Reviews

Applying for the Fortiva® Mastercard® Credit Card: learn how!

Applying for the Fortiva® Mastercard® Credit Card offers a path to rebuild credit and earn rewards. Get cashback on groceries and utilities while managing your credit health with ease and convenience.

Advertisement

Fortiva® Mastercard® Credit Card: Easy Application

The Fortiva® Mastercard® Credit Card can be great for those who don’t have a good credit score. After all, you can have up to a $2,000 starting limit and have some interesting rewards.

However, to guarantee approval, it is essential to know how to fill out your application correctly. It can be done online or through an app. So, check out the step-by-step to be approved.

Apply online

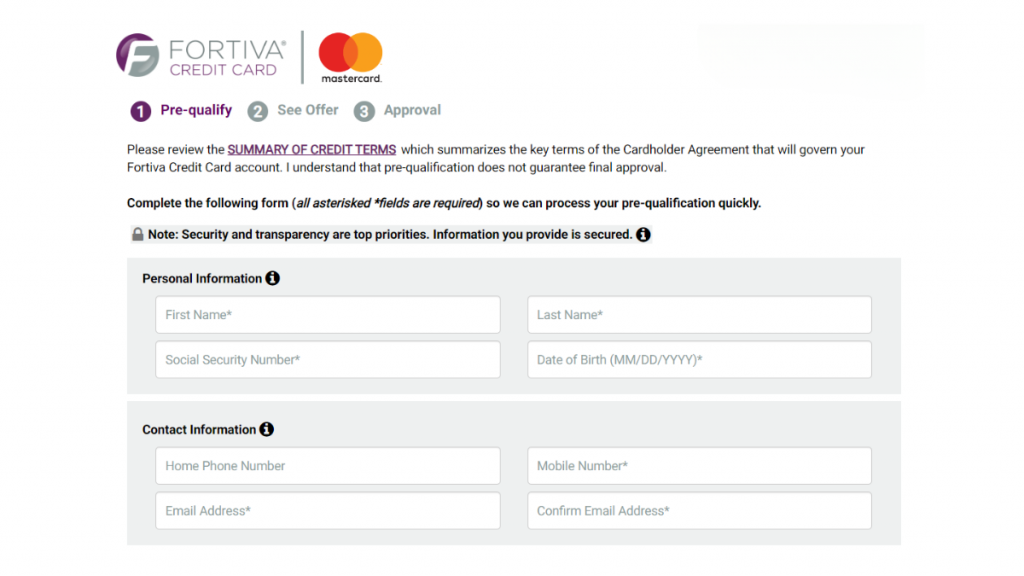

Applying for the Fortiva® Mastercard® Credit Card is simple and convenient. In this sense, you can do it wherever you are through your mobile device or even from your computer.

To make your application, it is essential to fulfilling some requirements. That is, it is important that you are over 18 years of age, a US citizen, and a physical address.

If you meet these requirements, you can start your application. To apply online, you need a device with internet and access to the website. Then, fill in your details and submit them.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can apply for this card only and pre-qualify it, as we mentioned above. However, you can only use the mobile app to manage your credit card and get alerts.

Fortiva® Mastercard® Credit Card vs. Petal® 1 Visa® Credit Card

The Fortiva® Credit Card is one of the few reward cards for bad credit scores. In this sense, he has a cashback of between 1 and 3% on purchases and an initial limit of up to $1000.

However, you can also think of some alternatives. The Petal® 1 Visa® Credit Card can be very attractive. You have no annual fee and still get 10% cashback on multiple purchases.

However, it is important to know which option best fits your needs. So, check the comparison and determine which one to choose to improve your financial life.

Fortiva® Mastercard® Credit Card

- Credit Score: Good/ Fair/ Poor;

- Annual Fee: $49 to $175 during your first year as a member, then $0 to $49 thereafter.

- Regular APR: 22.74% to 36% Variable APR;

- Welcome bonus: None;

- Rewards: 3% cash back on eligible purchases.

Petal® 1 Visa® Credit Card

- Credit Score: All credit scores are welcome;

- Annual Fee: $0;

- Regular APR: 25.24% – 34.74% Variable APR;

- Welcome bonus: N/A;

- Rewards: Up to 10% cash back on select merchants.

If the Petal® 1 Visa® Credit Card is the best choice for you, check out our post below to learn about the application process!

How to apply for the Petal® 1 Visa® Credit Card

Ready to get a credit card fast and easy? Here is what you can expect when you apply for the Petal® 1 Visa® Credit Card.

Trending Topics

What is an annual fee on a credit card?

Annual fee on a credit card is a common thing, but do they make sense? How can you get rid of them? When should you accept them?

Keep Reading

Citrus Loans review: is it worth it?

Need cash but have a bad credit score? Check out this Citrus Loans review on how to solve this situation and get your money today.

Keep Reading

Discover Student Loan or Sallie Mae Student Loan: pros and cons

Need help completing your studies? Know about Discover Student Loan or Sallie Mae Student Loan. There are two great options!

Keep ReadingYou may also like

Applying for the GO2bank™ Secured Visa® Credit Card: learn how!

GO2bank™ Secured Visa® Credit Card may be all you need to improve your score. Learn how to apply quickly and have your card.

Keep Reading

The Vatican will launch an NFT gallery

The Vatican is developing a NFT art gallery to allow people from all over the world to access thousands of art works, manuscripts and more.

Keep Reading

Apply for Pyramid Credit Repair: simple and quick process!

Looking to apply for credit repair services? Then check out how to apply for Pyramid Credit Repair. Enjoy free credit repair evaluation.

Keep Reading