn more about one of the best premium cards in the market.

Advertisement

Get rewards for everyday purchases and dining!

If you’re looking for a credit card with many advantages, the American Express® Gold Card is a great option.

With this card, you’ll get access to exclusive deals and discounts at restaurants and stores and travel benefits that can save you money on flights and hotels.

It has so many opportunities for discounts and rewards points that the annual fee will easily pay off. So, if you want to learn about the American Express® Gold Card, keep reading!

| Credit Score | Recommended 670 or higher. |

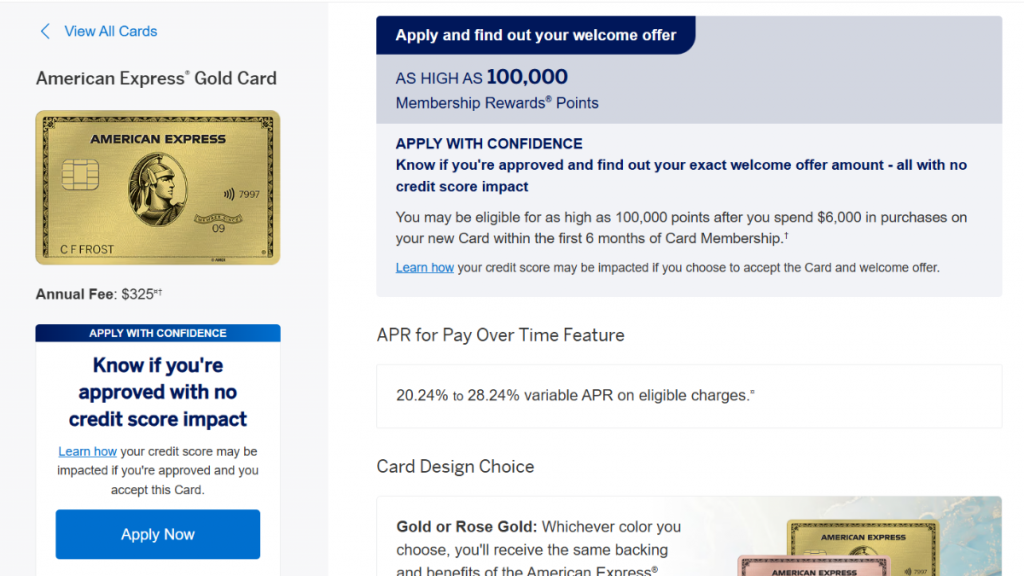

| Annual Fee | $325. (rates & fees). |

| Regular APR | 20.24% to 28.24% variable APR on eligible charges. (rates & fees). |

| Welcome bonus | Up to 100,000 points after spending $6,000 in the first six months. (terms apply). |

| Rewards | 4x points on dining; 4x point on groceries; 3x points on flights; 2x points on prepaid hotels; 1x points on other purchases. Terms apply. |

How does the American Express® Gold Card work?

The American Express® Gold Card is an excellent middle-range card. Even though considered a travel credit card, it will give you a lot of rewards for daily purchases.

It is known to be a more “foodie” credit card. Even Amex says on the official webpage that this card will “reward your appetite for life”.

The annual fee of $325 may seem a little high, but not if you compare it with the big brothers in his category (the Platinum and the Centurion).

The dining $120 credit and the Uber cash $120 credit alone will compensate for the annual fee.

Also, you’ll get a lot of Membership Reward Points to redeem. You can earn up to 100,000 Membership Rewards Points if you spend $6,000 within 6 months.

And finally, if you care about some style, this card has two color options: the traditional yellow gold and the rosé gold.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

American Express® Gold Card pros and cons

Now, we’ll show you the pros and cons of this Gold card. That way, you can compare its features to decide if it is the best option for your financial needs!

Pros

- A lot of reward points for everyday purchases like dining, groceries, and food delivery.

- Preferred seats at some of the best cultural and sports events.

- No foreign transaction fees.

- Personalized Travel Services to help you make the best of your trips.

- No preset spending limit.

Cons

- No access to airport lounges.

- It has a relatively high annual fee if compared with another credit card in the market.

- The Membership Rewards Points program can confuse some people.

How to apply for American Express® Gold Card?

Are you looking for a new credit card? If so, you may want to apply for the American Express® Gold Card.

This card has various benefits that can be useful for anyone, especially those who love to travel and eat out.

With the Membership Reward Points, you’ll earn points with the potential value of hundreds of dollars. And the best part is you get them in everyday purchases, like dining and groceries.

If you’re interested in this card, this post will show you how to apply. Keep reading to learn more.

What credit score do you need to have?

You’ll need a great credit score to be approved for the Amex Gold. The recommended is at least 670. Also, you’ll need a steady source of income.

Besides the credit score requirement, you’ll need to meet other criteria:

Age and Residency:

- Be at least 18 years old.

- Have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Maintain a U.S. residential address.

Income:

- Demonstrate a stable and sufficient income to support credit responsibilities. While there is no disclosed minimum income, applicants usually have a stable and sufficient income to support credit responsibilities.

Credit History:

- Maintain a positive credit history with timely payments and low credit utilization.

- A limited number of recent credit inquiries and a longer credit history can enhance approval chances.

Existing Relationship with American Express:

- A positive history with American Express, if applicable, can be beneficial.

Debt-to-Income Ratio:

- Maintain a reasonable debt-to-income ratio, indicating the ability to manage additional credit.

Apply online

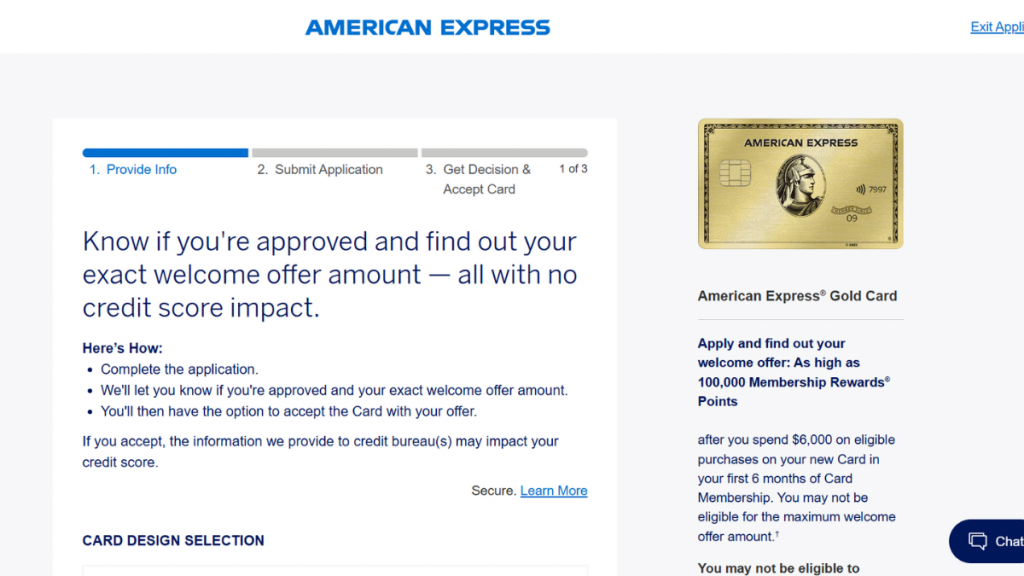

It is easy to apply for the American Express® Gold Card. Go to the American Express website and find the Gold card page.

If you’re lucky, you can receive a 25% increase on the welcome bonus. Be ready to click right away. You’ll see the “Apply now” button at the top of the page.

It will redirect you to the application form. You’ll have to provide personal info, like name, e-mail, address, birth date, and social security number.

Also, you’ll have to inform your annual income and its source. Remember, this is a premium card, so you need a great credit score to be approved.

They’ll give you an answer in 30 seconds.

Apply using the app

There is no option to apply using the app. The application is made on the American Express website.

American Express® Gold Card vs. Amex Blue Cash Everyday® Card

Amex has excellent options for travel cards. One step above the premium lineage is the Amex Blue Cash Everyday® Card.

This card brings no annual fee, 0% intro APR for 15 months and more amazing benefits to cardholders. Check it out.

| American Express Gold card | The Platinum Card® by American Express | |

| Credit Score | Recommended 670 or higher | Good to excellent; |

| Annual Fee | $250. (rates & fees) | $0 (rates & fees); |

| Regular APR | 21.24% to 29.24% variable APR on eligible charges. (rates & fees) | 0% intro APR for 15 months from account opening; 18.24% to 29.24% on purchases and balance transfers after (rates & fees); |

| Welcome bonus | Up to 90,000 points after spending $6,000 in the first six months. (terms apply) | Earn up to $250 back after spending $2,000 on purchases in the 1st 6 months of card Membership (terms apply); |

| Rewards | 4x points on dining; 4x point on groceries; 3x points on flights; 2x points on prepaid hotels; 1x points on other purchases. Terms apply. | 3% cash back on groceries, U.S. Online retail purchases, and gas stations; 1% cash back on other purchases (terms apply). |

Do you want to learn more about the Amex Blue Cash Everyday®? Then follow the link below and discover a world of benefits made for you! Good reading.

Amex Blue Cash Everyday® Card Review: Earn more!

Learn all about the American Express Blue Cash Everyday® Credit Card in our detailed review. Pay $0 annual fee and enjoy exclusive perks.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The information provided was accurate at publication, though certain offers may no longer be applicable.

Trending Topics

FIT™ Platinum Mastercard® Review: Build credit easily

If you're having trouble getting a credit card because of a poor credit score, check the FIT™ Platinum Mastercard® terms in this review.

Keep Reading

Borrow up to $400k: Figure Home Equity Line of Credit review

Looking for a flexible loan option? Check out our Figure Home Equity Line of Credit review! Borrow up to $400,000 easily. Keep reading!

Keep Reading

Lazy investing portfolio: a beginners guide

A lazy investing portfolio is the best strategy for people who want to build wealth without having to keep track of complex market data.

Keep ReadingYou may also like

Rewards credit cards: learn their pros and if they are worth it!

Learn about the pros of credit card rewards and how you can use them to save money. Also, are rewards credit cards worth it? Find out here!

Keep Reading

Unlock your power: OnPoint Community Credit Union HELOC review

Unlock the power of your home equity! Read our OnPoint Community Credit Union HELOC review and learn to enjoy flexible conditions!

Keep Reading

Credit Versio Review: repair your credit with confidence

Struggling with bad credit? Check out our Credit Versio review. A unique credit repair company that puts you in the driver's seat.

Keep Reading