Credit Cards

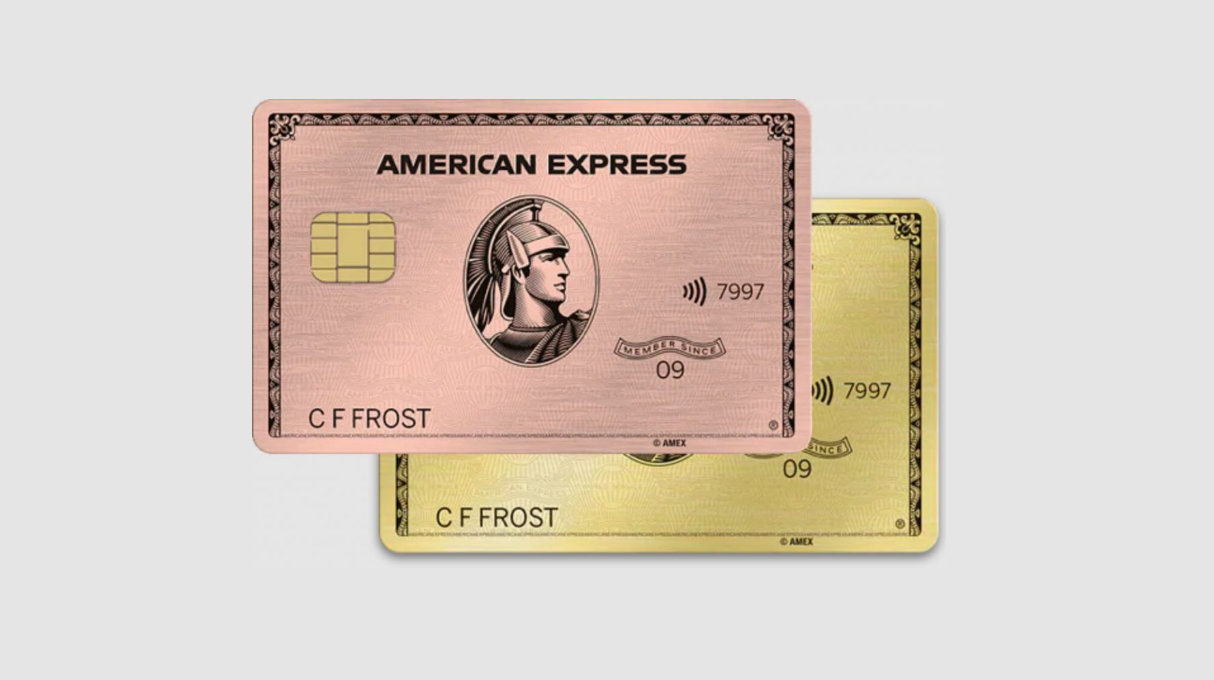

American Express Platinum or American Express Gold card: choose the best!

Are you looking for a travel credit card? American Express has two options for you. Would you like the Platinum or Gold card? This review has a comparison to help you figure this out.

Advertisement

American Express Platinum vs American Express Gold: decide what credit card you should get

Are you trying to decide between American Express Platinum or American Express Gold? We’ve made this comparison review to help you.

American Express issues both of these cards and has excellent reliability. Also, the cards have a lot of perks and benefits, especially for travelers. The Platinum is more exclusive, while the Gold is more accessible.

Do you like to travel with Elite Status? Or do you prefer to earn more points on everyday use? This article will put light on each card’s pros and cons. We hope you find it helpful. Stay here and keep reading.

How do you get the American Express Platinum card?

Learn how to apply for the American Express Platinum credit card. Check the requirements and the benefits you'll get with the best travel card in the market!

How to apply for the American Express Gold card?

The best benefits if you love food and travel, with reward points in almost every purchase. Learn everything you need to apply for the American Express Gold card here!

| American Express Platinum | American Express Gold | |

| Sign-up bonus | 100,000 points after spending $6,000 on your first 6 months | 60,000 points after spending $4,000 on the first 6 months |

| Annual fee | $695 | $250 |

| Rewards | 1x to 5x Reward Points for selected purchases | 4x points on dining 4x point on groceries 3x points on flights 1x points on other purchases |

| Other perks | – $200 hotel credit – $240 digital entertainment credit – $200 Uber credit – Access to airport lounges. – Elite Status at hotels worldwide | .- Credits at Uber Cash and partner restaurants – $100 os experience credit at selected hotels. Terms apply. – Baggage and car rental insurance |

| APR | 15.99% to 22.99% (variable) | 15.99% to 22.99% (variable) |

American Express Platinum credit card

This credit card was introduced in 1984. Yes, it has been one of the best cards for almost 40 years now. It has excellent reliability in the market, and many people desire its exclusive benefits.

Amex Platinum is widely accepted in the four corners of the world. It has no preset limit, so it is unlikely to see this cardholder’s purchase get rejected. And speaking about the four corners of the world, this is a premium travel credit card.

This card is a sure bet if you like to travel a lot. It charges no foreign transaction fee and provides you with VIP experiences. Platinum members have exclusive access to more than 1,400 airport lounges worldwide. Say goodbye to uncomfortable airport chairs, and say hello for being well treated.

For each dollar spent on flights with American Express Travel, you’ll get 5 points. This rate is one of the best rewards for travel expenses among credit cards. On top of that, you’ll receive many discounts and credits to use in various services.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros

- No foreign transaction fees

- This card has a potential value of thousands of dollars in benefits in the first year due to the welcome bonus.

- Gold Elite Status at Hilton Honors and Marriott Bonvoy

- Access to airport lounges in thousands of airports worldwide.

- Premium Car Rental Status

- Excellent welcome bonus.

- Reward Points that don’t expire.

- Exclusive access at entertainment events with preferred seats.

Cons

- Has a high annual fee.

- Requires high credit score and annual income for approval.

- The most valuable rewards rely on travel expenses, so it’s not the best option for everyday use.

- It doesn’t give cashback, just the reward points.

American Express Gold credit card

The Amex Gold has found its place right in the middle of the travel credit cards range. It is not that fancy, but not that popular. Furthermore, the annual fee is more affordable than the premium ones but not accessible as the circa-$100 cards.

On top of that, this card is well known for its benefits for food lovers. The enthusiasts of good gastronomy will earn lots of reward points. That’s because the Amex Gold gives fantastic 4 points for spending at restaurants and food delivery services and also 4 points for purchases at supermarkets (terms apply).

But it is still a travel cred, so you’ll also earn 3 points for each dollar spent on flights. You need to book your flights through American Express Travel to receive these points.

Pros

- No foreign transaction fees.

- Earn 4 points for each dollar spent on dining.

- The welcome bonus has a potential value of $1,200.

- Personalized Travel service to help you plan your trips.

- $120 Uber Cash credit

- $120 dining credit for dining at selected partners.

- Preferred seats at selected events.

Cons

- No access to airport lounges.

- Requires a high credit score for approval.

- It doesn’t give cashback, just the reward points.

American Express Platinum or American Express Gold card: which you should choose?

They are both excellent credit cards. The decision relies on how much you’re up to spend on your annual fee and how often you travel.

The Platinum card will give you much more benefits and comfort if you travel a lot, especially on business travels. Also, it gives you a lot of credit and discounts on many services. You should check which one of these services suits your lifestyle to see if they’re worth the high annual fee.

The Amex Gold is the best option for everyday use and food lovers. It doesn’t provide so many perks as a Platinum credit card, but it also has a lower annual fee. This credit card may fit a more modest budget. The welcome bonus plus the potential earning points in everyday use can help travel a few times a year.

Still not sure which one you should choose? We can give you a third option. The Chase Sapphire Preferred card is at a lower range than the Amex options. But it has one of the best reward points programs and can be worth the price of its annual fee. It also comes with a generous welcome bonus with great potential value for travel.

To see more benefits and the application requirements, read the following content.

How do you get the Chase Sapphire Preferred card?

If you like being rewarded for your purchases and traveling, consider applying for the Chase Sapphire Preferred card. Read this content and we will show you how!

Trending Topics

Make up to $22,75 hourly working at Whole Foods Market: see job vacancies

Craving a job with purpose and fresh perks? Dive into Whole Foods Market open vacancies - earn up to $22.75/hour and enjoy 20% discounts!

Keep Reading

Earn Big Rewards: Apply for Pelican Points Visa

Get straightforward instructions to apply for the Pelican Points Visa! Earn points on every purchase and make the most of your money!

Keep Reading

Applying for the Regions Life Visa® Credit Card: learn how!

Wondering how to apply for the Regions Life Visa® Credit Card? We'll show you how! Enjoy 0% intro APR for 15 months and more!

Keep ReadingYou may also like

CreditFirm review: get a professional credit repair

If you think your credit score is beyond fixing it's because you haven't read this CreditFirm review yet. You'll be surprised.

Keep Reading

Universal Credit Personal Loans review: up to $50K

Get full insights into what Universal Credit Personal Loans has to offer in this full review! Flexible rates and terms! Read on!

Keep Reading

Apply for the Employee Retention Tax Credit and earn up to $26k/Employee!

Learn how to earn up to $26k per employee through the Employee Retention Tax Credit. Find out how to apply in our comprehensive guide.

Keep Reading