Reviews

Applying for the Capital One SavorOne Rewards for Students Card

If you want to earn rewards and enjoy your student life at the same time, read our post to learn about the Capital One SavorOne Rewards for Students card application!

Advertisement

Easy application and no annual fee

Do you already know the Capital One SavorOne Rewards for Students card? With it, you, the student, who is starting your financial life, can have several benefits with incredible cashback.

Through this rewards program, you get 8% cashback on tickets, 5% on hotels and car rentals made by Capital One, 3% on restaurants and streaming services, and 1% on all else.

Are you interested? Then today’s tips are for you! Today, you will learn how to apply for the card through the website and the app. Check out!

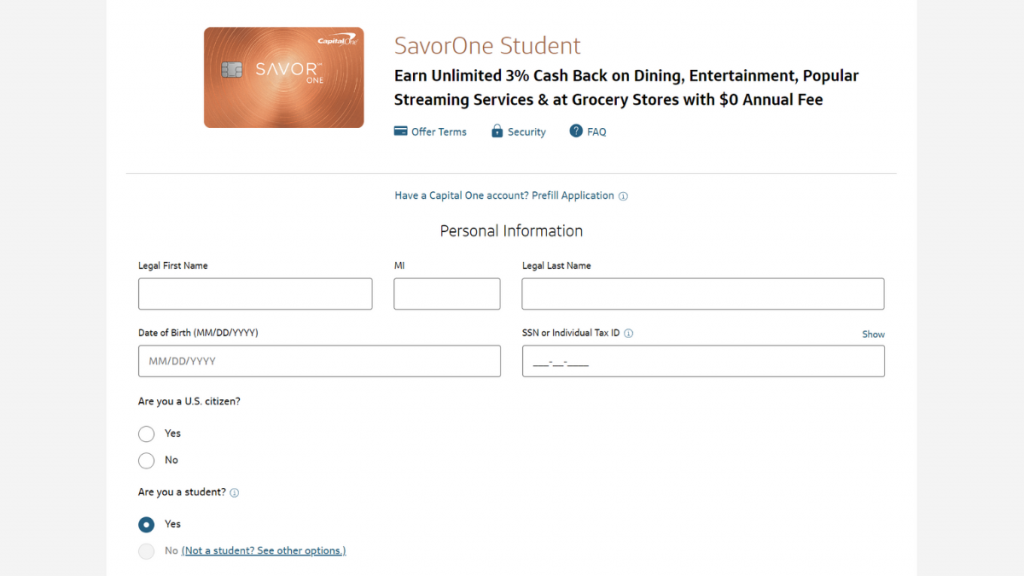

Apply online

If you want to apply for the Capital One SavorOne Rewards for Students credit card online from your computer or tablet, you can do so through the Capital One website.

You will then need to complete the requested fields with your information.

The site requests personal information such as name and MI, contact information such as phone number, and financial information such as income and employment status.

At the bottom of the page, you will find additional information and important disclosures.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

While the application process can be done through the website, you will need the application to manage the account. Therefore, you can also take the opportunity to apply there.

To carry out the application process through the app, you need to check if your smartphone or tablet system is Android or iOS. Then, look for the app in the store, download it, and open registration.

As with the website, the application will ask you to register personal information, such as an address, name, MI, and contact information, such as phone number.

You will also be asked for information about your financial history. From this data, the company will generate a credit proposal, and you can accept or decline it.

Capital One SavorOne Rewards for Students credit card vs. Upgrade Triple Cash Rewards credit card

Choosing a new credit card that meets your needs is not always easy.

However, the Capital One SavorOne Rewards for Students credit card offers similar benefits to others like the Upgrade Triple Cash Rewards credit card, but without requiring an excellent credit history.

Capital One SavorOne Rewards for Students

- Credit Score: Fair

- Annual Fee: $0

- Regular APR: 19.99% – 29.99% for purchases (variable)

- Welcome bonus: Earn a one-time $50 cash bonus after spending $100 on purchases in three months from your account opening

- Rewards: 8% cashback on tickets purchased through the Vivid Seat platform, 5% on hotels and car rentals through Capital One Travel, unlimited 3% cash back on dining, entertainment, streaming services, and at grocery stores, and 1% cash back for other purchases

Upgrade Triple Cash Rewards Visa®

- Credit Score: Average to excellent

- Annual Fee: $0

- Regular APR: variable between 14.99% – 29.99% depending on the credit limit

- Welcome bonus: offer of a $200 bonus if you open a Rewards Checking account and make at least three transactions with your debit card

- Rewards: up to cashback of 3% on selected purchases

Apply for the Upgrade Triple Cash Rewards Visa®

Don't know how to apply for your Upgrade Triple Cash Rewards Visa®? Don't worry. This article has every piece of information you need to get this card.

Trending Topics

Chipotle Hiring Now: Apply for a job!

If you're interested in working at Chipotle, here's how to apply for a job. Enjoy health coverage, free food, paid time off, and more!

Keep Reading

Temporary Assistance for Needy Families (TANF): get the help you need

Do you know what Temporary Assistance for Needy Families (TANF) is? It is a social program that lifts families out of poverty. Read on!

Keep Reading

Quick Loan Link: how to apply now!

Discover how to apply for a loan with Quick Loan Link online or through their app! Borrow up to $50,000 with flexible terms! Read on!

Keep ReadingYou may also like

What is an annual fee on a credit card?

Annual fee on a credit card is a common thing, but do they make sense? How can you get rid of them? When should you accept them?

Keep Reading

Surge® Platinum Mastercard® Review: Strengthen Your Finances

Check our Surge® Platinum Mastercard® review to learn how you can boost your credit score with a $1,000 initial credit limit.

Keep Reading

X1 Credit Card full review: earn up to 10x points

Check out our review of the X1 Credit Card to see how it can help you. Earn points on purchases and pay no annual fee!

Keep Reading