Credit Cards

Apply for the American Express® Gold Card: Learn how!

Consider applying for the American Express Gold credit card. It has the best benefits if you love food and travel. You'll have discounts and gain reward points in almost every purchase. Learn everything you need to apply here!

Advertisement

The best credit card for food and travel enthusiasts

Are you looking for a new credit card? If so, you may want to apply for the American Express® Gold Card.

This card has various benefits that can be useful for anyone, especially those who love to travel and eat out.

With the Membership Reward Points, you’ll earn points with the potential value of hundreds of dollars. And the best part, you get them in everyday purchases, like dining and groceries.

If you’re interested in this card, this post will show you how to apply for it. Keep reading to learn more.

Apply online

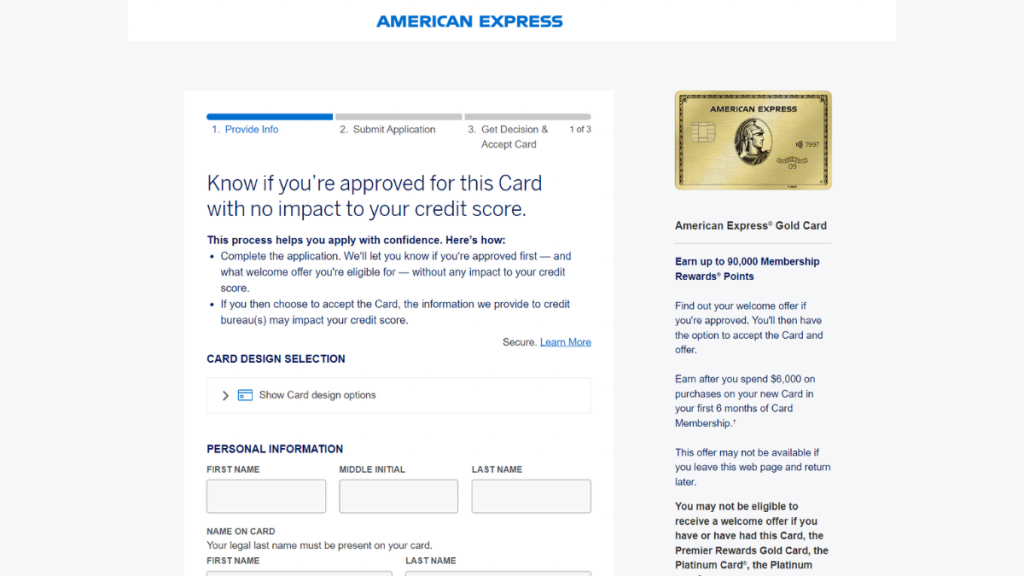

It is easy to apply for the American Express® Gold Card. Go to the American Express website and find the Gold card page.

If you’re lucky, you can receive a 25% increase on the welcome bonus, be ready to click right away. Right at the top of the page, you’ll see the “Apply now” button.

It will redirect you to the application form. You’ll have to provide personal info, like name, e-mail, address, birth date, and social security number.

Also, you’ll have to inform your annual income and its source. Remember, this is a premium card, so you need a great credit score to be approved.

They’ll give you an answer in 30 seconds.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

There is no option to apply using the app. The application is made on the American Express website.

American Express® Gold Card vs. The Platinum Card® by American Express

Amex has excellent options for travel cards. One step above in the premium lineage we have The Platinum Card®.

If you can pay its annual fee, it will increase your travel benefits and give you Elite Status in hotels and VIP access to airport lounges.

| American Express Gold card | The Platinum Card® by American Express | |

| Credit Score | Recommended 670 or higher | Recommended 720 or higher |

| Annual Fee | $250. (rates & fees) | $695. (rates & fees) |

| Regular APR | 21.24% to 29.24% variable APR on eligible charges. (rates & fees) | 21.24% to 29.24% variable APR on eligible charges. (rates & fees) |

| Welcome bonus | Up to 90,000 points after spending $6,000 in the first six months. (terms apply) | Up to 150,000 points after spending $8,000 in the first six months. (terms apply) |

| Rewards | 4x points on dining; 4x point on groceries; 3x points on flights; 1x points on other purchases. Terms apply. | 5x points on flights and hotels booked with American Express Travel; 1x points on other purchases. Terms apply. |

Apply for The Platinum Card® by American Express

Check here how to apply for The Platinum Card® by American Express and enjoy its benefits at airline companies and hotels around the world!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The information provided was accurate at publication, though certain offers may no longer be applicable.

Trending Topics

Make up to $17/h working at Five Guys: see job vacancies

Unleash your inner burger maestro: Discover Five Guys job opportunities with medical coverage and many other benefits. Read on!

Keep Reading

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep Reading

Buy on Trust account review: read before applying

Looking for a lease-to-own program that offers the latest electronics from top brands? Check our Buy on Trust Account review!

Keep ReadingYou may also like

The 5 best secured credit cards options: apply with no credit check

Want to know what are the best secured credit cards with no credit check? Here are 5 excellent choices for individuals with bad credit.

Keep Reading

NetCredit Personal Loans review: is it worth it?

Read our full NetCredit Personal Loans review and find out what this lender is all about! Any type of credit is accepted! Keep reading!

Keep Reading

Pyramid Credit Repair review: repair your credit with confidence

Looking for a reliable credit repair service? Look no further than Pyramid Credit Repair in this review. Apply for personalized plans!

Keep Reading