Credit Cards

Applying for the Chase Sapphire Preferred® Credit Card: learn how!

The Chase Sapphire Preferred credit card will amaze you. If you like being rewarded for your purchases and traveling, consider applying for this card. This content will show you how!

Advertisement

ChaChase Sapphire Preferred® Credit Card: high benefits for a low annual fee in this amazing travel credit card

If you’re looking for a travel rewards credit card with high benefits and low annual fees, the Chase Sapphire Preferred® Credit Card is definitely worth considering.

With this card, you’ll earn points that can be redeemed for travel expenses, merchandise, or gift cards.

So if you’re ready to start enjoying all the fantastic benefits a Chase Sapphire Preferred® Credit Card has to offer, read on to find out more!

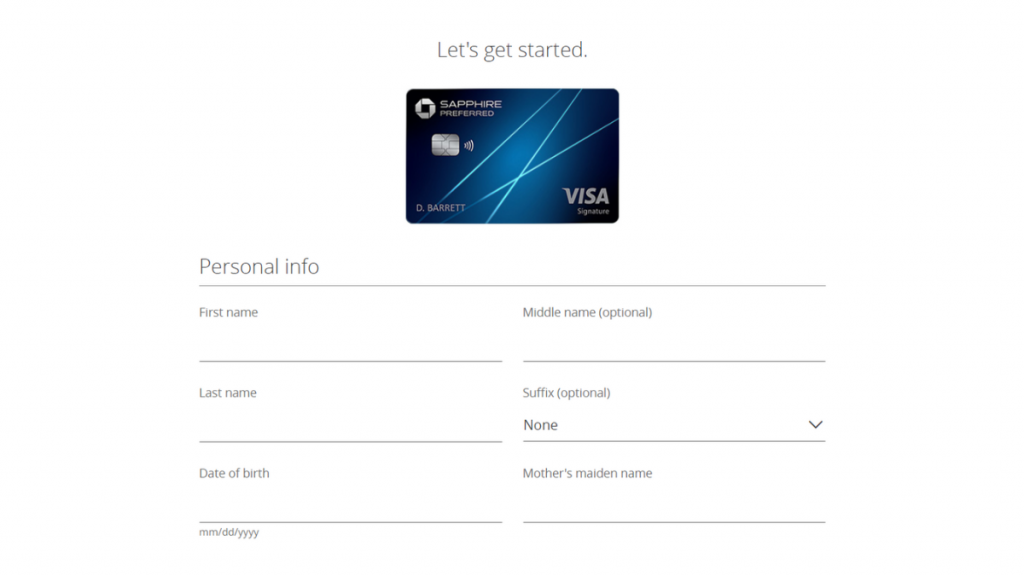

Apply online

The application for the Chase Sapphire Preferred® can be done online. All you have to do is go to the official Chase website and look for the page of the card.

After you hit the button to apply, you’ll be redirected to a form. It is relatively long, where you’ll have to inform your contact and personal information, like full name, e-mail, address, and so on.

Also, you’ll have to inform your Social Security Number and your income.

Remember to check the eligibility requirements before doing it.

- Credit score great or excellent.

- Open less than five credit accounts in the last 24 months.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Chase Bank has an app for its users to administrate their bank and credit accounts. However, if you’d like to apply for a credit card, you’ll have to go to their website.

Chase Sapphire Preferred® Credit Card vs. The Platinum Card® from American Express

Another option for a travel credit card is The Platinum Card® from American Express. This is a way more luxurious and expensive card.

So, check out the comparison chart below to learn more about it and choose the best option for your financial needs!

| Chase Sapphire Preferred® Credit Card | The Platinum Card® from American Express | |

| Credit Score | Good to Excellent. | Excellent. |

| Annual Fee | $95 | $695 |

| Regular APR | 21.49% – 28.49% variable. | 21.24% to 29.24% variable on eligible charges. |

| Welcome bonus | 60K bonus points after $4,000 spent in the first 3 months. | Earn up to 150,000 Membership Rewards® Points after spending $8,000 within the first 6 months. |

| Rewards | 5x points on travel purchased through Chase Ultimate Rewards; 3x points on dining; 3x points on select streaming services and online grocery purchases; 2x points on other travel purchases; 1 point per $1 spent on all other purchases. | 1x to 5x Reward Points for each dollar spent (according to the category of each purchase). |

If you’d like to get your Platinum membership and get your travel credit card, we have an article about it here at the Stealth Capitalist. Read the content below and apply for your card.

How do you get The Platinum Card from Amex?

Learn how to apply for The Platinum Card® from American Express and check out the benefits you'll get with the best travel card in the market!

Trending Topics

The Credit People review: repair your credit with confidence

A good credit score opens doors for negotiations. Check out this review from The Credit People, a great option to improve your finances!

Keep Reading

What is tax deduction and how does it work?

Discover the basics of how does tax deduction work. Also, learn the types of deductions available, and how to use them in your favor. Read on!

Keep Reading

Applying for the Discover it® Student Cash Back Card: learn how!

The Discover it® Student Cash Back Card offers great rewards. Here's how to apply for this card and take advantage of these rewards.

Keep ReadingYou may also like

Qtrade Investing brokerage platform full review

Qtrade Investing is a brokerage platform which offers you both a mobile and a web-based application, and the best customer service.

Keep Reading

Truist Enjoy Cash Credit Card full review

Want a card option with great rewards? Check out this Truist Enjoy Cash Credit Card review and find out if it's what you're looking for.

Keep Reading

Applying for the American Express Platinum card: learn how!

Check here how to apply for the American Express Platinum card, and enjoy its benefits at airline companies and hotels around the world!

Keep Reading