Reviews

Applying for the Milestone® Mastercard® – Less Than Perfect Credit Considered: learn how!

The challenge of rebuilding credit is common to many people. Milestone® Mastercard® – Less Than Perfect Credit Considered is an option that can help. See how to apply!

Advertisement

Milestone® Mastercard® – Less Than Perfect Credit Considered: easy application!

The Milestone® Mastercard® – Less Than Perfect Credit Considered is great for rebuilding credit. You can report to the main credit bureaus in the country. In this way, you will be able to recover the credit lost.

However, you must apply to take advantage of these benefits in favor of your credit. Therefore, you must qualify online and fill out an application with your information.

Thus, your chances of approval increase. See how to apply!

Apply online

Milestone® Mastercard® – Less Than Perfect Credit Considered does not have a complicated application.

You can do it on your laptop, computer, tablet, or smartphone. However, being over 18 years of age and being a US citizen is essential.

Before submitting, you can request a prequalification on the website. In this sense, you fill in some data and then see if this option is viable for you. As we said, having a good credit score is not necessary.

To apply online, it is essential to have access to a computer or laptop with the internet.

After qualifying, just fill in your personal and financial data on the official website. So, just wait for the result, which can be in a few minutes or days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can only apply through the official website by following the steps in this post!

In addition, it is important to have your current address and finance information on hand to make it easier.

Milestone® Mastercard® – Less Than Perfect Credit Considered vs. Indigo® Mastercard® Credit Card

The Milestone® Mastercard® – Less Than Perfect Credit Considered is perfect for building credit.

However, as you can imagine, it is not the only option. After all, several credit card options exist for those who don’t have a good score.

Therefore, an interesting and similar alternative to this card is the Indigo® Mastercard® Credit Card.

It has an annual fee that may be lower, depending on your qualifying credit score. However, the APR is the same, and you don’t need to have a good credit score either.

The official websites of the two credit card options do not have clear information about welcome bonuses.

However, both serve to rebuild credit. See what the main differences are in this comparison and choose yours.

Milestone® Mastercard® – Less Than Perfect Credit Considered

- Credit Score: Poor / Bad;

- Annual Fee: $35 to $99;

- Regular APR: 24.9%;

- Welcome bonus: N/A;

- Rewards: N/A.

Indigo® Mastercard® Credit Card

- Credit Score: Bad / Poor;

- Annual Fee: $75 in the first year. Then, $99;

- Regular APR: 24.90%;

- Welcome bonus: N/A;

- Rewards: N/A.

If you’re more interested in getting the Indigo® Mastercard® Credit Card, we can help! Check out our post below to learn how to apply for it!

Applying for the Indigo® Mastercard® Credit Card

The Indigo® Mastercard® Credit Card is perfect for helping you rebuild credit. See what are the steps to make the application!

Trending Topics

CreditFresh Line of Credit: how to apply now!

Looking for a reliable and convenient line of credit? Then apply for the CreditFresh Line of Credit today! Borrow up to $5,000 fast!

Keep Reading

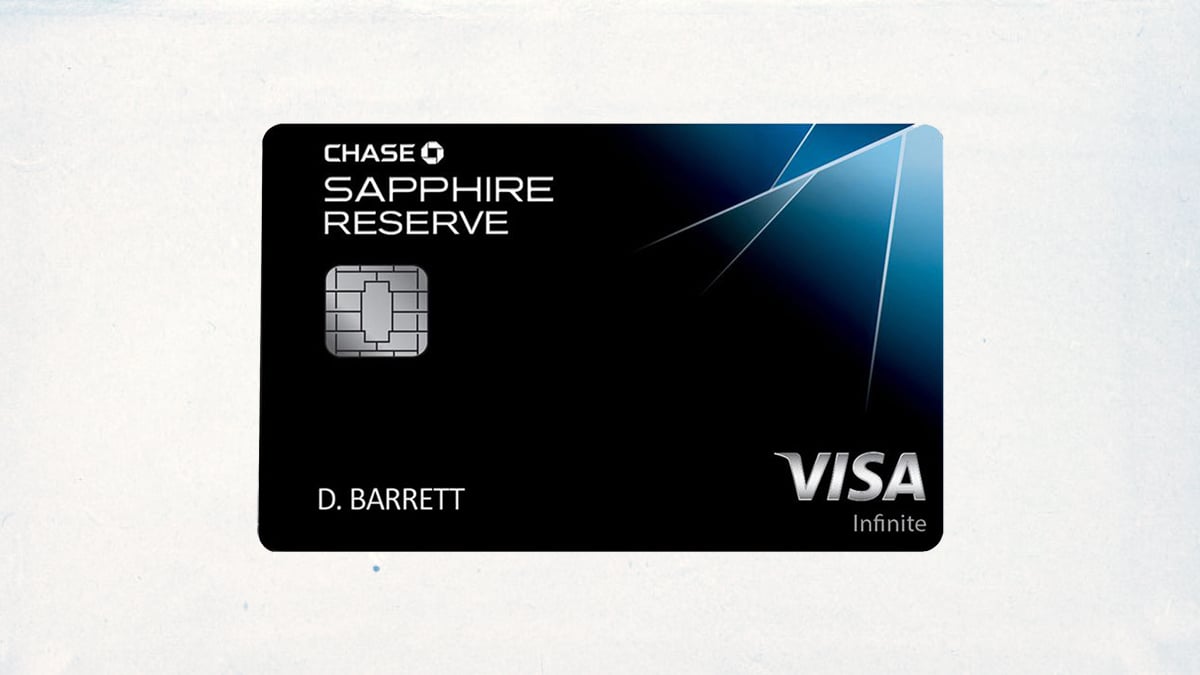

Chase Sapphire Reserve credit card full review

If you're looking for a premium travel rewards card, this is the one to get. Learn more in our Chase Sapphire Reserve credit card review.

Keep Reading

Apply for the FIT™ Platinum Mastercard®: Learn how!

You can easily apply for the FIT™ Platinum Mastercard®, get a quick response, and start building your credit score today! We'll show you how.

Keep ReadingYou may also like

5 best options of credit cards for traveling: enjoy the benefits!

Which are the best credit cards for travelling? Compare top rated travel rewards and premium travel rewards. Read on to learn more!

Keep Reading

Blue Cash Everyday® Card from American Express Review

Looking for a cash back credit card? Check out our in-depth review of the Blue Cash Everyday® Credit Card from American Express.

Keep Reading

Quick and simple: apply for MyPoint Credit Union Platinum Visa

Get ready to earn points on every purchase! Apply for the MyPoint Credit Union Platinum Visa Card today and revolutionize your spending!

Keep Reading